Dividend Stock Spotlight: Steel Dynamics (STLD)

For the first time since last October, Steel Dynamics (STLD) closed above its 200-DMA on Wednesday. This comes after the stock has remained in a long term downtrend over the past year after the first round of tariffs on steel were imposed. Although the company is not out of the woods yet on the political front, this long term downtrend was broken earlier this summer. Afterward, the stock pulled back to retest this downtrend. STLD then made a higher low at the end of August (8/27) and has since risen over 23%. In the process, STLD not only took out its 50-day moving average, but it also closed marginally above its 200-DMA, holding above there today.

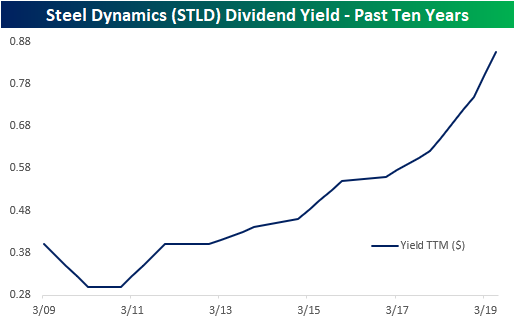

Even with the recent move higher, STLD’s yield remains attractive. With a current yield of just under 3%—$0.24 per share paid quarterly—the dividend yield is higher than both the average for the broader S&P 1500 and the Materials sector which are 1.76% and 1.96%, respectively. In regards to other S&P 1500 steel companies, along with Nucor (NUE), STLD has the joint highest dividend yield. The growth rate of STLD’s dividend has also outpaced the sector dramatically. The dividend grew by 24.82% over the past year and 13.7% over the past five years. By both measures, this is nearly twice the growth rate of other stocks in the sector. That growth has been in spite of the past year and a half’s trade headwinds. Furthermore, with the dividend payout ratio at 27.36%, the company’s still has plenty of cushion to pay shareholders in the event that earnings do decline.

Disclaimer: Read our full disclaimer here.