Disastrous Bond Auction Sparks Rate-Rout Selloff In Stocks

Bond bulls just had a 'Cliffhanger' moment...

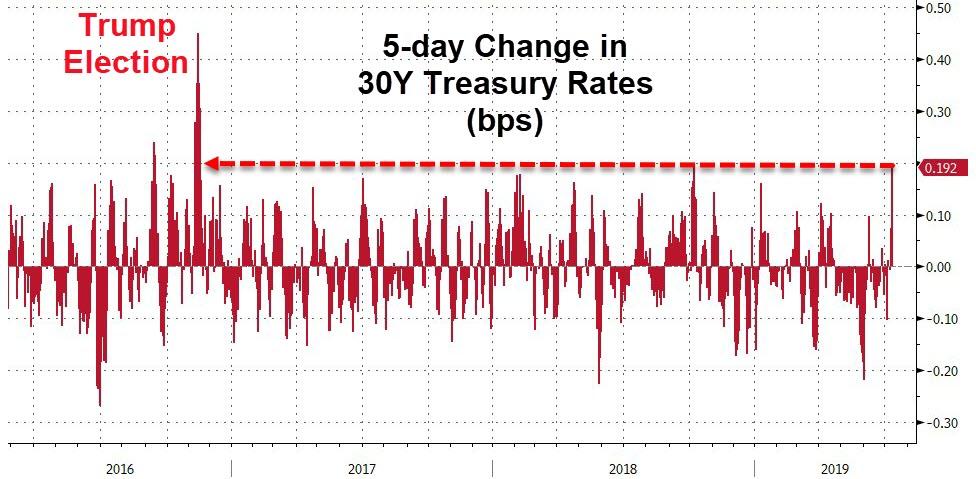

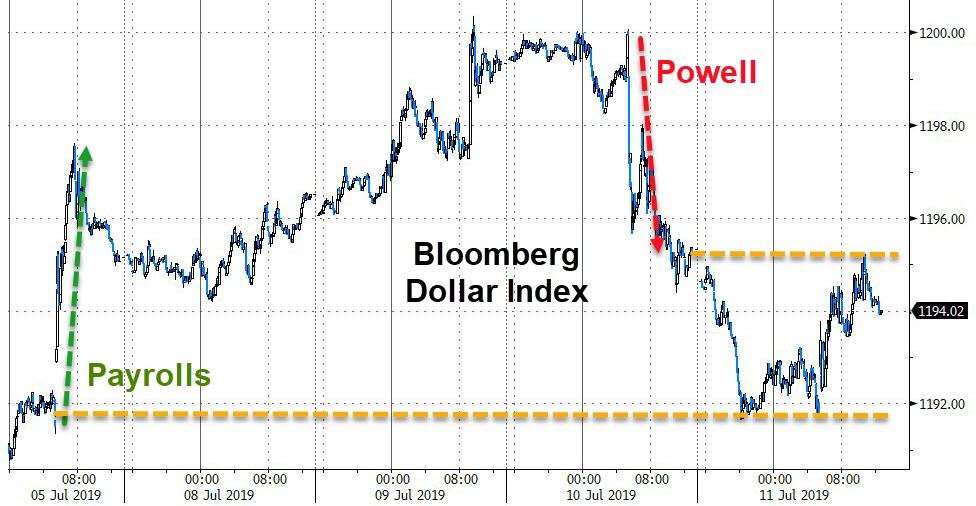

Payrolls, Powell, and Panic at the Auction have sparked the biggest bond bloodbath since Trump was elected in Nov 2016...

(Click on image to enlarge)

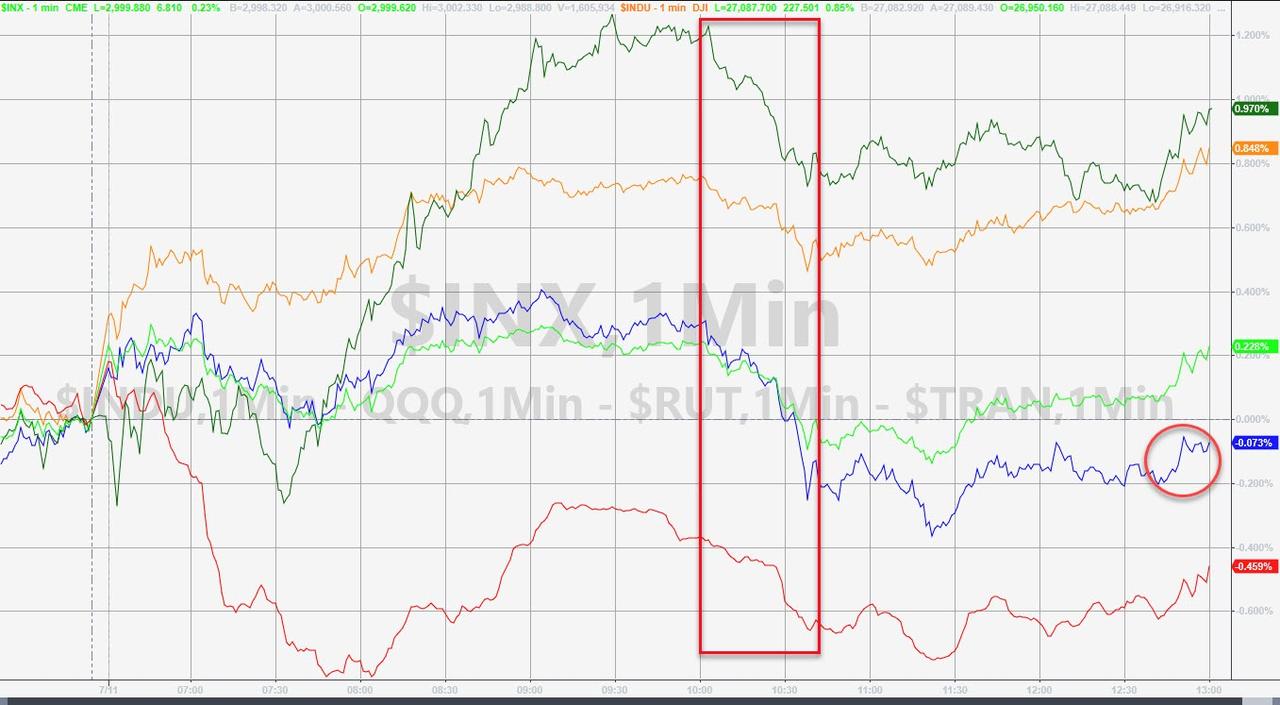

And as bond yields exploded higher, something odd happened... stocks dumped too...

(Click on image to enlarge)

Suggesting Risk-Parity funds forced to delever/rebalance as the bond legs blow up.

30Y Yields exploded to 6-week highs...

(Click on image to enlarge)

The Dow managed to hold gains (thanks to United Health jumping on Trump's backdown) and S&P limped back into the green but Nasdaq ended red. Small Caps were worst on the day with Trannies best...

(Click on image to enlarge)

NOTE - around 1300ET, Trump tweeted about China disappointment and sparked selling.

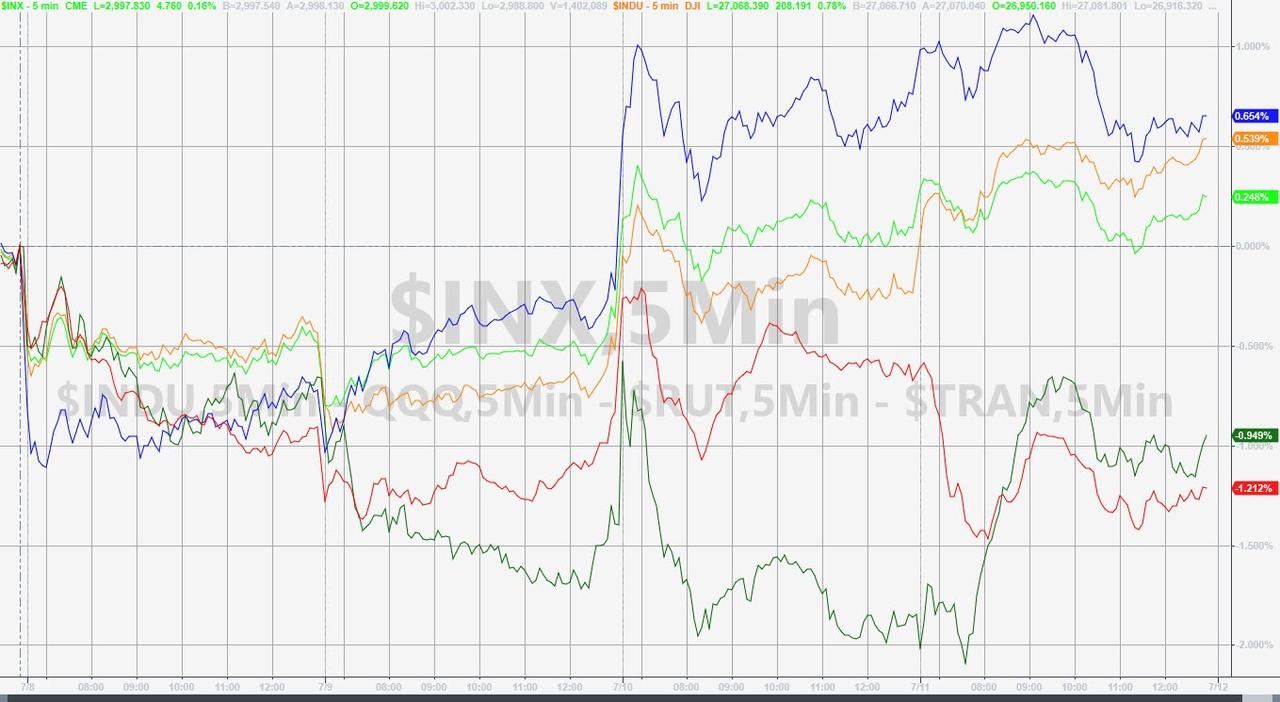

Trannies and Small Caps remain red on the week.

(Click on image to enlarge)

Dow topped 27k for the first time...

(Click on image to enlarge)

And President Trump loved it...

The S&P closed at 2999.89!! As one veteran trader noted, "this is all gamma trap!"

(Click on image to enlarge)

Defensive stocks were pummeled (interestingly catching down to unch for the week with Cyclicals)...

(Click on image to enlarge)

Bonds weren't the only bloodbath of the day; Bed, Bath, & Beyond was battered...

(Click on image to enlarge)

UnitedHealth surged on the White House backpedal...

(Click on image to enlarge)

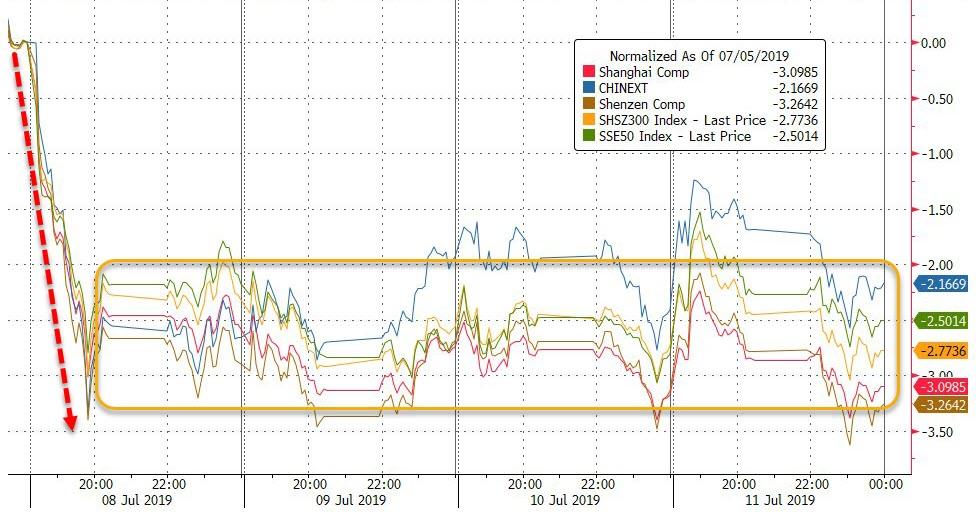

Chinese stocks have gone nowhere since Monday's dump...

(Click on image to enlarge)

European markets continued to diverge dramatically with Germany slammed and Italy bid...

(Click on image to enlarge)

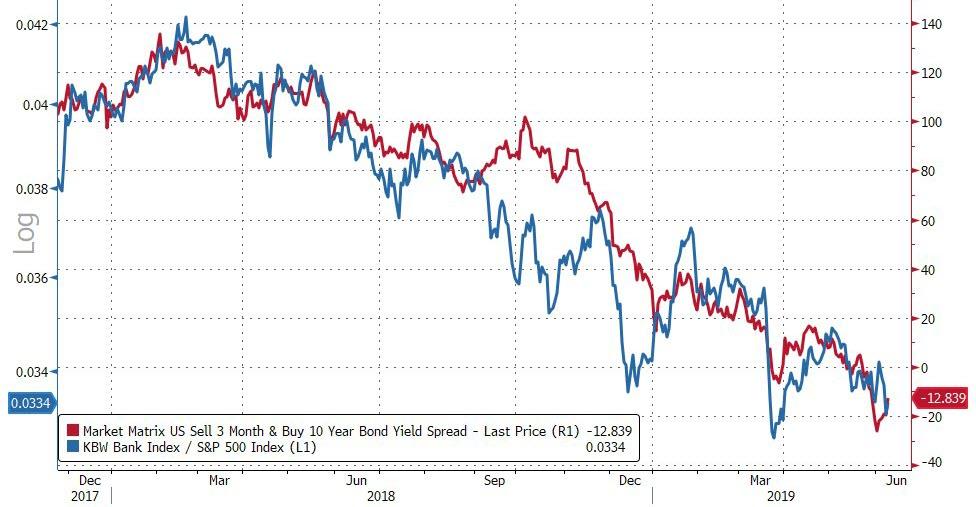

Banks and the yield curve...

(Click on image to enlarge)

Treasury yields exploded higher on the day with the long-end dramatically underperforming...

(Click on image to enlarge)

The yield curve (3m10Y) remains inverted... just...

(Click on image to enlarge)

The dollar ended marginally lower after scrambling up to unch after a weak overnight session...

(Click on image to enlarge)

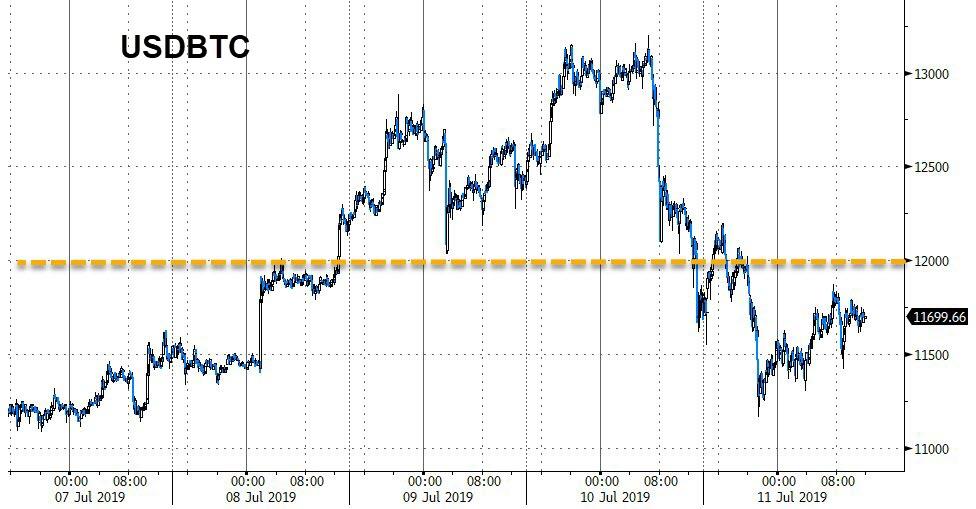

Cryptos were down modestly on the day with Bitcoin the only major that remains green on the week...

(Click on image to enlarge)

With Bitcoin unable to scramble back above $12k for now...

(Click on image to enlarge)

Commodities rolled over today as the dollar recovered

(Click on image to enlarge)

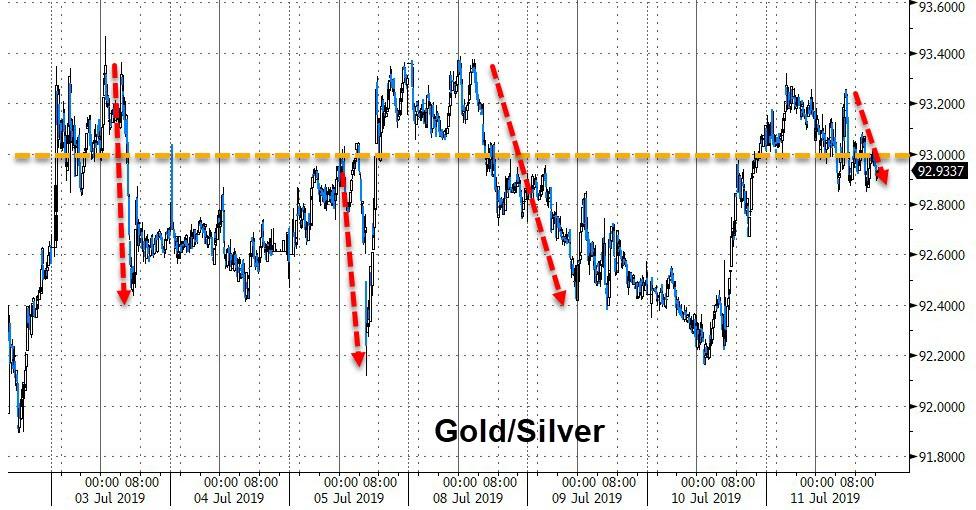

Silver marginally outperformed gold today...

(Click on image to enlarge)

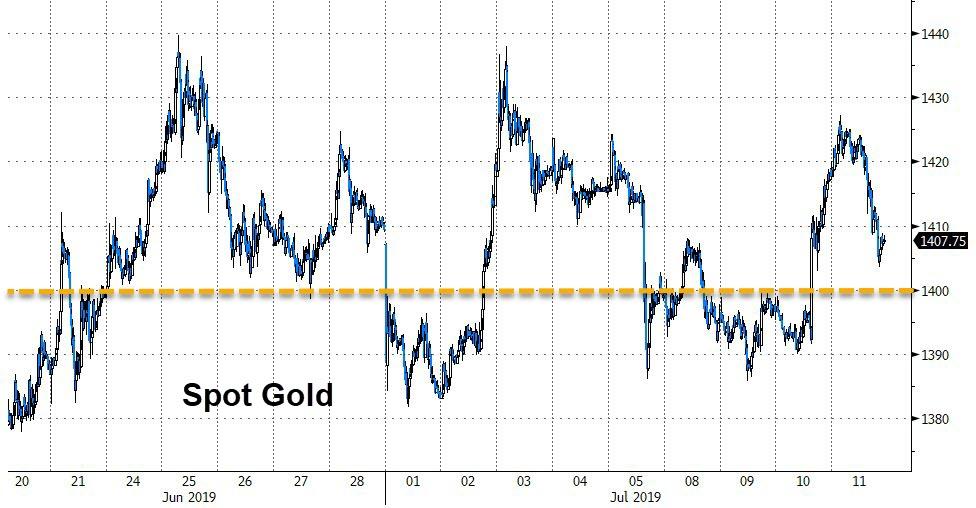

But gold held above $1400...

(Click on image to enlarge)

Finally, we note the following from Strategas:

"nearly all of the incremental news on China since the G-20 has been negative. There is no trade meeting set; China is questioning what the US said was agreed to .. The China hardliners seem to be taking over and trying to wait Trump out past the 2020 election."

And this tweet from China's current twitter mouthpiece:

"Congrats to American investors. But watch your President and don’t let him trigger recession with the trade war."

As we have noted numerous times, it's not the economy, or trade, or earnings, or sentiment... it's central bank liquidity, stupid!

(Click on image to enlarge)

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more