Core Consumer Prices Surge At Fastest Rate Since 2008

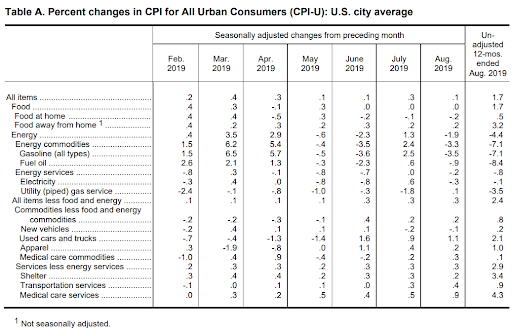

After a hotter-than-expected producer price print yesterday, consumer prices were more mixed with headline CPI rising less than expected and core CPI rising more than expected.

In fact, core CPI rose 2.4% YoY (2.3% exp) - which is the hottest since September 2008...

Source: Bloomberg

Energy prices weighed the index down as commodity prices rose...

The surge in inflation was led by a jump in Goods prices...

Source: Bloomberg

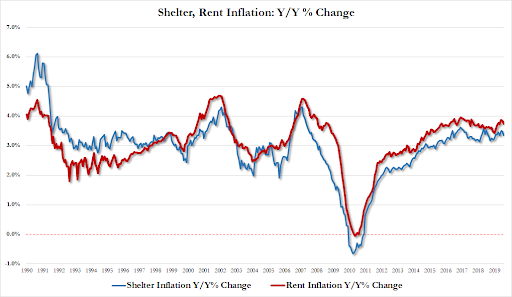

On the brighter side, shelter/rent inflation slowed a little in August...

So hotter-than-expected CPI and PPI must be transitory, right? Or Powell won't be able to deliver what Trump and the market demand?

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more