Central Bankers Caught Are In A State Of Paralysis

As equity markets slide and bond yields drop, central bankers find themselves caught between a rock and a hard place, not really knowing which is the best way forward. The forces that are operating on the financial markets form a series of cross-currents that make navigating difficult for the monetary authorities. A quick review of these forces include:

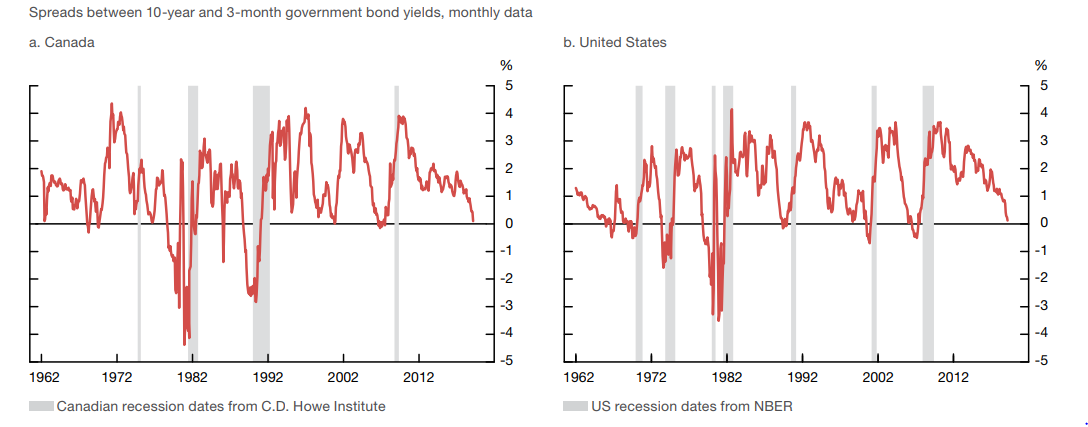

- Yield curve inversion. Despite all the protestations that today’s yield curve inversion does not necessarily mean a recession is on the horizon, the evidence is overwhelming that yield inversions are good predictors of a recession (Figure 1). In the US, the entire curve from 1-year to 10-year is under the Fed funds rate. Canadian yields are even more dramatically inverted, as the entire curve from 3-months to 30-years is below the Bank of Canada’s policy rate of 1.75%. It takes a lot of resistance on the part of these two central banks to ignore bond investors who anticipate that both banks will announce rate cuts before year’s end.

(Click on image to enlarge)

Figure 1 Interest Rate Spreads in the United States and Canada

- Inflation targets are consistently missed. After a decade of throwing everything at this problem---from zero-bound interest rates to a series of heavy bond buying programs----there is a greater concern today with deflation; inflation is running at 1.0% in the US according to data for the first quarter of 2019; freely admitting that there is a deflation problem, Chairman Powell said earlier this year that “we’re trying to think of ways of making that inflation 2% target highly credible”, recognizing that the investors are losing faith in their efforts to date.

- Political forces are playing havoc with monetary policy. Monetary policy is virtually thwarted by the reckless trade war unleashed by the US Administration, starting with China, then moving on to Mexico, and with the real prospects of introducing tariffs on imports from the EU. As trade flows decline and deflationary forces take hold, the central bank policy is essentially held hostage to the wimps of the US president;

- No room to cut rates dramatically in response to a recession. In the past the cut in the Fed funds rate from its peak to tough has been approximately 5-6% points before hitting a rate of zero; today, the Fed funds rate stands at 2.5 %., offering very little bang for the buck should the Fed find it necessary to cut rates; and, finally,

- The need to maintain independence from political interference. The Fed is under considerable pressure from the White House to lower rates; the Fed must jealously guard its independence if it wants to maintain credibility with investors worldwide; so, the timing of any decision to cut rates must not appear to be in direct response to explicit political pressure, but in response to what is prudent monetary policy.

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!