Fed Tapers QE Again, Will Buy "Only" $30 Billion In Treasuries Per Day

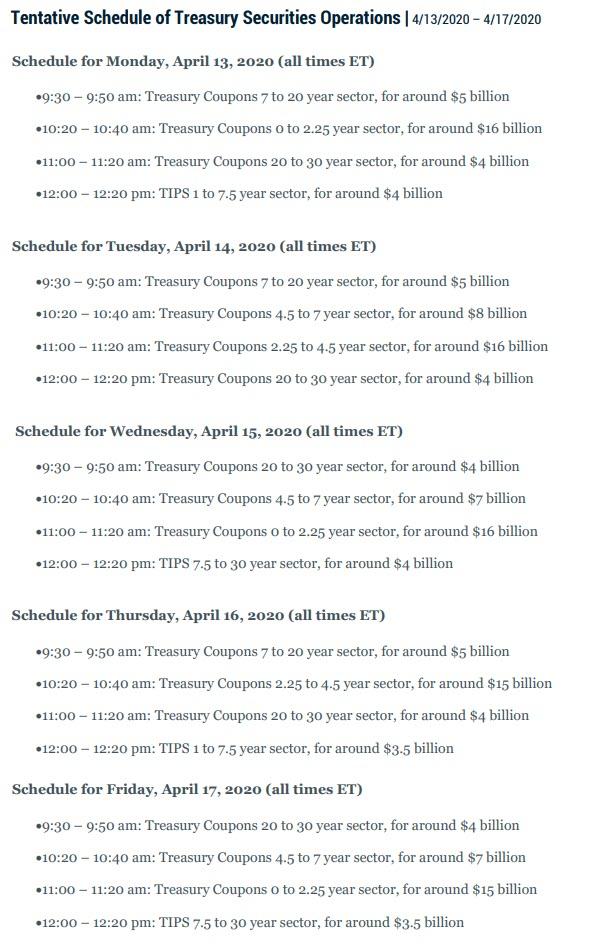

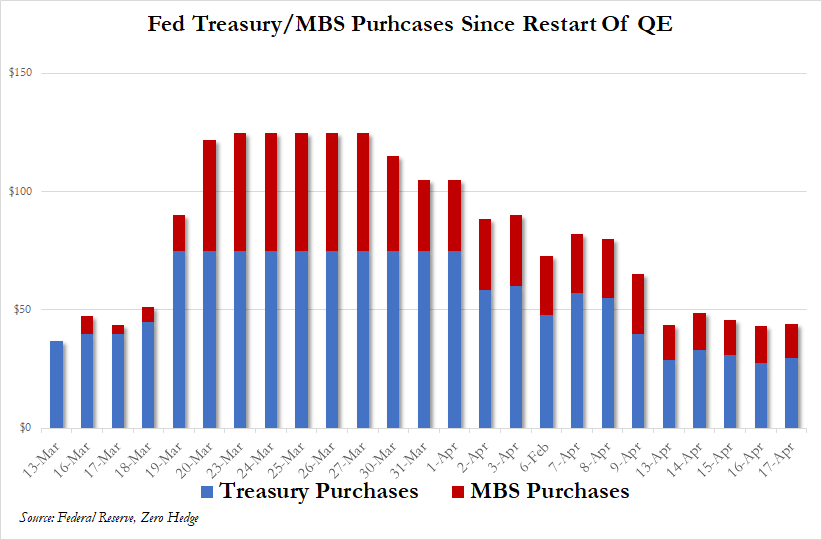

From an initial $75 billion per day, The Fed reduced its daily buying to $60 billion per day, then last week announced another 'taper' in its bond-buying program to $50 billion per day for next week. Now it has slashed its buying to "just" $30 billion per day.

(Click on image to enlarge)

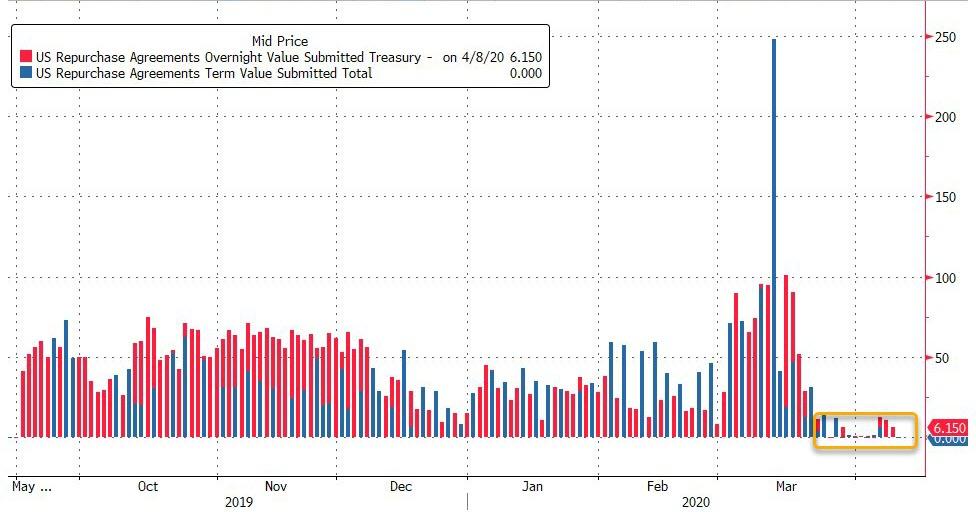

Having implicitly confirmed there is now a shortage of bonds as demonstrated by the recent repo ops that saw zero submissions as instead of using repo to park bonds with the Fed Dealers merely sell them back to the Fed, the NYFed has announced it will continue cutting back, or tapering, its "unlimited QE" bond-buying next week.

(Click on image to enlarge)

Here is the full schedule for the week ahead.

(Click on image to enlarge)

Additionally, The Fed will taper its MBS buying from $25 billion to around $15 billion in MBS per day next week:

- Mon: $14.55

- Tue: $15.675

- Wed: $14.55

- Thur: $15.675

- Fri: $14.55

(Click on image to enlarge)

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more