Do Debt-To-GDP Ratios Really Matter?

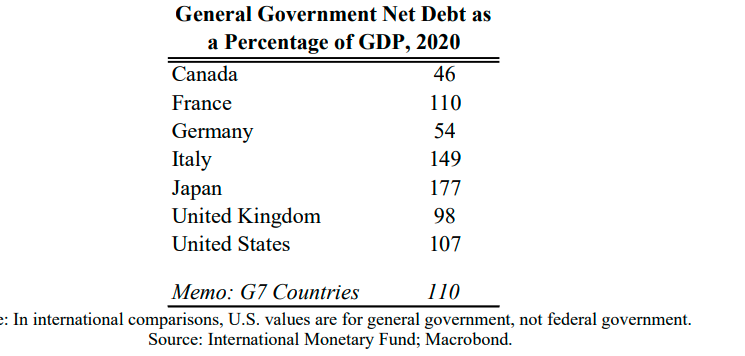

As government deficits soar, commentators increasingly focus on the debt-to-GDP ratio to measure a country’s fiscal health. The debt-to-GDP ratio for the G7 countries, on average, exceeds 100%, a point of departure that has raised alarm bells. Economists have long found this measure to be unsatisfactory, despite its widespread use. A recent study makes the case that the debt-to-GDP measure ignores the fact that both the present value of GDP has risen and debt service costs have fallen as interest rates have fallen. That is, the measure does not reflect how to evaluate the impact of debt on a nation’s fiscal condition.

(Click on image to enlarge)

Accordingly, debt-to-GDP ratio is misleading because:

- It ignores the fact that debt can be repaid over time. First-year economic students know full well the fallacy of mixing a “stock” with a “flow”. In this case, the debt is a stock, a measure at a point in time, and GDP is a flow, a measure over a period of time.No borrower or lender expects the debt to repaid in one year, hence the importance of time. Just like the homebuyer looks at mortgage interest costs compared to his/her earnings over time, we should compare the interest costs to economic growth rates over an extended period of time. As long as economic growth rates exceed interest rates, the debt is manageable over time and eventually, interest costs will play a smaller role in total government expenses. This means that over time the economy will outgrow its debt and associated interest costs so that the debt will be reduced.

- Low-interest rates increase the present value of future GDP, hence the cost of servicing the debt is more manageable. Governments recognize that they have a great opportunity to borrow at historically low-interest rates. Low-interest rates result in a higher estimate of discounted future GDP and, at the same time, a lower costs of debt service.

- Country comparisons are very misleading. The authors note the burden of paying interest as a percent of GDP varies widely. Japan pays interest costs amounting to 0.2% of GDP with its debt-to-GDP ratio of 177%; the US devotes 2% of GDP to interest expense with 107% debt-to-GDP. Put differently, the burden of debt depends heavily on prevailing long-term interest rates, and in this instance, both countries have real interest rates either negative or close to zero.

In sum, the authors conclude that:

“The main concerns about fiscal expansion in economic downturns is that they will lead to unsustainable debt and may not be affordable in countries that currently have high debt levels. This concern is misplaced. At a minimum, countries can always come back later to raise revenues or reduce spending in order to get debt trajectories back on a desired course. More importantly, this may not even be needed as fiscal support may help fiscal sustainability by increasing output more than it raises debt, thus reducing the debt-to-GDP ratio.”