Dividend Income Update August 2020

The start of every month is exciting for all dividend income investors as we look back at the previous month and see how much passive dividend income our portfolios generated. There’s just something special about passive income. Knowing that an income is hitting your account without having to do any active work to earn it.

August was a little underwhelming for me as my income dropped a bit but this was due to sales made last year. Still, my year over year annual numbers continues to highlight the trifecta magic of dividend investing which includes, adding fresh capital, dividend raises and basic compounding to create an ever-increasing passive income stream. Even if I stopped adding fresh capital today and every dividend stock I owned kept all distributions flat, without a single raise, my passive income stream would continue to grow. With that being said, let’s take a look back at my August 2020 dividend income.

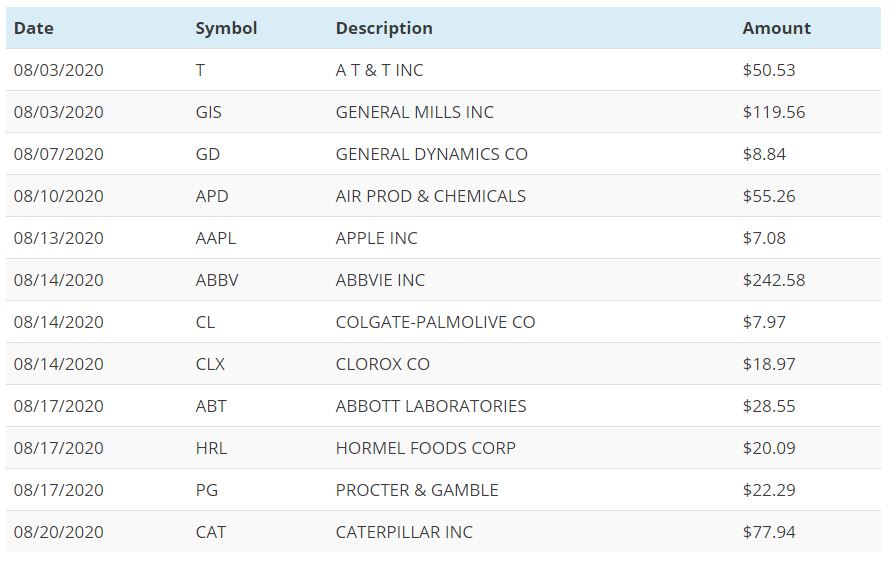

Dividend income from my taxable account totaled $659.66 down from $702.57 a decrease of -6.1% from August of last year.

Dividend income from my ROTH account totaled $273.78 up from $240.86 an increase of 13.7% from this time last year.

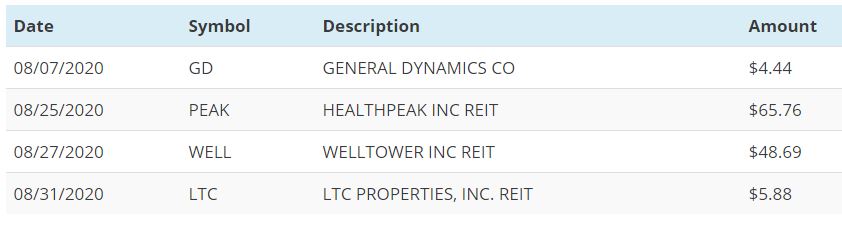

Dividend income from my IRA account totaled $124.77 down from $184.66 from this time last year, a decrease of -32.4%.

Grand total for the month of August: $1,058.21 a decrease of -6.2% from August 2019.

Brokerage Account

Year to date dividends: $8,015.41

ROTH Account

Year to date dividends: $2,051.04

IRA Account

Year to date dividends: $663.32

While I am very happy to bring in a four-digit total for the month of August it was a little sad to see a year over year decrease but this is easily explained as I have sold off several of my spin-offs that pay in August. Those stocks were included in my brokerage and IRA account. Names like Sabra Healthcare REIT (SBRA), Versum Materials (VSM), and Wabtec (WAB) have all been shuttled and can account for my year over year decrease.

So there you have it. August in the books! With patience and consistency, these results and better can be achieved. Just remember, sometimes investing with blinders on can be beneficial as it blocks out the constant noise we are bombarded with on a daily basis and keeps you focused on the job at hand which is to keep investing, not falling for market timing traps, diversifying, not getting shaken out of the market when it tumbles and just creating a solid, ever-growing (sometimes) passive income stream.

Disclosure: Long all the above.