Disappointing Inflation Helps The Fed

Disappointing Inflation - Big MBA Applications Report

Before getting into Disappointing Inflation, let's review the MBA Applications. MBA applications report showed huge growth numbers that were shocking at first glance. In the week of June 7th, the composite index was up 26.8% weekly compared to 1.5% growth in the previous week.

Growth was high mostly because of the huge burst in refinance activity. Growth went from 6% to 47% weekly. That’s because of the recent decline in mortgage rates. In the week of June 6th, the 30 year fixed mortgage rate fell from 3.99% to 3.82% which was the biggest one week drop since March 28th.

Mortgage rates are the lowest since September 14th, 2017. This will help the housing market which will already have strong yearly growth in the 2nd half of this year because of the weak comparisons from late 2018.

Keep in mind the context of this refinancing activity to understand how weekly growth was so high. As you can see from the chart below, refinancing is near historic lows. This big weekly burst doesn’t look so big when you see this chart.

Refinancing activity is low because up until recently rates were relatively high compared to the past few years. Many home buyers refinanced in 2016 when rates were lower. There was no need to refinance in 2018 and early 2019.

(Click on image to enlarge)

Purchase applications data is far more valuable when studying the health of the housing market

It’s also notable how many homeowners will save money on their monthly mortgage payment when they refinance at these newly low rates. That will increase their disposable income. Homes will also be more affordable to new buyers. Soon home price growth will fall below wage growth if the recent trends continue.

Specifically, weekly wage growth in May was 2.8% and the March Case Shiller national home price index was up 3.7%. It’s possible that if price growth falls further in April and May that weekly earnings growth is already higher than home price growth.

With those tailwinds in mind, the purchase applications index was up 10% weekly which is on top of a 2% decline. Last week’s performance wasn’t great, so this is a reversion back to the recent solid growth rate. Unrevised yearly growth in purchase applications was 10%. When you average that with the 0.5% growth in the prior week, you get 5.25%. That’s solid, but unremarkable growth.

Disappointing Inflation Misses Estimates

Inflation is important again because the Fed will probably cut rates by September. Inflation certainly isn’t high enough to justify rate cuts; it is in a range where maintaining rates is fine. However, inflation needs to fall for rate cuts to make sense. The market got its hope as May CPI missed estimates.

It’d obviously be better if the economy was strong and we were discussing rate hikes. However, since the market already knows the economy is weak, it likes when inflation misses estimates as it gives the Fed room to cut rates. The Fed is in better shape now than before this report.

Specifically, month over month headline CPI was 0.1% which matched estimates and was below the prior month’s 0.3%. As you can see from the chart below, headline yearly CPI growth was 1.8% which missed estimates for 1.9% and April’s rate of 2%. That decline isn’t because of rounding; it’s because of energy price weakness. On a non-seasonally adjusted basis, energy prices were down 0.5%.

(Click on image to enlarge)

Monthly core CPI was 0.1% which missed estimates for 0.2% and matched April’s reading.

Yearly core CPI was 2% which missed estimates and April’s reading of 2.1%. Again, this wasn’t caused by rounding issues. This all but assures core PCE will be below 2% in May. That’s not a huge shocker because we’re in a slowdown and core PCE has almost never been above 2% in the past 7 years.

Even if growth was accelerating, core PCE might not be above 2%. I’m not sure at what core PCE level the Fed will decide inflation is too low, causing rate cuts. The NY Fed President John Williams already said last week that low inflation is a pressing problem. If core PCE inflation declines in May, the Fed will have support for that argument.

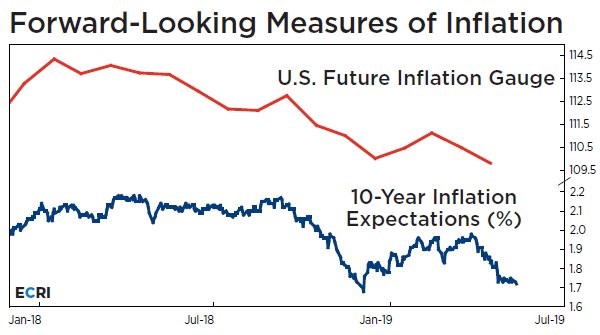

Fed doesn’t need support by next Wednesday because it won’t be cutting rates. The Fed fund futures market shows there is a 24.2% chance the Fed cuts rates then. If the Fed guides for the rate cuts the market is pricing in, it will have the support of the 10 year inflation expectations rate shown in the chart below.

The prediction for lower inflation in the next 6 months isn’t a foreign one; it’s the consensus. Specifically, the market now sees the most likely Fed decision to be 3 rate cuts in 2019 as there is a 34.4% of that occurring. There is a 51% chance of at least 3 rate cuts this year.

(Click on image to enlarge)

Disappointing Inflation - Let’s look at the details of this CPI report.

Food inflation was 2% as it was driven higher by food away from home prices which were up 2.9%. Food at home inflation was only 1.2%. The decline in energy prices was driven by energy services which had a 0.7% decline. Energy commodities prices were down 0.3%. Natural gas prices through pipelines were down 2.6%.

A main driver of core CPI was services less energy services as its prices were up 2.7%. Commodities less food and energy commodities were down 0.2%. Apparel prices were down 3.1%. Just like the PPI report showed, transportation services inflation was weak as it was only 1.1%. Also shown in the PPI report was high medical care services inflation. It was 2.8%.

The main driver of core CPI was shelter inflation as it usually is. It was 3.4%. Since the national Case Shiller home price index’s growth rate has been falling, it’s probable that it fell below 3.4% in May. Its reporting is 2 months behind.

Keep in mind, shelter inflation includes rent. Rent as a percentage of renters’ disposable income is at a record high.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more