Eurozone: Avoiding A More Serious Slowdown

There are still some underlying growth drivers in the eurozone, but the expansion is losing steam. A multitude of potential adverse shocks could add to the downside risks. Inflation expectations are falling to an uncomfortably low level. So it's no surprise the ECB has suggested interest rates will be cut again.

ECB President, Mario Draghi

Just when it seemed that the eurozone economy was starting to look better again, the escalation of the trade war between the US and China soured the mood. We shouldn’t forget that Europe (especially Germany) is very exposed to international trade. Any trade slowdown will leave its mark on the eurozone economy. While some might argue that Europe could benefit from the US-China conflict through trade diversion, we think that the overall negative effect on world growth will be more important. What’s more, Europe itself is likely to be in the line of fire if President Trump decides to impose import tariffs on cars later this year. No wonder ECB President Mario Draghi has now clearly Indicated that more easing is underway.

Consumption in the driving seat

The strong drop in German exports in April was a testament to the fact that international trade was not strong even before President Trump decided to tweet about additional import tariffs. However, the weakness was probably exaggerated because of the end of stockpiling in the UK after the Brexit date was delayed until the end of October. To be sure, domestic demand has done rather well on the back of a strong service sector and decent construction activity. Indeed, unemployment continues to fall and the pick-up in wages continues. Passenger car registrations rose by a healthy 4.7%, month on month in April, continuing the rebound witnessed in the first quarter.

This clearly shows that household consumption will continue to be an important driver in this phase of the expansion, even though the decline in consumer confidence in June illustrates that we are certainly not looking at accelerating consumption expenditure. As for business investment, the worry is that economic and political uncertainty will have a dampening effect even in an environment of rock bottom interest rates. According to the ECB’s New Multi-Country Model, a stabilization of the Economic Sentiment Index at its May 2019 level, already points towards a modest negative contribution of confidence to investment growth in 2019.

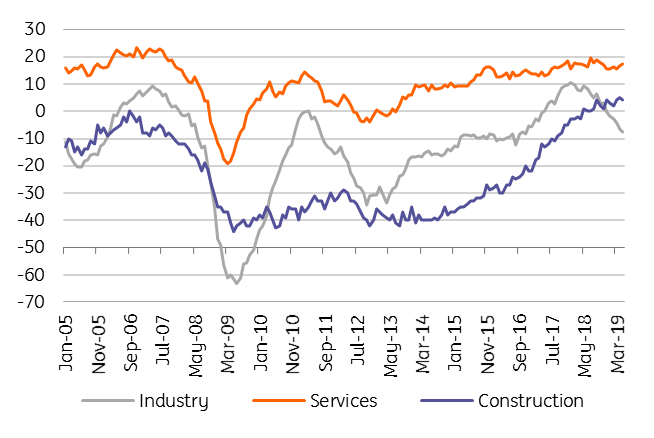

New orders signal some deceleration

(Click on image to enlarge)

Source: Thomson Reuters Datastream

Soft patch?

For the time being the eurozone economy seems to be in a soft patch rather than on the verge of a recession. The flash composite PMI rose for a second month in a row in June, although the manufacturing sector continues to languish. While inflows of new work in the service sector improved, there was another steep fall in new orders for manufactured goods, deteriorating at one of the sharpest rates seen over the past six years, Export orders for both goods and services fell again in June. So there is no economic standstill for the time being, but the subdued growth pace makes the eurozone economy quite vulnerable to shocks. There is also the fear that weakness in manufacturing might ultimately spread to the rest of the economy.

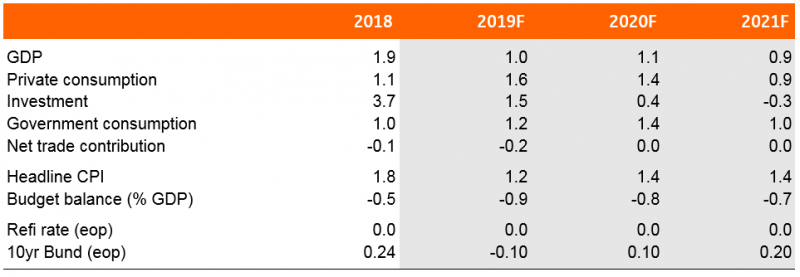

We now look at GDP growth at 1.0% for this year and 1.1% for 2020. A small wildcard though for next year is the fact that, in several European countries, the number of working days will be 2 to 4 days higher than in 2019, something that is likely to mask the underlying deceleration in growth.

More politics

The European elections results were not really a shocker; there were some interesting local results, with the most direct consequence the announcement of a snap election in Greece. To be sure, political uncertainty has not disappeared. Brexit is far from resolved and the story is likely to linger on for a while, potentially weighing on business investment. At the same time, things are heating up again in Italy, now that the European Commission recommended to start up an excessive deficit procedure against the country. A final decision on this matter is likely to be taken at the Ecofin meeting on the 9th of July, though we might see a delay.

In any case, this is sure to create tensions within the Italian government, certainly if it necessitates the scrapping of a number of election promises. We, therefore, think that the likelihood of early elections in September has significantly increased, especially now that Lega strongman Matteo Salvini might be keen to capitalize on his very strong result in the European elections

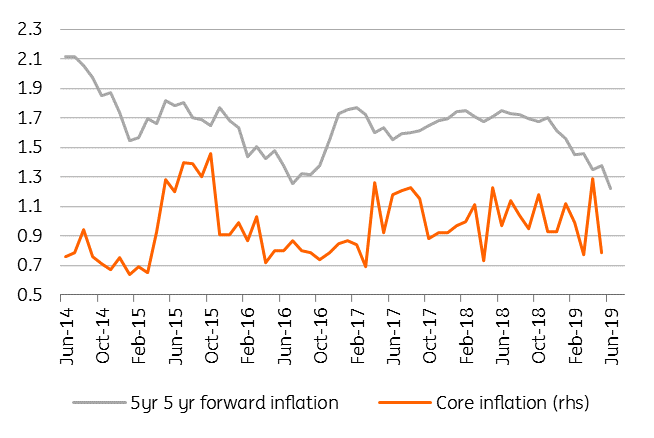

Cry wolf

After the artificially higher inflation readings for April because of late Easter holidays, inflation fell back in May. Underlying inflation actually declined to only 0.8% in May with the closely followed 5yr 5yr forward break-even inflation rate now at the lowest level in years. According to the PMI survey Input Cost inflation moderated to the lowest level since September 2016 in June, in turn alleviating upward pressure on selling prices. Average prices charged for goods and services printed the smallest increase since November 2016. With oil prices having declined lately, headline inflation is also likely to fall again in the coming months.

We expect headline inflation to average 1.2% in 2019 and 1.4% in 2020, which remains too low. The ECB, that has continuously been forecasting higher inflation rates, has seen itself confronted with a core inflation rate that remained on average below 1% over the last five years.

Inflation remains too low

(Click on image to enlarge)

Source: Thomson Reuters Datastream

ECB to ease again

Knowing that an inflation rate of below but close to 2% is the prime objective of the central bank (and we’re still far away from that level), it was not totally surprising that after the June meeting of the Governing Council of the ECB suggested an easing bias. The new TLTROs were announced with a rather generous (though conditional) interest rate of deposit rate + 10 Bp. At the same time, the forward guidance of keeping interest rates unchanged was lengthened through the first half of 2020.

But at the ECB’s conference in Sintra Mario Draghi went even further, strongly hinting at a further rate cut (the subsequent depreciation of the euro triggered a new tweet from president Trump, actually accusing Draghi of currency manipulation). We, therefore, believe that a 10 basis point cut is now on the cards in the second half of this year. It could come as soon as July, although the September meeting would be more logical since the ECB will then present the new staff forecasts. So it will pretty much depend on the economic data flow in July.

Mario Draghi just announced more stimulus could come, which immediately dropped the Euro against the Dollar, making it unfairly easier for them to compete against the USA. They have been getting away with this for years, along with China and others.

— Donald J. Trump (@realDonaldTrump) June 18, 2019

Given that a lower negative deposit rate for a longer time to come will increasingly become a burden on bank profitability, a tiering system for excess liquidity is likely to be introduced a bit later. And we wouldn’t be surprised if the ECB would suggest the potential of restarting net asset purchases if the economy fails to show signs of improvement in the second half of this year.

Amongst the likely options, a new corporate bond purchase program would seem a sure bet, potentially also including senior bank bonds. As for sovereign bonds, we still think there is some potential, though it is unlikely that the maximum threshold on sovereign exposure would be altered (if the ECB were to cross the 33% threshold, it becomes a preferential creditor and could block all debt restructuring). We believe that the ECB would be more likely to diverge from the capital key, no longer buying in jurisdictions where it already reached the threshold.

The eurozone economy in a nutshell (%YoY)

(Click on image to enlarge)

Source: Thomson Reuters, all forecasts ING estimates

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more