Central Banks To Add Liquidity Worth 0.66% Of Global GDP On Average Every Month In 2021

Earlier today we explained why Morgan Stanley's chief equity strategist Michael Wilson voiced concerns about the continuation of the "overcooked" equity rally, expecting a drawdown into year-end for the simple reason that "both fiscal and now monetary policy have become reactive rather than proactive. For markets, that becomes the itch that needs to be scratched--i.e. market pressure is necessary and likely to get Congress and/or the Fed to act."

And yet, once the coming period of volatility is over, Morgan Stanley sees the bull market continuing with the S&P expected to rise another 10% over the next 12 months.

Why? The answer is simple and is the same one explaining the market's rally over the past decade: the unprecedented liquidity injection by central banks since 2009.

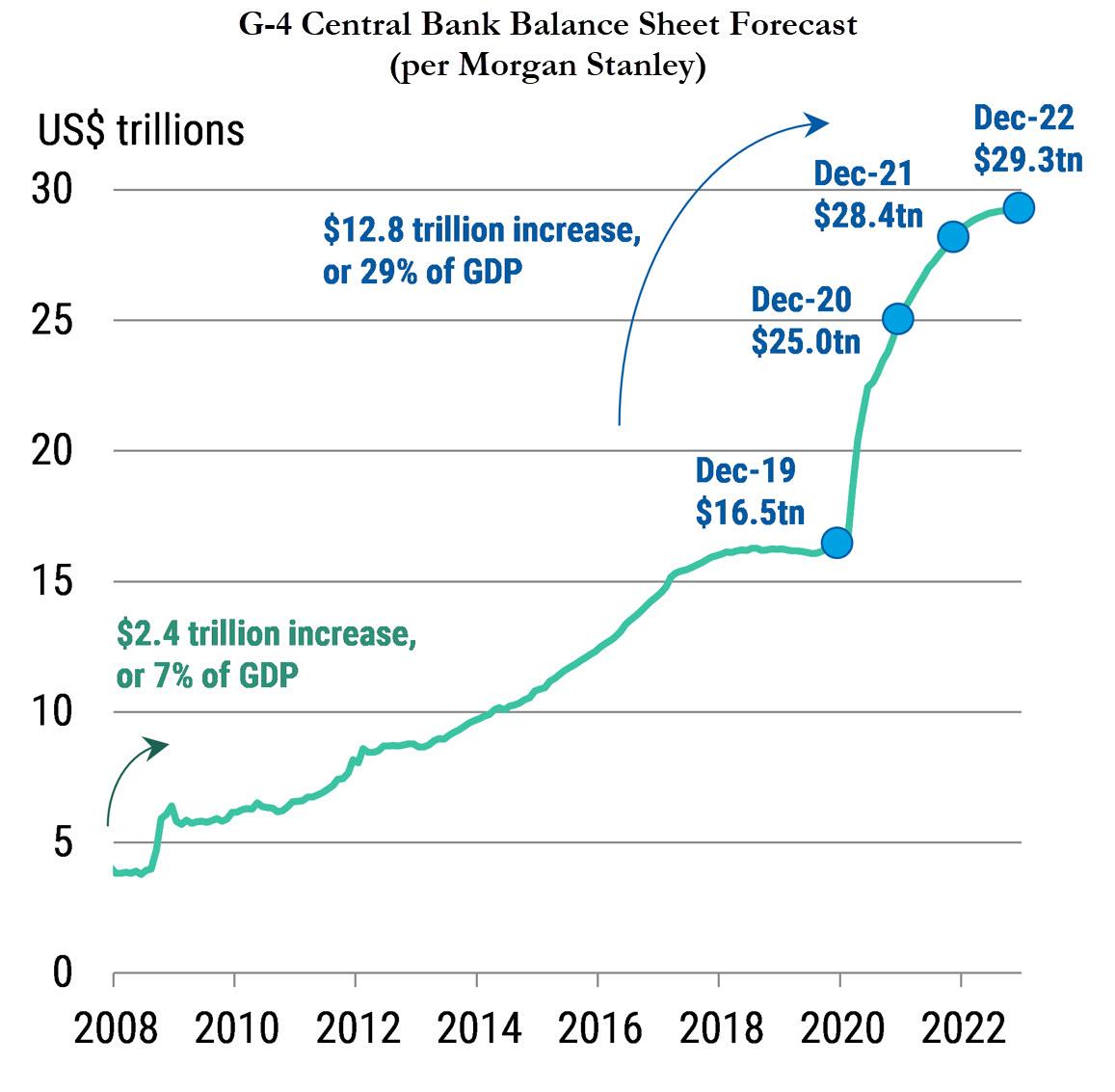

As Morgan Stanley's chief rates strategist Matthew Hornbach wrote in a note this morning while conceding that "unforeseen obstacles to a buoyant risk environment will arise" he said that "current central bank policies are aimed at softening those blows, and will be effective at doing so." Indeed, as Hornback predicts, "not only will central bank balance sheets continue to expand", with the Morgan Stanley strategist expecting G4 central bank balance sheets to hit just why of $30 trillion in two years, up from $25 trillion currently...

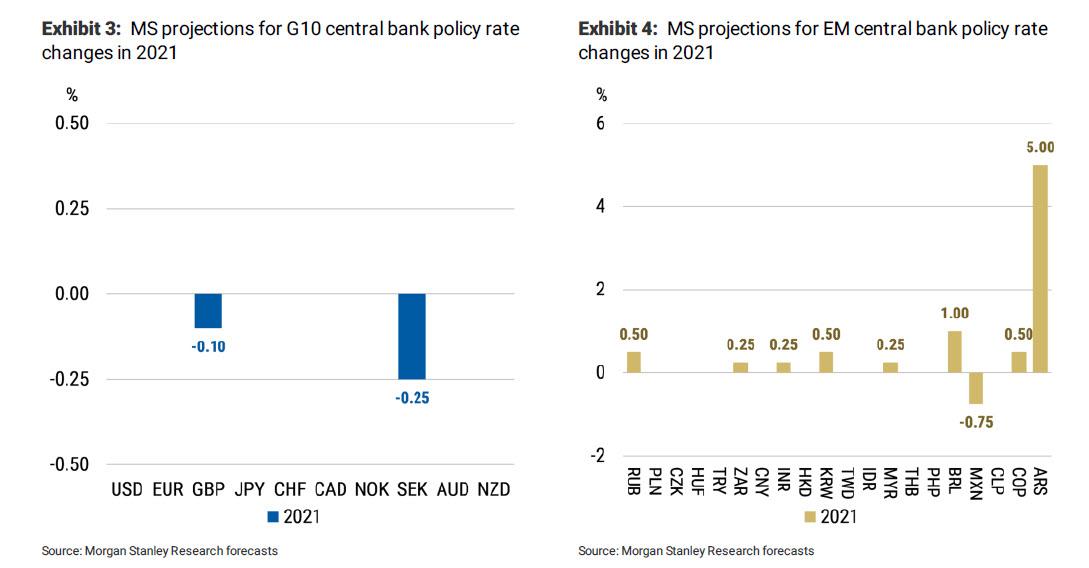

... but additionally "very few central banks will be raising policy rates in 2021, and a few will be cutting them further."

While it was once seen in poor form to assign a bullish thesis to central bank liquidity and intervention, those days are long gone as Hornbach shows:

Back to Liquidity

An important feature of 2021 will be the liquidity underlying economic growth. Why is liquidity important to macro markets? It both greases the wheels of transactional finance and changes the opportunity set available to investors. When it comes to liquidity, our focus is on both "narrow" and "broad" measures, as defined by Goodfriend (2000). And we expect both types of liquidity to expand in 2021.

Liquidity will come from continued central bank QE...

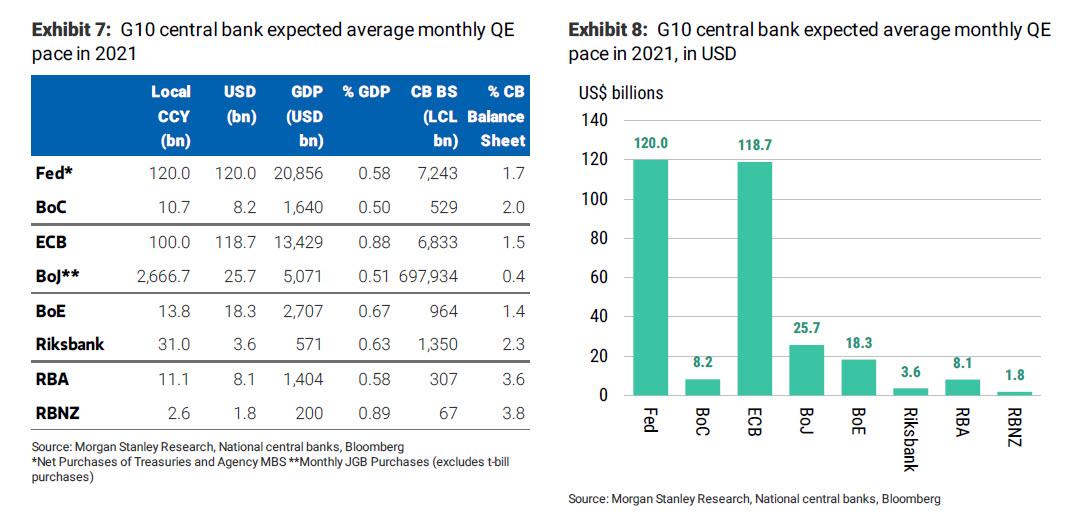

Central bank purchases of private sector assets (government bonds, corporate bonds, agency MBS) feature heavily in both types of liquidity injection. Exhibit 7 shows our monthly QE projections for the 8 central banks we think will be active in 2021.

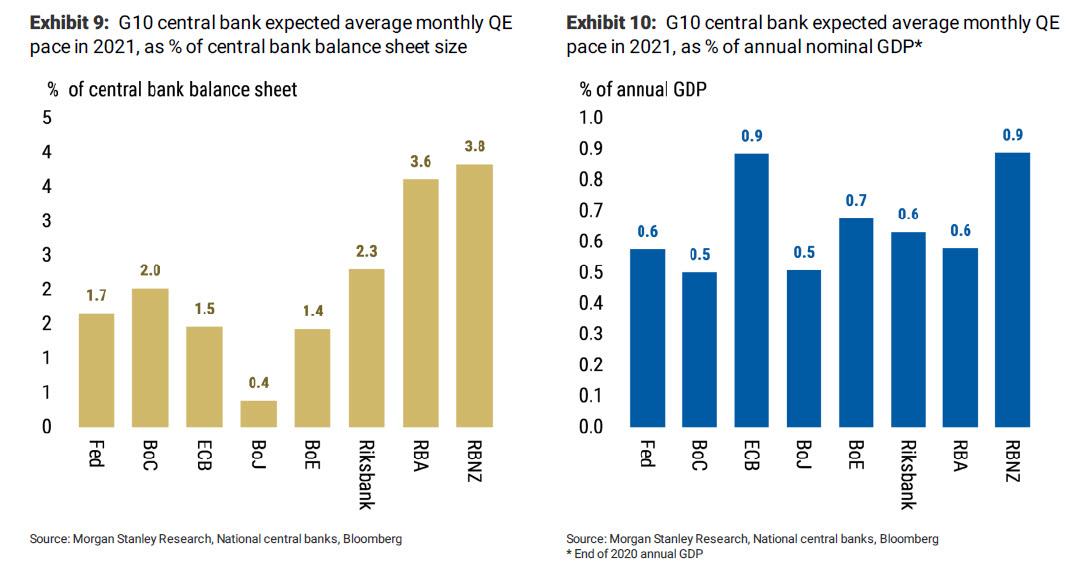

We expect these 8 combined to remove US$304 billion of securities ($238 billion of which will be government bonds), on average, from private markets every month in 2021. Unsurprisingly, the Fed and the ECB will remove the most securities each month, in US dollar terms (see Exhibit 8).

In total, these 8 central banks are expected to add liquidity worth 0.66% of annual nominal GDP, on average, every month in 2021. "That is a rapid pace of global liquidity injection, the likes of which we haven't seen outside of 2020" Hornbach casually inserts.

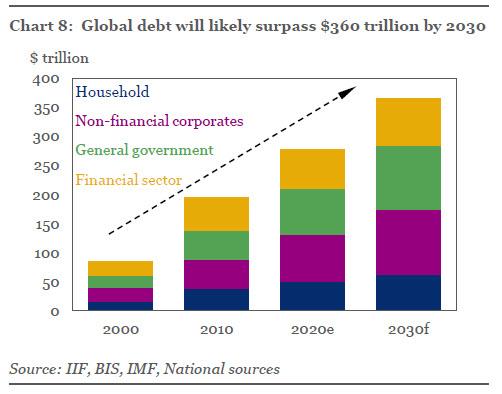

While these are staggering numbers, consider that the IIF now sees total global debt rising from $277 trillion at the end of 2020 to a grotesque $360 trillion by 2030, over $85 trillion from current levels.

And in a world in which helicopter money is the norm as government debt is now actively monetized by central banks to enable MMT, we expect the real central bank balance sheet number to be drastically higher than Morgan Stanley's forecast.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more