MarineMax: Soft 2017 Guidance Punished Bigly

Earnings Summary

On November 1st, MarineMax (NYSE: HZO) reported Fiscal 4Q earnings. For the quarter, EPS came in at $0.18 on revenue of almost $227.4M. Sales climbed over 20% y/y and EPS rose 38% y/y after stripping out one-offs. MarineMax also enjoyed same-store sales growth of 12% against a strong comp.

One-Year Stock Price Chart

Gross margin fell 60 bps y/y in 4Q and now stands at 24.8%. SG&A, however, fell 50 bps as a percentage of revenue to 21.6%. Expense leverage is definitely improving the operating margin as MarineMax has been able to sell significantly more boats without adding numerous new dealerships. The current dealer footprint is operating more efficiently than in the past.

Guidance: FY17 EPS guidance was $1.04–$1.14, and sales guidance wasn’t offered. (No surprise.) Forward View had previously forecast FY17 EPS of $1.24, and we were just a little above the consensus. Thus, guidance was certainly lackluster, and the stock plummeted from almost $21.50 to $15.80 by the end of the week. Selling pressure hasn’t quite abated yet.

Best & Worst News

Best News

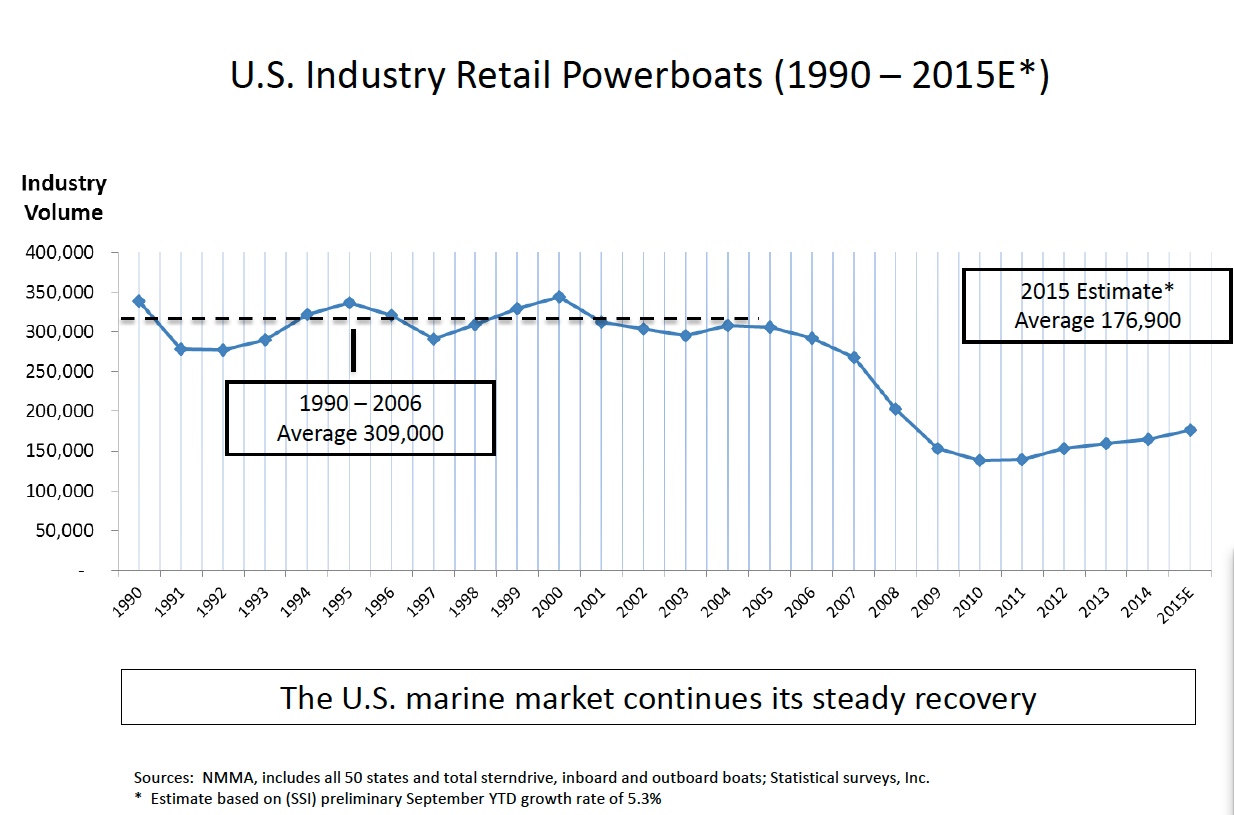

MarineMax continues to see strong industry dynamics and inventory levels. There’s no sign of a slow-down in the boating sector, especially in the high-end models sold by MarineMax. Affluent Americans enjoy significant disposable income and remain generally optimistic about their future. As long as the wealthy don’t decide to hold cash, MarineMax has room to sail because the boating sector is still around 30% below its pre-recession peak (on a units-sold basis). Interestingly, MarineMax’s gross margin has suffered slightly because big boats (yachts!) are out-selling smaller ones. A small price increase for the yachts might be warranted next year as demand for such status symbols isn’t price-sensitive. (For those of you with Economics degrees, that means that yacht demand is price inelastic, ceteris paribus.) Still, while sales of larger vessels slightly crimp gross margin, the strong gains in revenue from yacht sales also ensure that SG&A leverage steadily climbs. What is removed from gross margin, then, is partially offset by improvement further down the income statement. With a slight tweak in pricing. MarineMax can have the best of both worlds, so we’re not forecasting any issues with margins.

Boat manufacturers also remain committed to R&D, with electronics, control systems and passenger comfort the focal points of technological advances. As much as MarineMax likes to tout its own sales and marketing strategies, the company’s business would be far less impressive had boatbuilders not exited a design rut and created fresh products. One does not buy a new yacht just because his/her current one has a stain!

Worst News

In 4Q, MarineMax wasn’t able to fulfill customer demand for some boats. In the Northeast, that lack of available inventory caused some boat deliveries to be delayed until spring. Some boat manufacturers simply haven’t invested enough capital expenditures in production capacity to meet orders, and that hurt MarineMax in Fiscal 4Q. The company stated that sales weren’t lost, just delayed, so we’ll be looking for a very strong Fiscal 2Q and 3Q next year. (It’s unlikely that enough ice will be clear in all areas of the Northeast by the end of Fiscal 2Q17 to enable all deliveries.) Forward View will also be researching boat manufacturers’ capital expenditures to understand whether or not the inventory availability issue is likely to continue.

MarineMax also admittedly used 4Q to clean up their inventory. Boats with almost any age haven’t enjoyed good margins as the wealthy currently demand the newest and hottest models. Thus, look for MarineMax to invest heavily to restock fresh inventory while avoiding a build-up of any aging boats. That process will necessitate a careful balancing act between maintaining availability and ensuring that potential customers don’t see outdated inventory. MarineMax’s margins will be heavily dependent upon the company’s inventory position through Fiscal 2017.

The Forward View

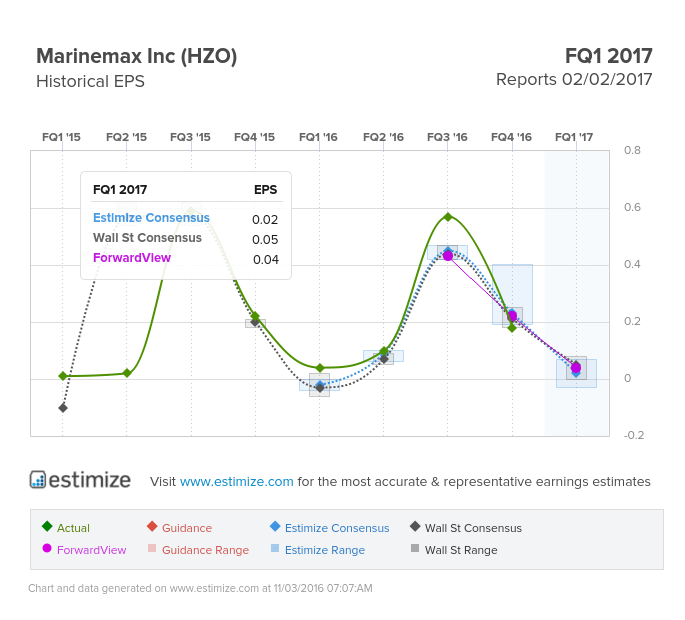

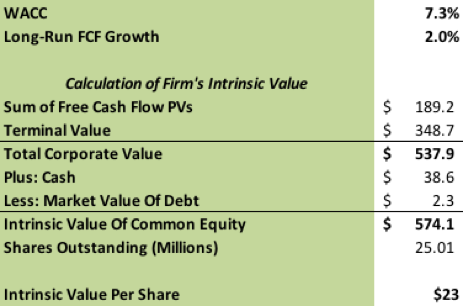

Forward View is reiterating our Buy rating on MarineMax, but we’re trimming our price target to $23. We believe that Wall Street overreacted to the FY17 guidance, especially since MarineMax indicated on the conference call that it was conservative. (Still, a slight target price cut was warranted.) In addition, MarineMax typically exceeds Wall Street expectations, as seen in Chart 1.

Chart 1: MarineMax Earnings History

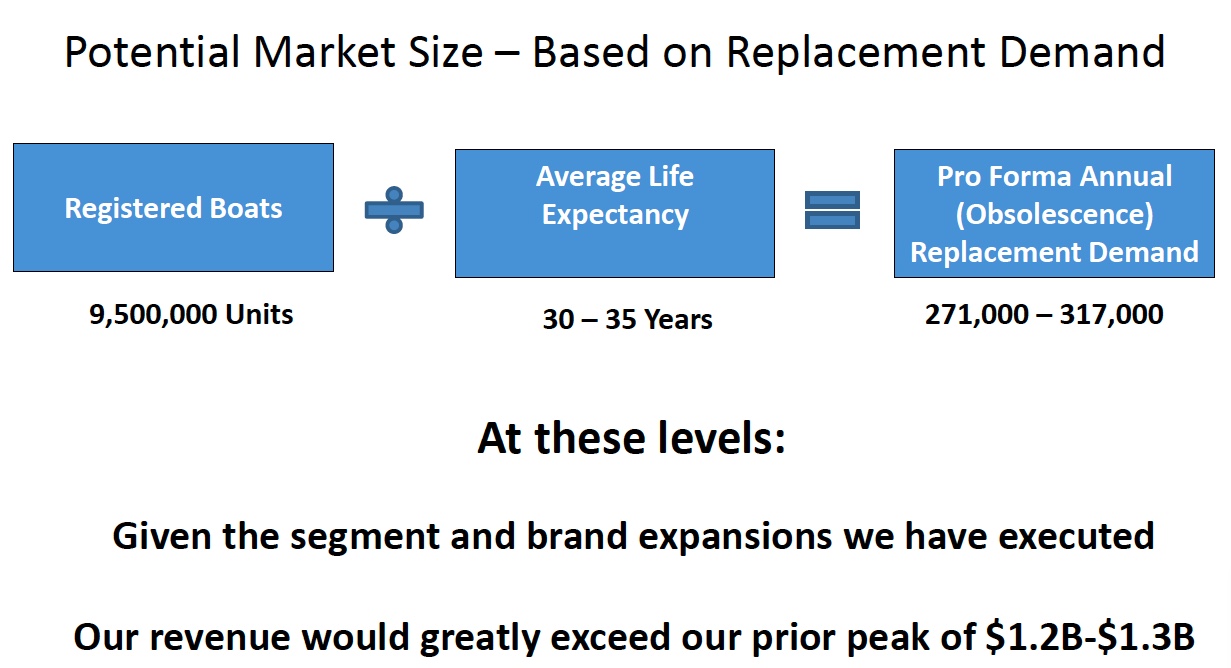

Boating sector trends remain positive, and MarineMax has plenty of room for growth. Forward View is still upbeat on MarineMax and boat manufacturers. You could do worse than buying shares of MarineMax and every single publicly-traded boatbuilder! See the charts below from MarineMax’s 4Q earnings presentation.

Chart 2:

Chart 3:

Chart 4:

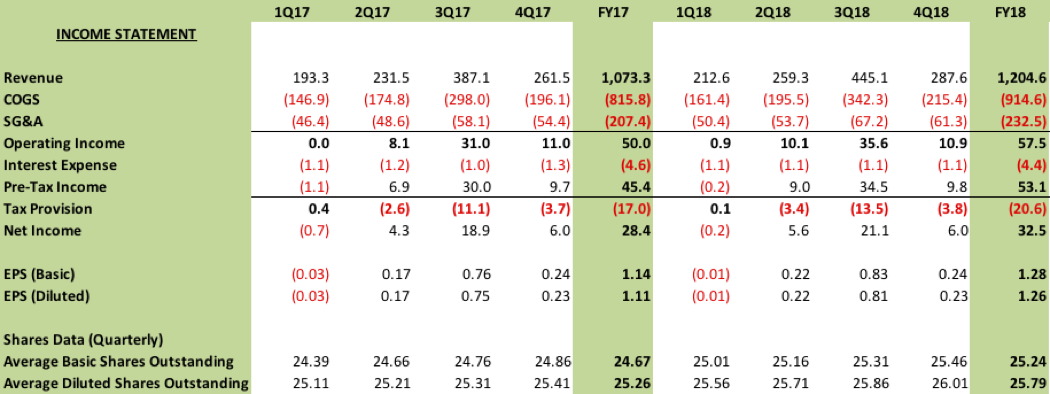

Forward View has trimmed $0.13 from our FY17 EPS estimate. Primarily, the reduction is due to the fact that we’re now forecasting a small loss in Fiscal 1Q17 as MarineMax’s acquisition of Russo Marine in the Northeast has created a slightly more seasonal business. (Northeast boat sales in the winter are just about nil, but SG&A expenditures are incurred.) Overall, though, Russo is connecting MarineMax to very desirable and affluent markets. We still like the acquisition.

MarineMax is now priced very attractively while retaining core fundamental strengths. The company’s business model is perfect for the current sales environment and to maximize consumer interest in the fresh boat models that continue to be delivered. Take advantage of today’s marine opportunities!

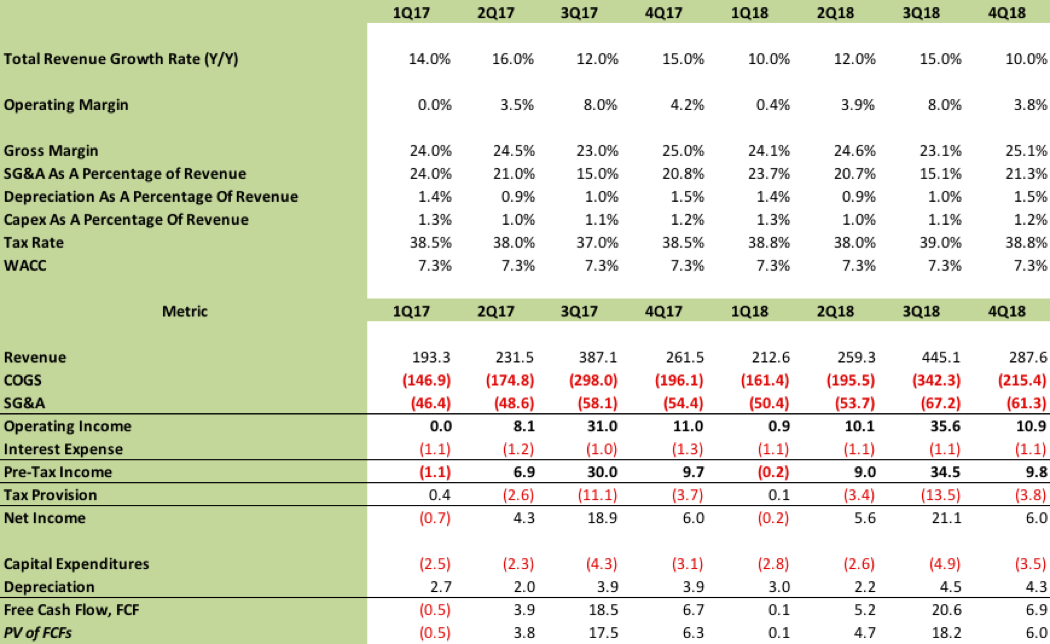

Earnings Estimates & Valuation

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Analyst Certification: I, Nathan Yates, certify that the views expressed in this publication accurately reflect my personal views about the subject companies and their securities. I ...

more