Everything Has Limits

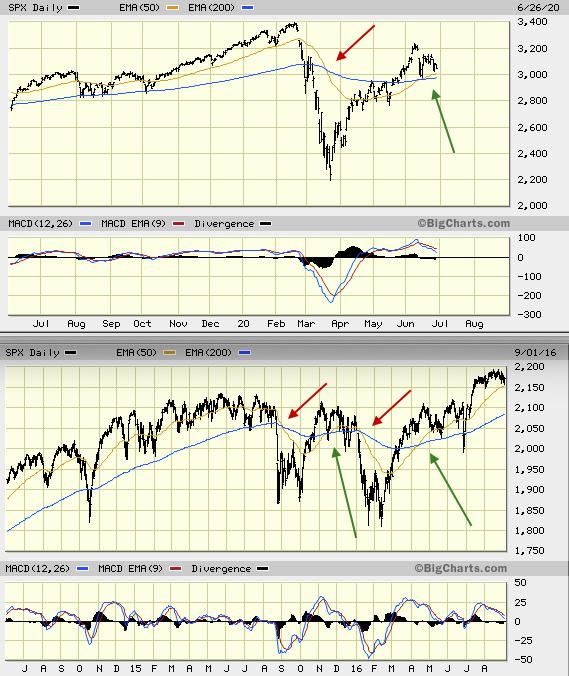

Bottom chart: In the fall of 2015 and then again in early 2016, US stocks broke to the downside generating a trend changing bear signal*. The Fed twice aggressively intervened and the stock market and the US economy responded favorably.

Top chart: The stock market plunged this year due to the coronavirus impacts and the Fed, once again, jumped in. And, once again, the market and to some degree the US economy has responded favorably.

It will be interesting to see if the pattern in the top chart repeats itself with a second downside break followed by a second Fed intervention. And what will be the markets reaction considering just how much deeper into the QE to infinity toolbox the Fed has delved?

Neither I nor anyone populating planet Earth knows the answer. What I do know is this:

If stocks break to the downside in 2H2020, like they did in early 2016, and the Fed intervenes again as they did in early 2016, BUT stocks fail to respond as they did in 2016, then the game has truly changed. Everything has limits.

*See prior posts on the Mega Trend.

Disclosure: Accounts managed by Blue Marble Research may presently hold a long/short position in the above mentioned issues and their inverse comparables.