30% Of GDP In Deficit Spending Is Required For A Quick Recovery

While the Federal Reserve can save the banks, only the Federal Government can save the economy. The Federal Reserve can create reserves for the banks--mark up the size of the accounts of the banking system--but only the lawmakers can mark up the accounts of the real economy through deficit spending. The Federal Reserve does not have the authority to do that.

During the GFC, the Fed "key-stroked" ~$5T into the accounts of the banking system (including the shadow banking system); almost 35% of GDP. At the same time, the Obama administration produced a $1.4T deficit in 2009 which was only 10% of GDP. The reason for such a weak response was because Obama--and nearly everyone else--thought the Federal government could "run out of dollars". This inadequate funding of the economy by Obama was the main reason for the slow recovery in GDP growth after the GFC. Obama then reduced the deficit by $1T between 2010 and 2015, nearly causing a recession in 2015; a recession that was averted when the deficit was again increased in 2016 by Trump.

This time around, the Fed again has been quick to provide reserves for the banking system--even though the banks, unlike in 2008, are not the cause of the current situation, they are being affected and must stay healthy in order to help with the economic recovery--but the Government has been slow to enact the laws needed to deficit spend and save the economy from an existential threat. $1.4T or even $2.5T of new spending, even if it goes go to the individuals and small businesses (as it must) will not be enough to save the economy from a full-on depression.

We need the kind of response that the Fed provided the banks in 2008-9 and the kind of fiscal policy response that the government provided during WWII; 35% of GDP, $7.5T transferred to individuals and small businesses. The world is facing an alien threat that transcends politics and economic theories.

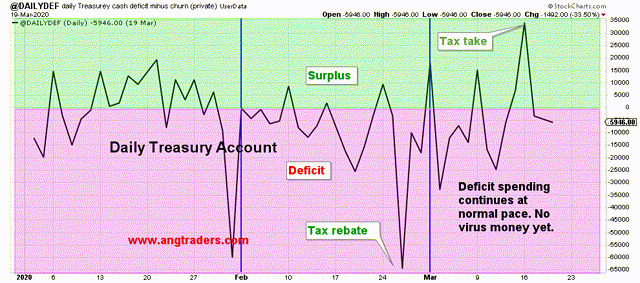

No "virus money" has been delivered yet. The treasury spending is proceeding as if nothing dangerous was happening, even the corporate tax take on the 16th took place (chart below).

(Click on image to enlarge)

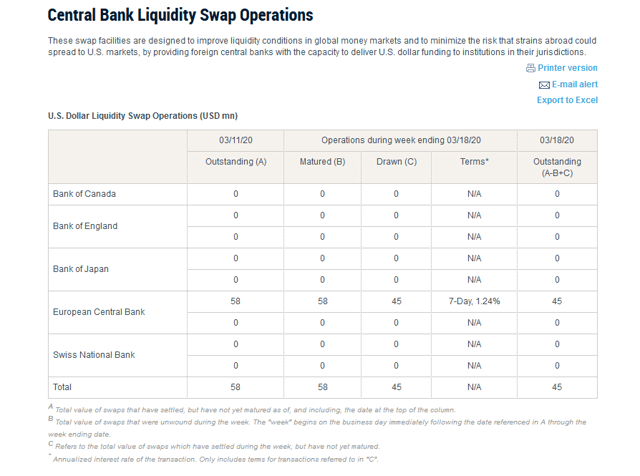

Despite all the talk of how the Fed is providing foreign currency swaps in order to ease the demand for dollars around the world, there is no evidence of these swaps (table below).

(Click on image to enlarge)

So far, there has been only talk, little action. With California and New York on shutdown--two of the top three state economies--the question becomes, what are they waiting for?

Update:

This is turning into the worst-case scenario; the defense against the alien viral invader includes a public and economic shutdown, but the politicians are not willing to work together to pay for the defense.

The Senate GOP huddled together, without the Democrats, and crafted what was supposed to be a bipartisan spending package to help pay for the defense against an alien invader. When asked why they did it without the Democrats, the answer was "because we are the majority". In other words, 'because we can'.

There was another reason for going it alone; to try and pull a fast one that would benefit large businesses disproportionately. Of the rumored $2T package, much was made of the $3000 onetime payment per family, but nothing was said about the fact that it represents only ~12% of the package, while 88% goes to corporations. There are approximately 85 million families in America. Multiply that number by $3000, and you get $250B of the $2T going to families, and $1.75T going to corporations.....nice try Mitch!

It is too late to avoid a horrendous drop in productivity and in demand, but the way they are handling this guarantees not only a deeper recession than was necessary but now the recovery will also be longer and slower than if they had funded the shutdown of the economy. Even thought the $2T was not even close to what the defense is going to cost, at least it could have started to help individuals maintain demand, and business prevent bankruptcy....with more to come later. It also would have produced a stock market bounce that we could use to sell into. Without spending 30% of GDP (~$7T) into the real economy, the market is going down hard.

Hopefully, there will be some optimism about the vote today that will allow us to get out of some positions on an up-tick. We are not getting a recovery any time soon without the $7T.