Brazil: Dilma Rousseff Needs To Embrace Market Economics

Brazilian president-elect Dilma Rousseff enters her second term following last Sunday's tight election. A leftist, Rousseff's victory was cheered by the Worker's Party she represents.

Sunday's election was one of the tightest contests in more than a decade for Brazil. President Rousseff won 51% of the vote, which is a reflection of polarity within the country. Her challenger, conservative Aecio Neves, captured almost 49% of ballots cast.

Brazil is an interesting story for investors, but it will require president Rousseff to recognize the economic issues beyond her socialist platform. She has been a champion to the middle class as a mechanism to eliminate poverty.

However, Rousseff's left-of-center social mandates have been costly. Weak export demand and declining commodity prices have not helped matters either. Rousseff also inherited the populist legacy of her predecessor, Luiz Inacio Lula de Silva. Lula was president of Brazil from 2003-2011.

Like Rousseff, Lula was a leftist, and many investors feared Lula's socialist politics as a significant threat to market economics.

Ironically, President Lula surprised investors during his first term by embracing market-friendly economic policies. Lula recognized that Brazil's future prosperity would require capitalizing on Brazil's natural resources and industrial base. The key to reaching this objective would be export demand and a stable currency (the real).

Lula never shied away from his liberal "roots," but he realized the need to gain the market's confidence. Under Lula, Brazil grew to become the world's eighth-largest economy.

It was during Lula's second term, that his growth acceleration initiatives shifted to domestic investment programs. Primary objective was to develop the country's infrastructure. It was an important social program to benefit Brazilians and it would help maintain trends of increasing foreign capital investments into the country.

Early on, Brazil's domestic public programs benefitted from a strengthening economic base, strong export demand and a firm real. Foreign investment flowing into Brazil and domestic growth initiatives also improved Brazil's credit rating. However, the downside to all this rosiness is rampant inflation and some of the highest interest rates in the world.

The financial crisis of 2008 saw global demand evaporate. As Brazil's GDP contracted so did the government's purchasing power. Consequently, many of the Lula administration's costly domestic programs were either deferred or re-prioritized.

Yet, when the Rousseff administration made World Cup a priority, public outrage reverberated throughout Brazil. Public rioting and demonstrations are rare in Brazil, but the World Cup divided the country deeply.

The sport of soccer is in the cultural DNA of most Brazilians, but they were critical of the government building costly stadiums when schools, jobs and inflation was a bigger problem.

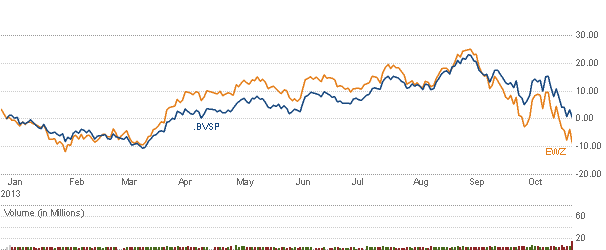

What President Rousseff Needs To Consider: Rousseff's slim victory in last Sunday's election, startled the markets significantly. Brazil's Bovespa stock index (IBOV) fell 4% while the MSCI Brazil Capped ETF (NYSEARCA:EWZ) lost over 6% on Monday, October 27, 2014. In the following days, Brazilian equities recovered some lost ground, but technical damage was significant.

President Rousseff has to be aware that you cannot have social programs unless you grow the economy first. She also must realize that feeble growth, high inflation and increased debt loads weigh in the balance.

Clearly, Brazilians favored the prospects of incumbent Rousseff over the market-friendly opponent Neves. The question is, will Rousseff recognize her razor-thin margin of victory as a need to unify the economic polarity expressed by voters?

If anything, Sunday's election shows a country at the crossroads. President Rousseff is the leader of South America's largest economy. Regionally, we do not expect a neo-populist trend like what ruined Venezuela.

Rousseff likely is aware that her Argentina neighbor and counterpart, President Cristina Fernandez de Kirchner is experimenting with nationalist policies. Access to capital markets is critical to Brazil and Argentina's bond default woes add to credit risks in the region.

Brazil has unique assets and resources, which can be converted into hard currency. Obviously, export demand will be key to economic growth, but Rousseff also has to cut government spending.

You cannot feed the social pipeline unless you have a revenue stream or credit balance to support it. The difficult task for President Rousseff will be to balance populist expectation with realistic economic policy.

Lula showed that economics and public welfare can co-exist. But, Lula benefited from the tailwinds of China and other export market demand during the first term as president. Lula was a leftist, pro labor and considered one of Brazil's most beloved politicians. Lula was also a founding member of the Worker's Party, which President Rousseff also represents.

President Rousseff, considered by many to be a "technocrat" lacks Lula's charisma and popularity. She is facing the greatest challenge of her political career. Rousseff inherited Lula's unfulfilled social commitments and faces a demographic constituency, which is divided.

The middle-class has a desire to keep moving forward and the less fortunate expect the government to support public benefits.

Rousseff's political ideology has traversed over the years from Marxism to what she refers to as "pragmatic" capitalism. Both Rousseff and Lula experienced the repressive military dictatorship in place prior to Brazil's shift to democratic government. In that perspective, the leftist dogma and radical "roots" of both Lula and Rousseff are understandable.

The question is, can President Rousseff bring about the necessary reforms needed to grow the economy and also realize her social mandate? It is possible, but investors should not expect the heady economic growth of previous years.

Given the close election results, Rousseff's pledge of reforms need to be a focus of her administration. Despite twelve years of tangible social benefits under Worker's Party rule, 48+% of Brazilian voters made it clear last Sunday they were less than satisfied.

Sometimes close outcomes can be a catalyst for getting results, and unity will require a thread, which weaves consensus and reality. Quite frankly, it is remarkable to see what socialism has accomplished in Brazil over the past decade.

It will not be smooth sailing going forward though for president Rousseff. Her calls for reform might buy her some time, but she has little wiggle room for error.

As investors, we will be watching closely to see what team she assembles to tackle the issues. Our hope is that her administration will steer clear of interventionist policies and focus on the reforms she has promised. It is a delicate dance between economic pragmatism and maintaining some sense of status quo.

Investing: Currently, our equity exposure to Brazil is limited to aircraft manufacturer Embraer (NYSE:ERJ). Our fixed income exposure includes sovereign, corporate and term facility debt. Our weighting to Brazil is an average 3% of total allocation and we do not plan to change that near-term.

The Bovespa Index is essentially flat Y-T-D while the financial and energy weighted EWZ is down about -10% Y-T-D.

Brazil can fix its problems if the administration of President Rousseff makes the effort. It is not political risk we are most concerned about in Brazil. The greater concern, is achievement risk.

Brazil is an exciting emerging market at an inflection point. The recent sell-off in Brazilian equities may have been an over-reaction to the headline risk. While we are bullish on Latin and South America over the long term, Brazil is now a show me story.

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.