Federal Reserve: Dovish Tone With More In The Tool Kit

The Federal Reserve has left policy unchanged and kept their cautiously optimistic outlook in place. Nonetheless, even with a growing prospect of a new fiscal support package and news on a vaccine, the Fed continue to suggest they see little chance of higher interest rates before 2024.

Federal Reserve

Fed takes a step back

The Federal Reserve has left monetary policy unchanged with the Fed funds target rate maintained within a 0-0.25% range. There was some speculation that the Fed could do more QE or could focus their asset purchases at the long end of the curve to help keep a lid on household and corporate borrowing costs, but perhaps signs of movement on a fiscal relief package reduced the need for near-term action in their minds.

The accompanying statement is barely changed, which is something of a surprise given the recent softer tone to some of the data. However, the Fed have provided a bit more guidance on their asset purchases. They will continue to buy Treasuries at a rate of "at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals”. This is still quite vague but reinforces the view the Fed are going to be doing all they can to ensure the recovery gains traction.

This theme is picked up throughout the press conference with Fed Chair Powell commenting that while the vaccine newsflow is clearly positive there are ongoing challenges for the economy and they could yet do more to support the recovery – here he does indeed mention the possibility of buying more assets or shifting the duration of bond purchases.

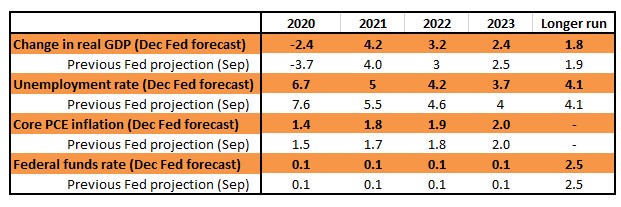

New Federal Reserve economic forecasts

(Click on image to enlarge)

Source: Federal Reserve, ING

Hints of optimism in the numbers

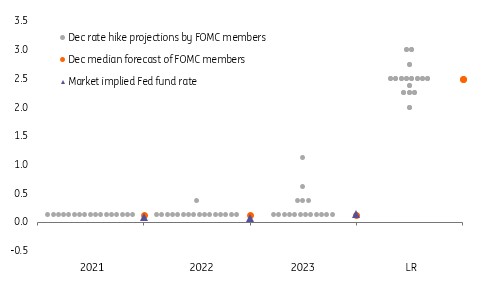

The Fed have updated their forecasts, which reflects the stronger 3Q data and the fact a vaccine is being distributed, but they continue to signal a rate rise is unlikely before 2024. Just one member expects a hike in 2022, but there are now five, rather than four (as in September) looking for a rate rise in 2023.

Fed "Dot plot" of individual interest rate forecasts

(Click on image to enlarge)

Source: Federal Reserve, ING

Macro outlook - Fiscal support is key

The latest data flow, including today’s retail sales numbers, suggest that the US recovery is already losing momentum. With more restrictions on movement likely to come in over the next few weeks, we are going to be hearing more cries for help.

Monetary policy can only do so much though. Interest rates are at historically low levels, credit is flowing and markets are functioning well. Additional QE could be implemented, but this will do little to offset the downturn we are currently seeing in demand and is more likely to boost equities and widen the disconnect between stock prices and the real economy.

The Federal Reserve have been at pains to emphasize that fiscal policy would get more traction and we are seemingly inching towards a deal on a fiscal support package that will help to mitigate some of the negative economic impact. However, it can’t fully offset the effects of people staying at home much more as there will inevitably be less spending and businesses are not going to be implementing investment plans.

By preventing a big rise in unemployment, such as funding a new round of the Paycheck Protection Program, or extending unemployment benefits for those that lose their job, it can, however, support sentiment and provide a stronger platform for recovery when the re-opening gets underway.

If politicians fail to reach an agreement then we are likely to see more businesses fail and more jobs lost, which will mean that it takes even longer for the US economy to return to pre-pandemic levels of output and employment.

Government bonds: Testing the big 1.0

Clearly, the Federal Reserve is keen to protect the system, extending dollar swap lines and repurchase facilities. These have not been in significant use of late, in fact, reflecting the success the Fed has had with securing minimal systemic stress through a series of hand-holding measures for the financial system since the COVID crisis first broke. The fact that the Federal Reserve sees necessary to maintain liquidity supportive facilities shows that they want to take out insurance, just in case things were to get tight in the months ahead.

And the quantitative easing underpinning remains as is. No big surprise there for us. There had been some market talk that the Fed could place a semi-buffer on a rise in long rates through an extension in the duration of purchases. But, the Fed will leave further deliberation on this front until 2021, and the same goes for any mention of the word tapering.

The impact reaction has been a mild test higher in yield and a moderately steeper curve, which seems about right. There is not much in the Fed’s statements that presents a material obstacle to a test of 1% in the 10yr; the only real obstacle is whether the market feels comfortable getting there as we head into a period where second wave COVID-impacted data will likely dip significantly.

That said, markets are tending to look beyond the worst of this, focusing more on reflation ahead. Enough there to push higher in yield (and steeper in curve), and see how it feels up there with a 1-handle in play.

Dollar should stay offered

FX markets are no doubt keeping one eye on the modest rise in US yields and have taken the dollar slightly higher on the back of the Fed statement and the supporting materials. As long as the Fed remains wedded to its Average Inflation Target policy, however, the US yield curve steepening should pose no threat to the broad dollar decline.

We say this because the broad dollar decline has been driven by the reflation trade – built on the assumption that the Fed wants to keep the real Fed policy rate deeply negative as a means to deliver on its core objectives of 2% average inflation and maximum employment. As long as the Fed doesn’t touch the short end – or provide any hints of tapping the brakes (tapering) – we expect the reflation trade to dominate in 2021 and the dollar to fall 5-10% across the board.

We would probably say that a sharp rise in US 10-year yields above 1% might be the biggest threat to dollar short positions right now – with some of the EMEA high yielders such as the ZAR as the most vulnerable. But a sharp move through 1% is far from given. And with the US economy facing further headwinds over coming months, very dovish Fed policy should keep the dollar offered.

In short, we see nothing here to alter prevailing FX trends.