Coping With The COVID-19 Economic Shock

Every recession is different. The recession of 2020 will not be an exception to that rule.

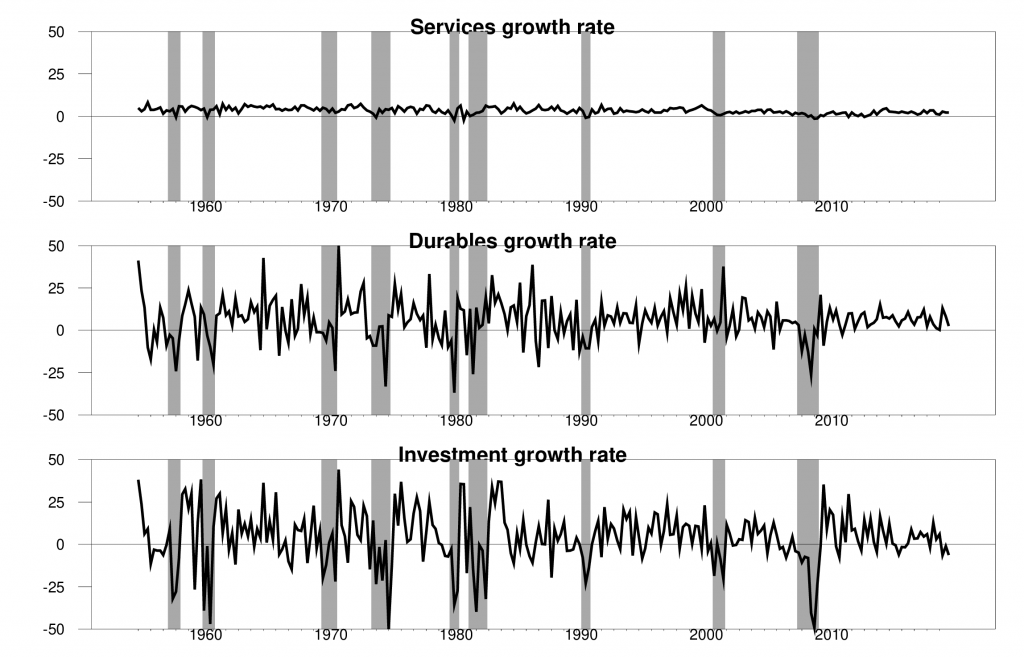

Spending on consumer services, which accounts for 47% of U.S. GDP, is normally quite stable over the business cycle. In a typical recession, service spending grows at a slower than normal rate but doesn’t actually fall. Not so this time. Restaurants, hotels, theaters, airlines, and so much more are devastated by the current environment.

(Click on image to enlarge)

Top panel: percent change in real personal consumption expenditures on services. Middle panel: percent change in real personal consumption expenditures on durables. Bottom panel: percent change in real investment spending. All growth rates are reported at an annual rate.

In typical recessions, most of the action is in investment spending and purchases of consumer durables. We’ll see that this time, too. Who is planning to buy a car this month? Businesses that can postpone big new expenditures surely will. U.S. oil companies have announced big spending cuts.

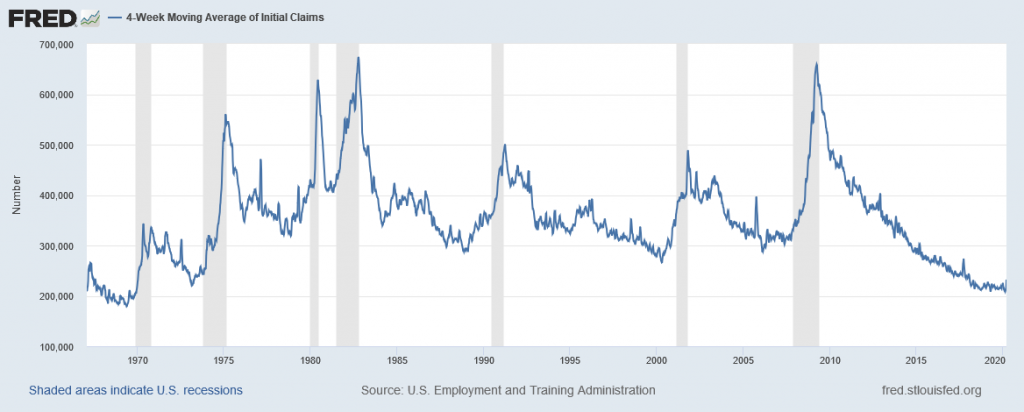

None of this is showing up in the main economic indicators yet. But it soon will. The most reliable leading economic indicator has always been initial claims for unemployment insurance. That’s moved up quite sharply over the last few weeks.

(Click on image to enlarge)

4-week average of initial claims for unemployment insurance, Jan 2019 to Mar 14, 2020.

Goldman Sachs is talking about an estimate of 2.25 million for the number of new claims for unemployment insurance during the last week. To put that in perspective, if GS is right, new claims for unemployment insurance during the last week were three times as bad as the worst week the U.S. has ever recorded.

(Click on image to enlarge)

Weekly initial claims for unemployment insurance, 1970 to Mar 14, 2020.

That’s enough to bring a sad face back to our Econbrowser Emoticon. We’ve used the countenance of the Little Econ Watcher to summarize our overall qualitative impression of incoming economic news. Today we’re bringing back the sad face, something we haven’t had to show since August of 2009.

(Click on image to enlarge)

![]()

Econbrowser emoticon, Sep 2006 to Mar 2020.

So what’s the end game? If a vaccine or cure could be found and mass-produced, this could all be put back together as rapidly as it fell apart. Most people could go back to their old jobs, and this would all be an asterisk to the economic statistics and a horrible shared dream. This scenario would mean a V-shaped recession with sharp recovery. Unfortunately, most health experts think that a real cure or vaccine are a long way off. Still, a lot of very smart people are working very hard on this from all kinds of different angles. It’s often a mistake to underestimate the resourcefulness and ingenuity of the human race. Don’t count us out just yet.

The more realistic scenario is that we continue to hunker down, waiting for lockdowns to bring the number of active infections down. But when the lockdowns are lifted and more people try to return to some semblance of normal life, the virus will spread again, until it is ultimately checked by immunity of the growing number of people who have been exposed. That’s a scenario in which life takes years to get back to normal, and many businesses must deal with a huge long-term shock.

The more months that the normal patterns of business and work are disrupted, the harder it’s going to be to rebuild. As more companies go bankrupt, as more restaurants never re-open, it means more people can’t go back to their old jobs. Permanent dislocations make the process of rebuilding the economy much longer and more painful, and mean a recession that looks more like an L than a V.

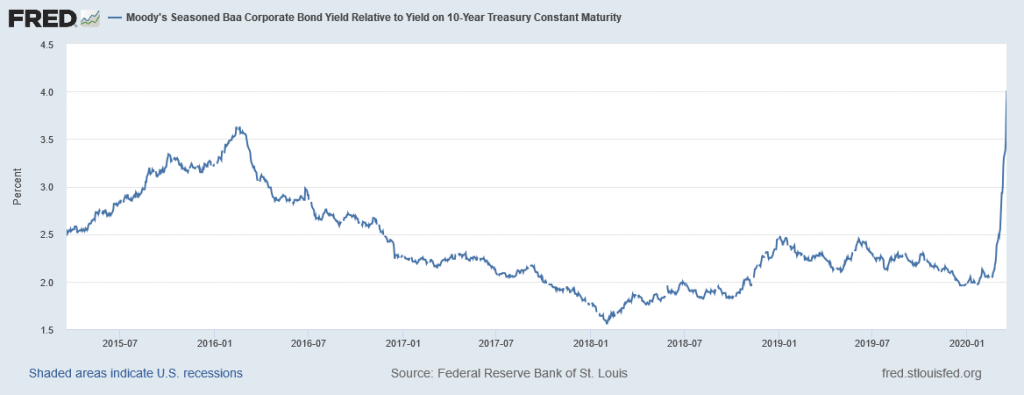

The Federal Reserve has responded appropriately by bringing short-term interest rates back to zero. But despite a lower risk-free interest rate, corporate borrowing costs have been shooting up as a result of a spiking risk premium.

(Click on image to enlarge)

Spread between yields on Baa-corporate bonds and 10-year U.S. Treasuries.

To deal with that, the Fed is resuming large-scale purchases of mortgage-backed securities and today announced a number of new facilities designed to help get credit to consumers and businesses, taking some of the risk-off private-sector lenders and putting it on the balance sheets of the Fed and the U.S. Treasury. Like the emergency measures adopted in the fall of 2008, these may help prevent the situation from becoming worse than it otherwise would be. But they are not going to turn the economy around. It is one goal (and a very important one) to prevent a bad situation from becoming even worse. But no monetary stimulus will cause oil companies to resume their spending plans.

I would say the same thing about the massive fiscal stimulus measures currently being debated. I do not buy the Keynesian view that the core problem in the current situation is that there’s not enough spending. In my view, the core problem is that we have huge sunk capital investments in infrastructure like airplanes and restaurants and hotels that were very valuable a few weeks ago but in current circumstances can contribute nothing to GDP. Nothing the Fed or Treasury can do will change that.

My recommendation is for a fiscal stimulus that is targeted at some of the very specific problems that the federal government is uniquely equipped to address. Medical bills and health-care providers need to be paid, whether patients are insured or not. Hospitals must have access to the supplies they need to deal with the enormous task with which they’re about to be confronted. Parents who are forced to stay home with children out of school, or are prevented from working at their old jobs, need help keeping the bills paid.

And the highest priority of all is to develop effective vaccines and treatments and then distribute them widely.

Disclosure: None.