Concentration Of Wealth And Power

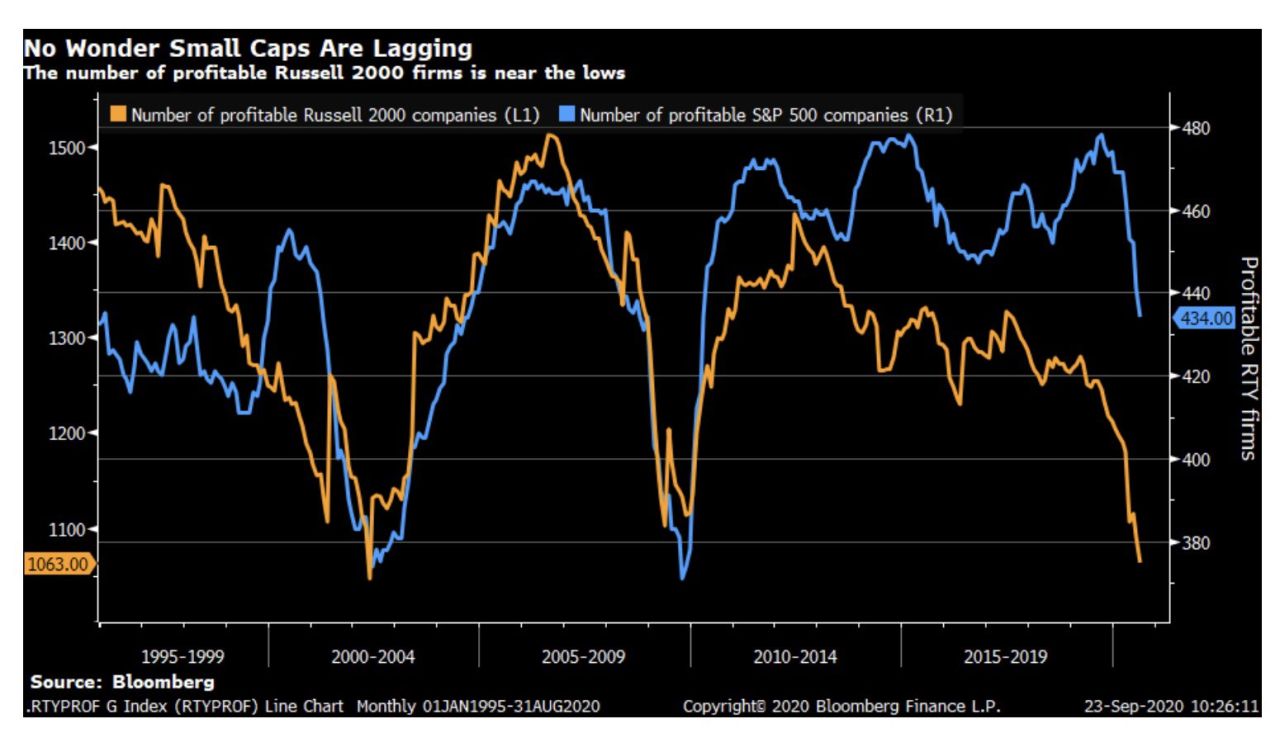

The data exhibited in the accompanying chart shows a disturbingly divergent trend that emerged pre-Covid recession/depression. As the forces of surveillance capitalism in our global digital economy exercise their impacts, other socioeconomic and geopolitical factors also play a major role. Now extend this data to companies smaller than those in the Russell 2000 and the picture gets even more ominous.

If unchecked this corporate version of income inequality augers badly for the health and well-being of the global economy. This is particularly true as the second wave of Covid makes its entrance.

A vaccine will help but it can't cure what truly ails the socioeconomic environment due in large part to the concentration of wealth and power on both an individual and corporate level.

Disclosure: Accounts managed by Blue Marble Research may presently hold a long/short position in the above mentioned issues and their inverse comparables.