Dividend Growth Stocks For Investors Who Like Monthly Dividends

If you invest for income you likely know that most of the thousands of dividend-paying stocks listed on the U.S. exchanges pay quarterly dividends or once every three months. Quarterly dividends are nice, but most of us pay our bills monthly, so it would be convenient to have investments that pay attractive yields and pay the income out on a monthly schedule.

If you like the idea of a monthly paycheck from your stock portfolio and if that is your goal, you have some options. There are roughly three dozen individual company stocks that pay monthly dividends instead of the quarterly standard.

If you want to get a growing income stream, i.e., regular dividend increases, that number of stocks shrinks dramatically.

The rules of dividend payouts are unique to the stock market. Each dividend payment comes with a set of dates. Each corporate dividend payment must be declared by the company’s board of directors. Once announced, the dividend will come with a record date and a payment date. To earn the next dividend, you must be an owner by the record date.

The stock market settlement rules take a day from when you buy the shares until you become the official owner. As a result, stocks go ex-dividend the day before the record date. Ex-dividend means that if you buy shares on that date, you will not receive the upcoming dividend payment. To earn the dividend, you must purchase the stock at least one day before the ex-dividend date.

Here are three monthly pay stocks, increasing dividends, and their usual ex-dividend date each month.

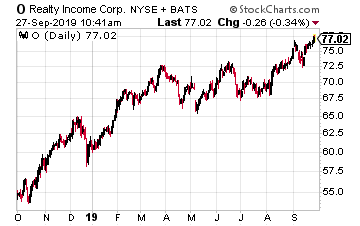

Realty Income Corporation (O) is a triple-net lease (NNN) real estate investment trust (REIT) that pays monthly dividends and has increased that dividend for 88 straight months.

That’s over seven years of getting a pay raise every month.

A triple-net lease means the company leasing a property pays for all the expenses, such as maintenance, utilities, and taxes.

Realty Income owns standalone retail properties like convenience stores and home improvement stores. Over 5,900 of them!

The company operates in 49 states, Puerto Rico and the United Kingdom. The shares yield 3.6%, and the dividend is growing by 3% to 4% per year.

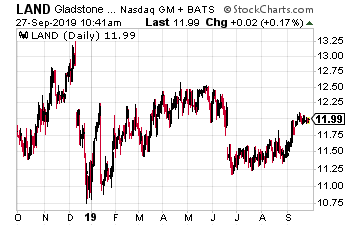

Gladstone Land Corporation (LAND) is a REIT that owns farmland. The company owns farmland in Arizona, California, Colorado, Florida, Michigan, Nebraska, North Carolina, Oregon, and Washington.

The REIT allows landowners to capitalize their property through either sale-leaseback transactions, or Gladstone buys farmland for cash and finds tenants to farm the properties.

Historically, this REIT has increased its dividend rate every few months, although in 2019 it has announced a small increase to the payout every month.

The rate of growth is less than 1% per year, but it is growing. Current yield is 4.5%.

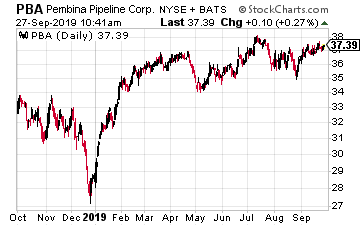

Pembina Pipeline Corp (PBA) is a Canadian energy midstream services company with shares that trade on the NYSE.

The company’s pipelines transport crude oil, natural gas, and natural gas liquids (NGLs) out of the western Canada productions areas.

Pembina is the largest independent midstream services provider in its operating region.

The current monthly dividend rate is 20 cents Canadian per share.

That works out to about 15 cents in U.S. currency. The dividend has been increased each year in May, with about 4% annual growth. Current yield is 4.7%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more