Central Banks: A Cycle Of Addiction

Requiem for a Dream (2000)

A 35-year Secular Trend

Two of the world’s major central banks – namely the Bank of Japan (BOJ) and the European Central Bank (ECB) – have created what is akin to a cycle of addiction to negative interest rates. Moreover, even those developed economies with positive rates appear addicted to near-zero rates. Without them, developed market economies seemingly begin to slip back into growth malaise. [1] Ben Bernanke’s 1999 critique of the Japanese central bank’s failure to act aggressively enough to stop their ‘lost decade’ is arguably one of the first seeds of the ‘do whatever it takes’ mantras now so common amongst global central bankers. [2] These mantras’ tools include quantitative easing (QE) – also known as Large Scale Asset Purchases (LSAPs) or Permanent Open Market Operations (POMOs) – which have ultimately forced long-rates negative in much of Europe and Japan. This suppression has far longer-lasting effects on capital allocation decisions and investor behavior than traditional rates policy using temporary open market operations (TOMOs). [3]

Step-by-step and slowly over time, the BoJ and ECB followed the Swedes and eventually arrived at negative interest rates policy (NIRP). This policy was not just limited to deposit rates but QE allowed its application to longer duration risk-free (as well as to risky) assets. Similarly, over the past 35-years, the Fed also has been on a march towards zero interest rate policy (ZIRP). However, the U.S. has the luxury of far better demographics than Europe and Japan. The U.S. also has the benefit of fiscal unity, which Europe lacks, and the U.S. has the benefit of possessing the world’s reserve currency. The structural impediments to growth in Japan and Europe have arguably necessitated more aggressive monetary policy. Not all within the central bank community agree with this approach. Former BOJ Governor Masaaki Shirakawa has identified what he calls the global ‘Japanification’ of monetary policy; importantly, he argues it has failed. [4] While Ben Bernanke has since recanted the severity of his 1999 critique, it has mattered little. Once socialized, central bankers seized upon it as an excuse to become even more active economic influencers.

An Anachronism

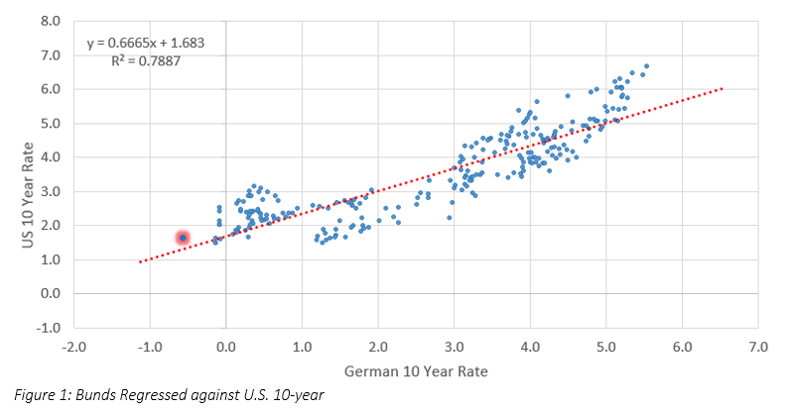

Traditional monetary policy models are anachronistic. Despite aggressive policy measures, inflation has not met central bank targets in the U.S., Europe or Japan. The closed and static monetary policy models of the past fail to recognize that the Fed is no longer the only large policy actor. They generally assume economies are closed and not reflexively adaptive (i.e. – dynamic). To the contrary, rates markets are open systems subject to cross-border capital flows. For example, negative rates in Europe and Japan have important impacts on U.S. rates. Figure 1 shows how the U.S. 10-year regresses against the Bund (the German 10-year). The repression of long-rates in those geographies has anchored rates here. [5] Lastly, QE killed the traditional relationships between inflation and rates, and it also murdered the Philips curve. In fact, QE has created the unintended consequence of overinvestment, overcapacity and consequent lack of pricing power. Thus, the low rates QE produced have arguably caused the low inflation central banks intended it to cure.

The most extreme deployment of QE results in prolonged periods of negative long-rates, as we currently observe in Europe and Japan. The concept of negative real rates should not be offensive on its face. Negative real rates may occur when inflation exceeds the nominal interest rate. By the Fisher identity, nominal rates = real rates + inflation; thus, real rates = nominal rates – inflation. Real rates have gone negative in the past at various periods in time, and it is one reason why the Fed or other central banks have generally chosen to hike when inflation gets too high relative to the policy rate. Traditional theory holds that negative rates are inflationary. Proponents may argue that because negative real rates have historically required central banks to raise policy benchmarks to prevent inflation (as in the Volker era) that the converse is true. That is, they may argue that the use of negative rates now will create inflation later. We disagree. Currently, in Germany, real rates = [-.3% – .9%] = -1.1%. These deeply negative rates suggest that the ECB may be profoundly concerned about renewed deflation – ironically, we believe their prescription is producing precisely the opposite of the desired result.

Figure 1: Bunds Regressed against U.S. 10-year

While exacerbated by the trade war, the slowdowns in Europe and Japan are largely structural. If negative rates in the developed world outside the U.S. – especially long-rates – remain pervasive, the bid for U.S. duration should continue. We think low growth and the potential for capital loss will require persistently low rates. Therefore, it is our view that long rates in Europe and Japan will continue to anchor U.S. long-rates, which will trend towards zero longer-term. Over the next three to six months, we forecast the U.S. 10-year yield will approach 1.25%. [6] This likely coaxes the Fed to cut the funds rate more aggressively in 2020, as it will desire to prevent a prolonged yield curve inversion and its impact on banks. We doubt that nominal U.S. rates ever go negative as there appears to be resistance within the Fed, but we posit that real rates most certainly will. Indeed, it seems as if a Lagarde ECB might not be quite as committed to negative rates as a Draghi ECB, but she may have no choice but to force rates more negative given the capital loss that less negative rates will create. [7]

Trapped

We believe QE has created an addiction to more QE (in both low-rate and negative-rate economies). Negative rates, in particular, necessitate yet more negative rates; they lock central banks and the economies they serve into a cycle of addiction to negative rate policies. [8] An addiction to low or negative rates can occur for several reasons. In order for a firm to invest in a new project, it must believe that low or negative rates will be persistent enough to limit refinancing risk. In the extreme example of negatively yielding debt, holders must also believe that rates will become more negative because they own these securities for capital appreciation rather than yield! Europe exemplifies this problem. These two behaviors are how the addiction to low rates forms.

Negative rates (whether real or nominal) are effectively a tax on capital providers – i.e. on savers. Capital providers that should receive a return for the privilege of a borrower providing stewardship of their capital are instead charged for it. This tax creates unintended consequences and incentives, just as fiscal tax policy often does. Indeed, we’d go a step further and suggest that negative rates are social policy clothed in the guise of monetary policy. Rates policy wasn’t always this way, but the world is here now and the voting public ought to pay as much attention to it as it does to fiscal policy. Democracies are based on the idea that a country’s citizens should determine a government’s decisions to tax, spend and redistribute wealth. Monetary policy has no such constraints, yet it has similar consequences for the redistribution of wealth from savers to consumers.

The costs of persistently low or negative rates may ultimately be far too high. For firms, they promote inefficient capital allocation decisions – specifically, they lead to overinvestment. Importantly, QE distorts perceptions about what rates of return an investment must produce over the long-term. For context, TOMOs distorted (lowered) capital costs for only short duration bonds. Therefore, the impact of lower short-rates was mostly to create a pull forward in demand (i.e. – an intertemporal demand impact) with only minimal impact on firms’ long-term investment decisions. As POMOs suppress term premia, the impact is also to pull forward investment (rather than just demand), as firms now have lower long-term hurdle rates. This appears to have created global overcapacity and oversupply. When industries have excess capacity, firms lose pricing power and inflation becomes difficult to achieve.

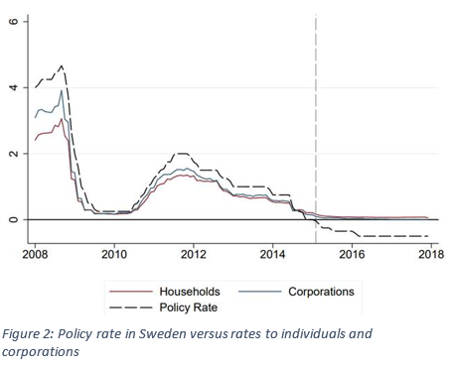

Disinflation is not the only risk to low or negative rates. It is particularly important to understand risks to a system where negative yields are common. Currently, there are about $15 trillion in negatively yielding securities. Most of those are in Europe and the rest in Japan. First, bank profitability suffers. Eventually banks pass those costs through to the real economy in the form of potentially higher lending rates (relative to the negative benchmark) and less lending. [9] Figure 2 shows that negative deposit rates are not passed along to borrowers. [10] Market participants ought to be painfully aware that the costs of negative rates may ultimately be borne by European taxpayers when Europe’s banks need to recapitalize. Because the financial system is global, a European bank recapitulation would have important implications for global market liquidity (not unlike in 2011) and the global economy. [11]

The impact of negative rates extends far beyond the banks. Negative real deposit or other policy rates force investors, especially captive audiences like pension funds and insurance companies, to take unwarranted duration or credit risk. For investors like these funds, when purchasing negatively yielding securities, they must receive the benefit of price appreciation to make up for the negative yield. It is the only inducement for such a purchase. In order to induce the purchase, central banks must implicitly guarantee they are committed to such policies. [12] This creates a self-reinforcing cycle that pushes the neutral rate to zero across the entire curve. It becomes a trap from which the central bank can’t escape. This can be said of low rates, but it is particularly true of negative rates. Negative rates necessitate more of the same.

Figure 2: Policy rate in Sweden vs. rates to individuals and corporations

Conclusion

The distortions QE has created (especially where QE produced negative rates) will be difficult to unwind. It is important to remember that the balance sheet expansion needed to execute on QE policies ultimately works through the suppression of term or risk premia. It is not through a quantity of money mechanism. Little firepower is left in most of the developed world for QE to have more impact, and we conclude more harm than good has already been done through negative rates policy. Overall, there are few levers left for central banks short of moving to purchases of equities (as in Japan). That leaves fiscal policy, which is notoriously inefficient and has empirically disappointed as a stimulant to growth when compared to good old fashioned productivity gains. These gains are harder to achieve when low rates keep zombie companies afloat. The seeds of aggressive rates policy and negative rates were sown in the late 1990s, and they have sprung into large dogmatic trees, which should soon be cut down.

---------------------------

[1] The need for a quick policy reversal here in the U.S. when the Fed funds effective rate hit 2.5% and the U.S. 10-year hit 3.25% is anecdotal evidence of this. Now, we think 2% on UST 10-year yields is the new 3%.

[2] The Swiss actually pioneered the practice back in the 1970s to keep their safe-haven currency from over-appreciating.

[3] For a discussion of the difference between temporary and permanent operations please see https://www.federalreserve.gov/monetarypolicy/bst_openmarketops.htm. Temporary open market operation suppress short rates while permanent operations suppress long rates (QE).

[4] World has learned wrong lessons from ‘Japanification’

[5] While alternate causes for the move in U.S. long rates may be a lack of above trend growth and inflation in the U.S., the move in 10-year yields versus the Bund and 10-year JGB is observable.

[6] It remains our view that European and Japanese negative yields will persist for at least the next eighteen months (and likely for much longer) because global growth will fail to turn. After the recent backup in yields, we foresee Bund yields once again below -50bps by year-end. The secular challenges to growth in Europe and Japan simply will not go away.

[7] The Philips Curve at the ECB. Those cataclysmic results include massive capital loss at pension funds and insurance companies that have purchased negatively yielding securities.

[8] Any withdrawal from these policies is likely to be a painful process for which few policy makers have the stomach. Perhaps, with a new ECB chief at the helm, a policy ‘mistake’ that allows European rates to become less negative too quickly will be the undoing of global risk-on.

[9] The impact of negative rates on banks may be summarized as follows:

- negative interest rates destroy NIMs;

- upon dipping below the ZLB (zero lower bound), banks no longer pass through negative yield to borrowers but in fact increase lending rates as a way to offset the cost of paying Central Banks for safely storing currency, and

- loan volumes may actually decline as rates rise because of the pass-through the costs.

[10] Negative nominal interest rates and the bank lending channel

[11] Tiering is one way the ECB has elected to attempt to ameliorate the negative impact on banks.

[12] The impact on pension fund returns is potentially catastrophic. This is where the duration and credit risk is most concentrated and could easily evolve into systemic risk.