Are Millennials A Lost Generation Financially?

from the St Louis Fed

-- this post authored by Ana Hernandez Kent, Policy Analyst; William Emmons, Lead Economist; and Lowell Ricketts, Lead Analyst, Center for Household Financial Stability

Millennials are the largest adult generation in the U.S. and make up the largest share (38%) of the workforce.[ 1] Yet, the wealth accumulated by the median (or middle) millennial family is much lower than what we would expect based on previous generations.

Because of this worrisome trend, we at the Center for Household Financial Stability have questioned whether a significant share of older millennials will be able to meet long-term financial goals or if they will become part of a “lost generation."

Indeed, we published a chapter in New America’s recently released book, The Emerging Millennial Wealth Gap, to excavate some of the causes of the growing generational wealth gap. We focused on one short-term cause - the Great Recession - and two long-term causes of secular wealth redistribution from younger to older families and from less- to more-educated families. We also highlighted the millennial racial and ethnic wealth gaps.

Great Recession and Younger Families

First, the Great Recession was devastating to many families, but younger families were hit harder and lost a larger share of their wealth than older families.

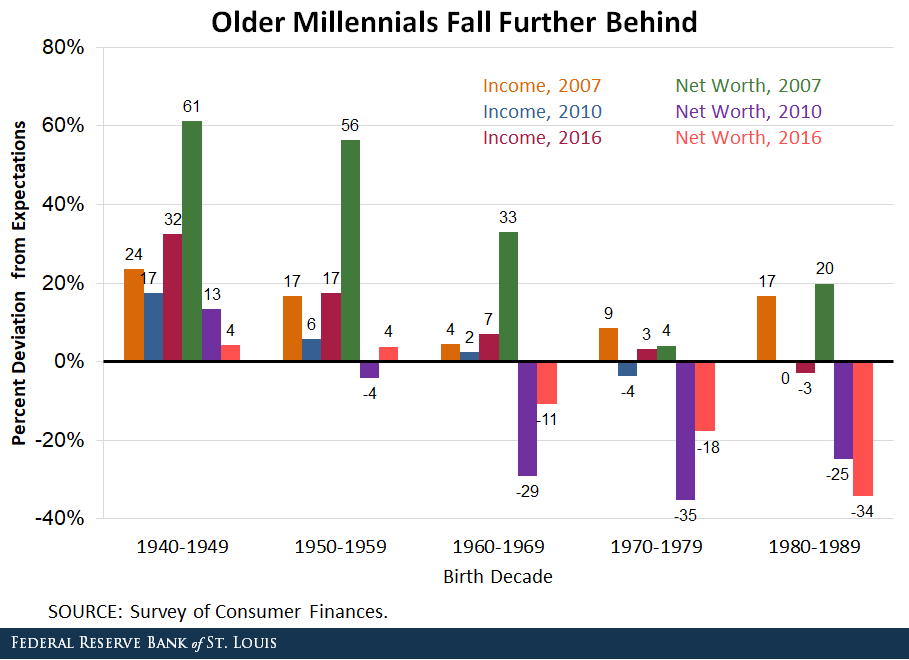

To dive deeper, we looked at families grouped by the decade in which the family head was born. We define older millennials (our focus group) as families headed by someone born between 1980 and 1989. We also focus on the median (or typical) family of each group.

The horizontal line in the figure below shows what we would expect income and wealth to be for a typical family based on previous generations at the same age:

- If the bars are above that line, the typical family in that generation was doing better than expected.

- If the bars are below, that generation was doing worse than expected.

The typical income and wealth observed for each generation fell between 2007 and 2010. While the earnings of typical families had recovered by 2016, the wealth outcomes for most generations were still below expectations.

Finances of Older Millennials

For older millennial families, what we find is troubling: They were the only group to lose ground on both income and wealth in 2010 and then fall even further behind in 2016, to 3% below income expectations and 34% below wealth expectations. As of 2016, older millennial families were the farthest behind.

Wealth Redistribution

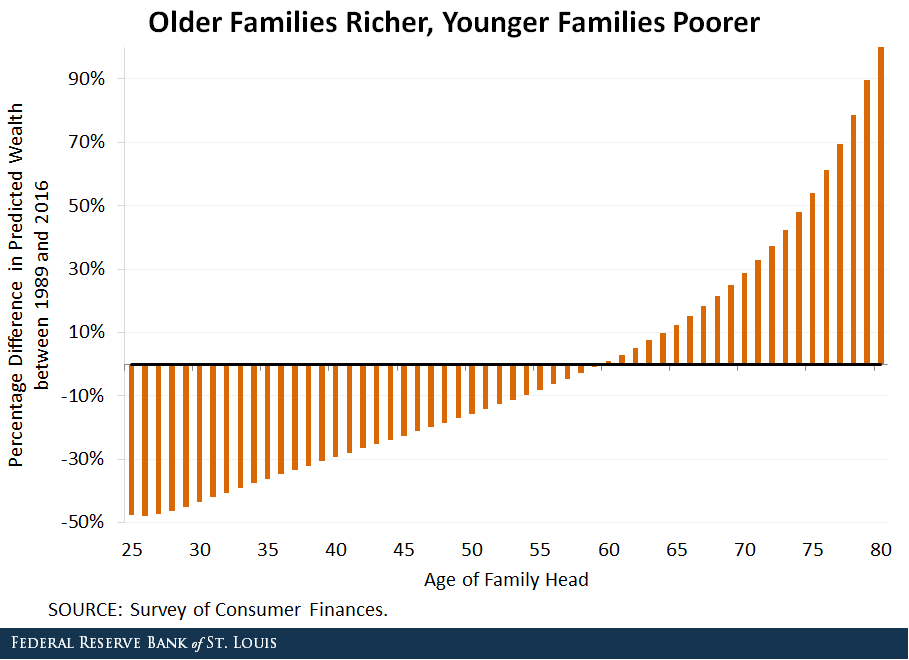

The Great Recession also amplified the trend of wealth redistribution from young to old families, which had been growing for many decades. In the figure below, we compared expected wealth levels in 2016 to those in 1989.

We found age 60 to be a demarcation point. Families with the household head near retirement age and older had higher expected wealth in 2016 than a family the same age in 1989. Younger families had less expected wealth in 2016 than in 1989.

For example, the average age within our group of older millennials was 32 in 2016. Their predicted wealth of $28,000 was 41% below a 32-year-old’s predicted wealth in 1989. For 1950s-born baby boomers (average age of 61 in 2016), their predicted wealth of $191,000 was 3% higher than 61-year-olds’ predicted wealth in 1989.

Millennials, College Education, Wealth and Income

Millennials are also compositionally different than other generations. They are more highly educated than any prior generation, for example, and thus we believed it would be instructive to disaggregate trends by education.

We broke families into two groups:

- Those headed by someone with at least a four-year college degree (hereafter college grads)

- Those headed by someone with less than a four-year degree, including those with two-year degrees (hereafter nongrads)

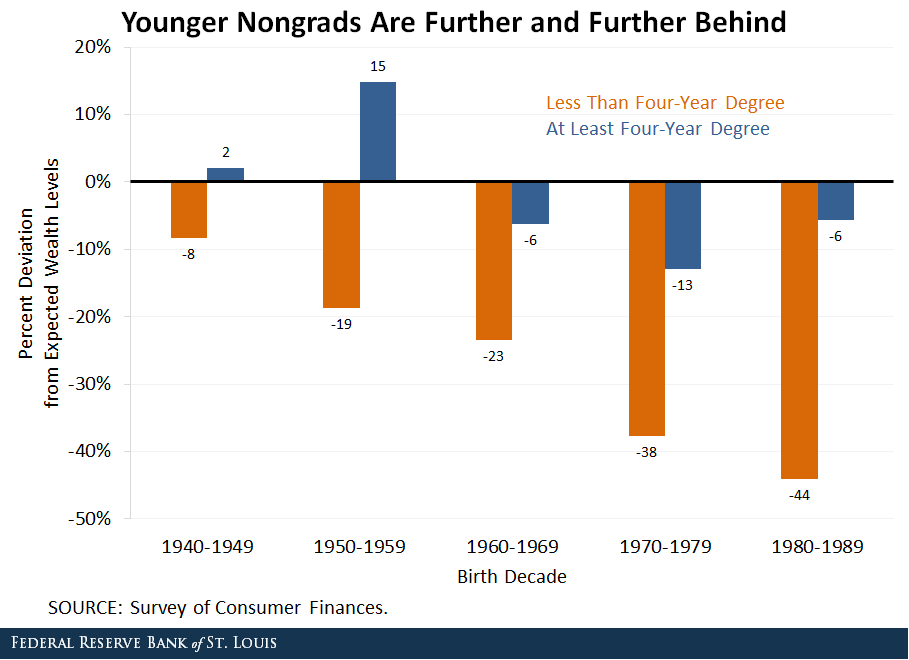

Millennial college grad families (37% of the 1980s cohort in 2016) were far above-predicted income and wealth levels in 2007, but the recession wiped out these advantages. Millennial nongrad families were already at or below norms in 2007, and the recession knocked them even lower.

The figure below is similar to the first one in this post, though expectations are derived from families with the same education (as opposed to all families combined). For example, college grad millennial expected wealth was compared to the wealth level we predicted based on predominantly older college grad generations at the same age.

College grad families’ wealth was fairly close to expectations. Typical millennial college grads were only 6% below expectations in 2016.

For nongrad families, the story is remarkably different. As of 2016, each successive generation was further behind wealth benchmarks than the last. Typical millennial nongrads were 44% below expectations in 2016, highlighting the struggle of nongrads to accumulate wealth.

Millennial Black/White Wealth Gap

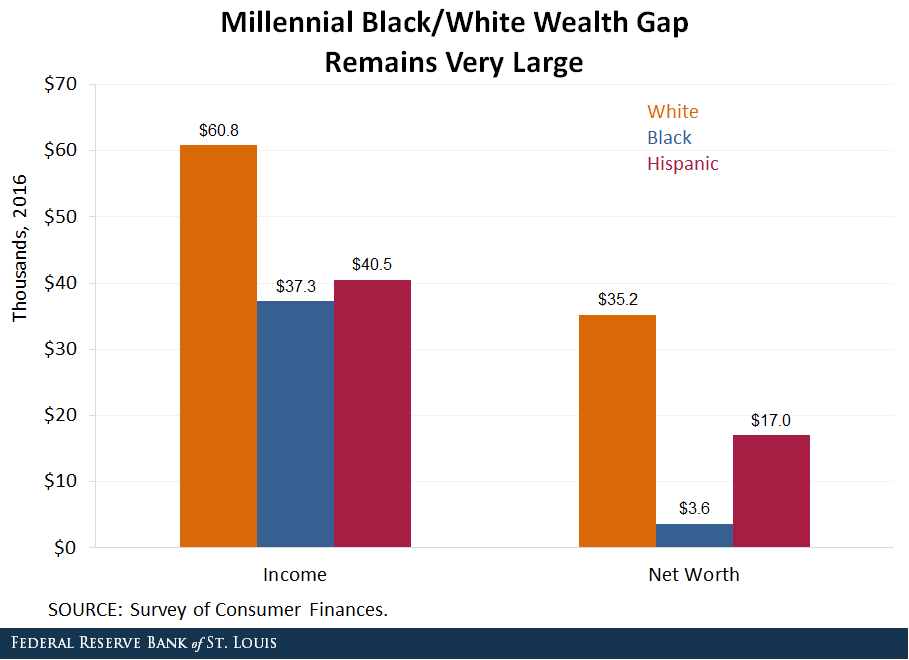

With 59% identifying as white, millennials are also more racially and ethnically diverse than previous generations. Given large income and wealth disparities by race and ethnicity, this may partially explain their poorer financial outcomes compared to prior generations (which had larger percentages of families who were white).

The millennial black/white wealth gap is nearly identical to the gap in the overall population, as the typical black millennial family has 11 cents per dollar of white millennial wealth. The millennial Hispanic/white gap was much smaller than in the overall population. The typical Hispanic millennial family had 49 cents per dollar of white millennial wealth.

Millennials Catching Up

The data summarized here illuminates the difficult path ahead for millennials if they are to catch up to the wealth experiences set by previous generations. The path may be particularly difficult for older millennials with less than a four-year college degree, who were 44% below wealth expectations.

Even more educated millennials may struggle to recover, as historically high asset returns seen in recent years may not continue. Even if these high returns do continue, the predominant types of debt millennials owe are student loans, auto loans, and credit card debt. The assets financed by these debts have not appreciated rapidly like stocks and housing in the past few years.[2]

If wealth accumulation continues to fall short, the large size of the millennial cohort may prompt policy responses in the future to close these gaps - only time will tell if such action will be necessary. Or perhaps the past experience of older generations is a poor guide and the wealth accumulation of millennials will occur later in life. Future surveys should offer new insights into the income and wealth of this generation.[3]

Notes and References

1 Cramer, Reid. “Framing the Millennial Wealth Gap: Demographic Realities and Divergent Trajectories," The Emerging Millennial Wealth Gap, New America, Oct. 29, 2019.

2 While it is difficult to measure the value of higher education financed via student loans in the same way as stocks or housing, it appears that it is not appreciating at rates greater than those assets. For more on this, see our paper “Is College Still Worth It? The New Calculus of Falling Returns."

3 The 2019 Survey of Consumer Finances should be released in late 2020.

Additional Resources

Views expressed are not necessarily those of the Federal Reserve Bank of St. Louis or of the Federal Reserve System.

Disclaimer: No content is to be construed as investment advice and all content ...

more