Fed Watch: In No Hurry For A “Liftoff”

A Federal Reserve (Fed) meeting on St. Patrick’s Day—for a bond guy like me, there’s nothing like it. In honor of these two events coinciding this year, and given what has recently been transpiring in the U.S. Treasury market (UST), an Irish saying comes to mind: If you buy what you don’t need, you might have to sell what you do.

This year’s rise in the UST 10-year yield has created speculation that the timing of the Fed’s first rate hike could get pushed up, while also heightening discussion about when any balance sheet tapering talk might occur. Based on recent comments from Powell & Co., and of course today’s FOMC meeting, the Fed appears to be in no hurry for a liftoff, i.e., raising the Fed Funds target range over the next year or two.

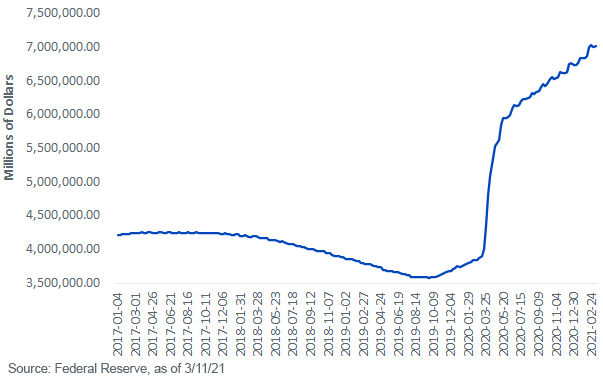

Fed Holdings of Treasuries, Agency Debt & MBS

Against this backdrop, it appears the more likely Fed policy headlines for this year will center around its balance sheet. But before any possible taper talk, the UST market has been waiting to see if the policymakers will make any shifts in the composition of their purchases. On this front, Chair Powell has been trying to thread the needle between what is considered ‘normal’ rate movements given the improved economic outlook and something that “was notable and caught my eye.”

At this point, the Fed seems to be downplaying the notion of a disorderly move higher in the UST 10-Year yield and instead focusing more on keeping monetary policy right where it is, namely, highly accommodative. Thus, the maturity composition of the Fed’s Treasury purchases, for now, has not been altered.

In terms of the Fed’s balance sheet, the policy makers’ holdings of Treasuries, mortgage-backed securities (MBS), and agencies have now topped $7 trillion. The accompanying graph reveals a bit of a sawtooth pattern since the spring of last year, but the unmistakable trend is one of higher totals. In fact, since March 2020, the Fed’s System Open Market Account (SOMA) has risen by over $3.1 trillion, with a little under $300 billion occurring year-to-date.

Conclusion

What often gets overlooked by investors is that even though the Fed is buying Treasuries at a rather aggressive clip, rates can still rise, specifically in the intermediate to longer duration areas. This possible development is important to keep in mind when positioning your fixed-income portfolio.

Unless otherwise stated, data source is Federal Reserve, as of 3/11/21.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more