Eight Centuries Of Global Real Interest Rates

Guest post by Constantin Gurdgiev, TrueEconomics.Blogspot.in

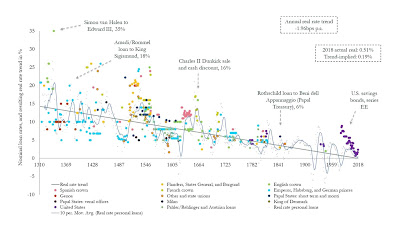

There is a smashingly good paper out from the Bank of England, titled "Eight Centuries of Global Real Interest Rates, R-G, and the ‘Suprasecular’ Decline, 1311 - 2018", Staff Working Paper No. 845, by Paul Schmelzing.

Using "archival, printed primary, and secondary sources, this paper reconstructs global real interest rates on an annual basis going back to the 14th century, covering 78% of advanced economy GDP over time."

Key findings:

- "... across successive monetary and fiscal regimes, and a variety of asset classes, real interest rates have not been ‘stable’, and...

- "... since the major monetary upheavals of the late middle ages, a trend decline between 0.6 - 1.6 basis points per annum has prevailed."

- "A gradual increase in real negative‑yielding rates in advanced economies over the same horizon is identified, despite important temporary reversals such as the 17th Century Crisis."

The present 'abnormality' in declining interest rates is not, in fact 'abnormal'. Instead, as the author points out:

"Against their long‑term context, currently depressed sovereign real rates are in fact converging ‘back to historical trend’ - a trend that makes narratives about a ‘secular stagnation’ environment entirely misleading, and suggests that - irrespective of particular monetary and fiscal responses - real rates could soon enter permanently negative territory."

Two things worth commenting on:

- Secular stagnation: in my opinion, interest rates trend is not in itself a unique identifier of the secular stagnation. While interest rates did decline on a super-long trend, as the paper correctly shows, the broader drivers of this decline can be distinct from the 'secular stagnation'-linked declines in productivity and growth. In other words, at different periods of time, different factors could have been driving the interest rates declines, including higher (not lower) productivity of the financial system, e.g. development of modern markets and banking, broadening of capital funding sources (such as increase in merchant classes wealth, emergence of the middle class, etc), and decoupling of capital supply from the gold standard (which did not happen in 1973 abandonment of formal gold standard, but predates this development by a good part of 60-70 years).

- "Permanently negative territory" for interest rates forward: this is a major hypothesis from the perspective of the future markets. And it is consistent with the secular stagnation, as availability of capital is now being linked to the monetary expansion, not to supply of 'organic' - economy-generated - capital.

More hypotheses from the author worth looking at:

"I also posit that the return data here reflects a substantial share of ‘non‑human wealth’ over time: the resulting R-G series derived from this data show a downward trend over the same timeframe: suggestions about the ‘virtual stability’ of capital returns, and the policy implications advanced by Piketty (2014) are in consequence equally unsubstantiated by the historical record."

There is a lot in the paper that is worth pondering. One key question is whether, as measured by the 'safe' (aka Government) cost of capital, the real interest rates even matter in terms of the productive economy capital? Does R vs G debate reflect the productivity growth or economic growth and do the two types of growth actually align as closely as we theoretically postulate to the financial assets returns?

The macroeconomics folks will call my musings on the topic a heresy. But... when one watches endlessly massive skews in financial returns to the upside, amidst relatively slow economic growth and even slower real increases in the economic well-being experienced in the last few decades, one starts to wonder: do G (GDP growth) and R (real interest rates determined by the Government cost of funding) matter? Heresy has its way of signaling unacknowledged reality.

Disclaimer: No content is to be construed as investment advice and all content is provided for informational purposes only. The reader is solely responsible for determining whether any investment, ...

more