A –> B –> C, Does A Imply C?

I believe the answer is yes, due to “transitivity”. But what do MMTers believe?

Let’s say A is: Big open market operations occur when interest rates are positive.

And B is: Interest rates change by a large amount.

And C is: Has a significant impact on the economy.

The MMT textbook I’ve been reading suggests that A does not imply C:

Monetarists are hostile to the creation of base money to finance deficits because they claim it is inflationary due to the Quantity Theory of Money (QTM). MMT advocates would first highlight institutional practice, namely that net treasury spending initially causes an equal increase in base money.

Second, they would challenge the theory of inflation based on QTM, and argue that if a fiscal deficit gives rise to demand pull inflation, then the ex post composition of ΔB + ΔMb in Equation (21.1) is irrelevant. Overall spending in the economy is the driver of the inflation process, and not the ex post distribution of net financial assets created between bonds and base money.

When I first read this I thought:

1. This is a shocking claim.

2. This is clearly wrong.

So I set out to try to discover why they hold this highly controversial heterodox belief. Do MMTers believe that OMOs don’t have a big effect on interest rates, or do they believe that big changes in interest rates are irrelevant?

On page 364, the authors clearly indicate that they believe a big open market purchase could immediately drive interest rates sharply lower, perhaps to zero:

However, this mainstream argument [for a money multiplier] fails to recognise that the added reserves in excess of the banks’ desired reserves would immediately drive the interbank rate to zero or to a non-zero support rate

The term “non-zero support rate” presumably refers to IOER, but we can ignore that since I’m considering a big OMO in 1998, a time when IOER was zero. It is possible that a huge monetary injection could raise interest rates due to the Fisher and/or income effects, but we can rule that out as the authors are claiming “irrelevance”. A policy that has a big impact on inflation and/or real income is clearly not irrelevant. So they are obviously assuming the liquidity effect is the only relevant consideration after an OMO, in which case this MMT claim is certainly true. A big OMO would drive rates much lower, probably to zero.

OK, so MMTers correctly understand that big OMOs can have a major impact on interest rates. But perhaps interest rates don’t impact the economy?

On page 366, we find that big changes in interest rates do impact the economy:

While small changes in long-term interest rates (following corresponding changes in the target rate) may have little impact on spending, higher and higher long-term interest rates will eventually diminish domestic spending that is interest rate sensitive.

On page 369 they discuss the downside of a tight money policy:

Often too tight if it [i.e. monetary policy] is is geared to a low inflation rate (or target range), which can impose major economic and social costs of higher unemployment

(MMTers continually engage in the fallacy of reasoning from a price change, but I don’t want to be too hard on them on that point, as so do Keynesians, Austrians and NeoFisherians.)

The two key points are that OMOs can have a big impact on interest rates, and big changes in interest rates can have a “major” impact on the economy. A –> B and B –> C. But A does not imply C.

So I’m still confused.

In the comment section, people sometimes fall back on the claim that the Fed cannot arbitrarily adjust the monetary base because they target interest rates. They are mixing up several unrelated points:

- Money is endogenous when you peg interest rates at a constant level.

- A sudden change in the base could be disruptive for the banking system/economy.

Both claims are true but have no bearing on the question of what would happen if you did a big OMO and didn’t care what happened to interest rates or the economy.

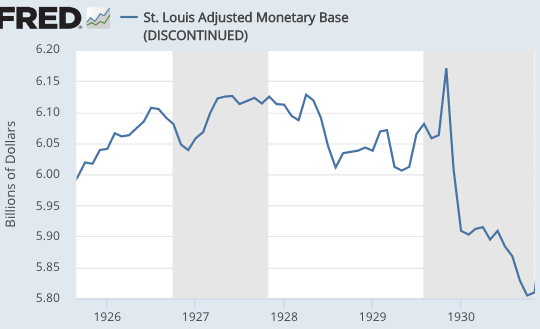

Yes, it would be very foolish to suddenly decrease the monetary base, as they did in 1929-30. That could drive the economy into a depression. But that doesn’t mean the Fed can’t reduce the monetary base. They have done so on several occasions. And it certainly doesn’t mean they cannot sharply increase the monetary base.

[The November 1929 spike is liquidity added right after the stock market crash.]

The textbook authors did not say that monetarists are wrong because the Fed has no technical ability to do discretionary open market purchases, they said that this action would be “irrelevant” if it were done. Monetarists know that money becomes endogenous if you peg interest rates, indeed that’s precisely why monetarists oppose interest rate pegs. So saying an interest rate peg makes money endogenous is not an effective critique of monetarism. Indeed monetarists either oppose interest rate targets entirely, or they favor adjusting the interest rate target frequently, as needed to keep the money supply on a non-inflationary path.

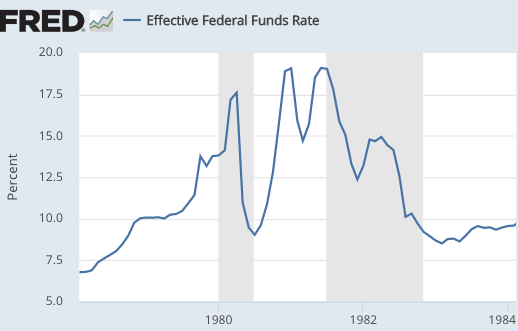

One commenter argued that the Fed continued to “set” interest rates even during the 1979-82 monetarist experiment. I’m OK with that as long as people understand that by “set” they mean this:

The Fed “set” the fed funds rate at 17.5% in April 1980, and then they “set” the fed funds rate at 11% in May 1980. A 650 basis point drop in one month. Is it just possible that the Fed had other objectives at the time, such as slowing money growth enough to reduce inflation?

And the textbook presentation of the monetarist experiment (p. 362) leaves much to be desired:

Many central banks, including those in the USA, UK, Canada, Germany and Australia, targeted a monetary aggregate that is a measure of the money supply in the late 1970s and early 1980s. They did so because through the Quantity Theory of Money (QTM), the growth rate of the money supply in the long run was alleged to determine the inflation rate. However, by the mid-1980s they had all discovered that they were unable to control the money supply, and abandoned this major plank of Monetarist thinking.

They didn’t “discover” they were unable to control the money supply, they came to believe that it was not a good idea. (Correctly, in my view.)

But that’s not my major complaint. Do you see the big problem in that paragraph? Students are informed that central banks such as the Fed adopted a monetarist policy in order to control inflation. But then students are not told the outcome of this policy experiment. Did the major central banks actually succeed in controlling inflation? Here’s the data they do not present:

Dec. 1978 – Dec. 1979: CPI rose 13.3%

Dec. 1979 – Dec. 1980: CPI rose 12.4%

Dec. 1980 – Dec. 1981: CPI rose 8.9%

Dec. 1981 – Dec. 1982: CPI rose 3.8%

And inflation has stayed fairly low ever since 1982. In other words, the monetarists were right that the Fed needed to abandon its previous interest rate smoothing policy and let rates rise as high as necessary to control the money supply growth rate. And the monetarists were wrong that a stable money supply target was a good idea (as they underestimated the volatility of velocity.) When inflation fell during the 1980s so did velocity, and the Fed rightly abandoned money supply targets and accommodated the increased demand for money

But students are not even told that the monetarist experiment succeeded in controlling inflation. Even if a textbook author (wrongly) believes it was just luck, and that the fall in inflation was unrelated to monetary policy, don’t you think that students would be interested in knowing how this famous anti-inflation experiment actually turned out?

Throughout the book, you keep encountering sentences like:

The central bank would have no choice but to add reserves back into the banking system to keep the market (interbank) rate at its target level

Yes, but what if they were willing to let rates gyrate wildly, as in 1979-82? Are they still unable to inject or remove reserves on a discretionary basis? I cannot find an answer.

If you are willing to abandon interest rate pegging and let rates move around, then you can control the money supply. You should not have a strict money supply growth rule, but you should adjust the monetary base each day as necessary to keep market expectations of NGDP growth at 4%. And let interest rates be set by the market.