Fed Keeps The Pedal To The Metal

Stimulus Is Almost Here

The stimulus is almost here. The latest details are the $900 billion stimulus will include checks between $600 and $700. It will also include $300 in weekly unemployment insurance for 16 weeks. This new bill is a revision of the $748 billion bill that excluded the politically divisive choices.

This new bill won’t include help to state and local governments. We will likely only see help given to them if the Dems tie the Senate by winning the two races in Georgia. The latest polls have the Republicans up by 1 point each. This puts Perdue (GOP) in the lead by 0.7% in the average of polls and Warnock (Dem) in the lead by 0.5%. It will come down to the wire on January 5th.

This stimulus will be great for consumers. November retail sales report was disappointing. It seems like holiday shopping won’t be great after all. This stimulus will boost spending early next year, bridging the gap from now until the full vaccine rollout.

It's unlikely that the stimulus will help consumers in time to boost holiday shopping unless some people go into debt in anticipation of the checks going out. Someone barely surviving on unemployment insurance won’t be spending a lot on Christmas even with this benefit extension.

Fed Keeps Rates At Zero Again

The Fed decided to keep rates at zero and maintain its $120 billion in bond purchases per month. In fact, Powell even said stocks aren’t overvalued because the 10-year yield is low. You would have thought this would have sent stocks spiking, but the Fed has been so dovish, this just maintained the modest rally on Wednesday. Could traders be so greedy that 14.56% returns in 2020 aren’t enough even with a pandemic? Markets will always welcome more stimulus.

The Fed stated it will continue its $120 billion per month in bond purchases “until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.” Fed will lower its purchases per month in 1H 2022 and end the program later that year.

Remember, the Fed isn’t going to sell its bonds in the tightening cycle. It will just maintain the size of its balance sheet which will shrink as a percentage of the economy over time. The Fed decided to never do QT again after it caused angst last cycle. That’s not necessarily the wrong decision, but you can argue the same logic says the Fed shouldn’t hike rates again because it causes angst.

One aspect that slightly disappointed investors was that the Fed didn’t extend the duration of its purchases. The Fed has been buying shorter duration bonds since the pandemic hit to keep financial markets functioning. This has worked as the financial conditions index shows conditions are almost the loosest ever. The Fed has recently discussed buying longer duration bonds to stimulate the economy like it did after the 2008 financial crisis.

In theory, this would bring down long term rates and push investors to take more risk in stocks. Of course, the issue here is the 10-year yield is at 93.1 basis points which is near its record low and stocks are almost as expensive as they were during the tech bubble. Frankly, most don’t think a 10-year yield 50 basis points lower would help stocks much. Surely, it would help the Nasdaq 100 modestly, but that doesn’t need any help moving up. It’s already up 45.1% year to date.

New Fed Expectations

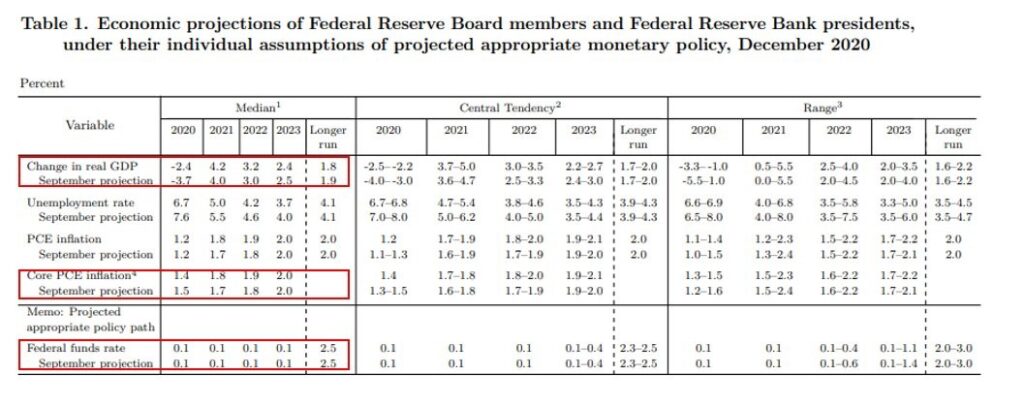

The December Fed meeting was important because it included the Fed’s summary of economic expectations. As you can see from the table below, the Fed raised its expectation for 2020 GDP growth from -3.7% to -2.4% which doesn’t matter much because the year is over. The Atlanta Fed GDP Nowcast expects 11% growth in Q4. The Fed raised its 2021 and 2022 GDP growth estimates by 0.2% to 4.2% and 3.2%.

If the economy actually grows that much in 2022, the Fed should consider hiking rates. However, that’s not in the cards for now as the median estimate is for no hikes through 2023. Fed will change its guidance for 2023 policy once the pandemic is over. Specifically, 5 FOMC members out of 17 see a hike in 2023 which is up from 4. Honestly, some think the Fed could even hike rates in 2022 if the vaccine is distributed properly and the economy reopens smoothly.

(Click on image to enlarge)

The Fed lowered its unemployment rate expectations. It's been apparent for a few months now that the Fed has been too negative on the labor market. These new guesses are fair. Specifically, the estimates for 2021 and 2022 went from 5.5% and 4.6% to 5% and 4.2%. The Fed thinks the longer run rate is 4.1%.

Why not hike in 2022 if the unemployment rate is almost at the longer run rate? The answer to that question can be seen in the projections for core PCE inflation. The Fed expects core PCE inflation to rise to 1.9% in 2022 which is 0.1% above its September guess, but below its 2% target.

It’s interesting that the Fed barely raised its inflation guess despite solidly raising its GDP growth forecast and lowering its unemployment rate forecast. Maybe it purposely was too negative on inflation. If the Fed would have projected 2.1% PCE inflation in 2022, the market would have feared rate hikes.

Finally, the 2023 forecast stayed at 2% core PCE inflation. That explains why most FOMC members don’t see a hike in that year either. The Fed has been saying it won’t raise rates until inflation averages 2%. Since the rate will be below 2% from 2020 to 2022, there’s an argument that the Fed won’t raise rates in 2024 either.

That’s very far in advance; we have no idea what the economy will look like then, but that is how guidance works. All else being equal, the market wants to know if the Fed plans to hike in 2024. It affects asset prices today.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more