“Do Central Banks Rebalance Their Currency Shares?”

Some do; some don’t. Revised paper by me, Hiro Ito, and Robert McCauley. From the abstract:

Do central banks rebalance their currency shares? The answer matters because the dollar’s predominant role in large official reserve holdings means that widespread rebalancing requires central banks to buy (sell) a depreciating (appreciating) dollar, stabilizing its value against other major currencies. We hypothesize that larger reserve holdings have led central banks to approach their investment more systematically and to make rebalancing in the face of exchange rate changes the norm. We illustrate the choice with two polar case studies: the US clearly does not rebalance its small FX reserves; Switzerland does rebalance its very large reserves, so that changes in exchange rates do not move its currency allocation. Our hypothesis finds partial support in global aggregated data. They reject both no rebalancing and full rebalancing and point to emerging market economies as the source of the aggregate result. We also test for rebalancing with panel data and find that our sample economies on average again behave in intermediate fashion, partially but not fully rebalancing. However, when observations are weighted by the size of reserves, the panel analysis finds full rebalancing. A variety of control variables and splits of the panel sample do not alter the thrust of these findings. Central banks rebalance their FX reserves extensively but not uniformly.

The most substantive innovation is the use of panel data with observations on how individual central banks and government agencies that hold foreign exchange reserves manage reserve composition. This is a unique data set, and represents an expansion of the data set compiled and examined in Ito and McCauley (2020), discussed in this post (the expansion is from 58 to 74 countries, 1999-2018 to 1998-2020).

Third, panel analysis of more than 70 economies also finds that in aggregate central banks partially rebalance. When advanced and emerging markets are separately analysed, their behavior does not differ substantially.

Fourth, when we weight the panel observations by the scale of reserves, full rebalancing is the result. From this perspective the Swiss approach is more typical of big reserve holders than the US approach. This finding is consistent with large reserve holders making reserve management more like private portfolio management.

Fifth, rapidly growing reserves are associated with a higher dollar share. We interpret this as reflecting the dollar as dominant (“vehicle”) currency in the FX market: most central banks buy dollars and then diversify into their target currencies with a lag. By contrast, there is little evidence that financial market volatility affects rebalancing.

Taking these altogether, the strong suggestion is the association of reserve size and rebalancing. In the case studies, the Swiss have large reserves and rebalance; the US, modest reserves and do not rebalance. In the aggregate data, rebalancing seems more characteristic of [Emerging Market Economies] EMEs, some of whom hold very large reserves. In the panel data, rebalancing is the norm when observations are weighted by reserve size in relation to GDP.

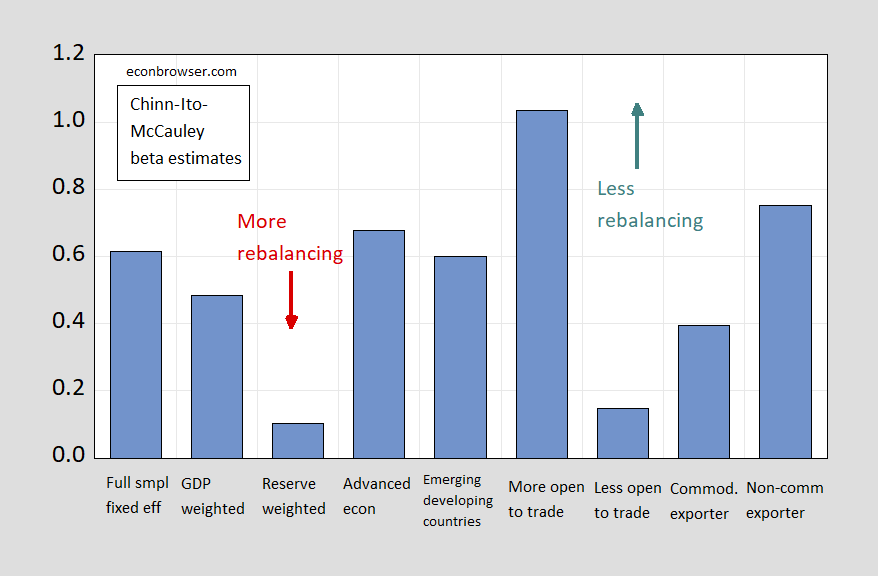

Stratifying the sample, we also find that closed-to-trade economies rebalance, while open-to-trade do not; commodity exporters tend to rebalance more than non-commodity exporters (the difference is not statistically significant in the latter case).

Some of these estimates are summarized in Figure 1 (higher values mean no rebalancing, lower values mean rebalancing).

Figure 1: Regression coefficient of change in dollar share response to valuation change in dollar share. Source: Chinn, Ito, and McCauley (2021), Tables 4, 5.

What are the macroeconomic implications? If enough central banks with enough reserves adjust in response to exchange rate changes, then there’s a possibility of effects on dollar asset values, like bond yields and the dollar itself. A back of the envelope calculation:

A 10% depreciation of the dollar could give rise to $150-$200 billion in dollar purchases. The implication for the foreign demand for US Treasury securities follows immediately.

The paper is also available as NBER working paper no. 29190.

Disclosure: None.