Deflation, Inflation, Or Stagflation?

As days pass, the long-term debt cycle dynamics become more important. This crisis has been one where we have had contraction of both supply and demand, at the same time. The current scenario signals deflation, and may also render previous inflation indices meaningless.

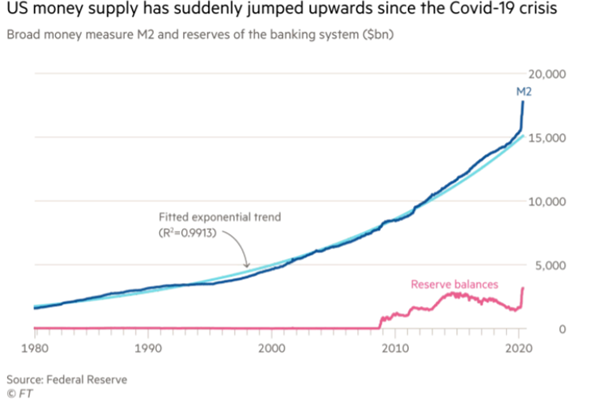

While previous money printing by central bankers had to led to hyper-inflation, current US M2 shows large jumps in growth, so a combination of constrained output, along with rapid monetary growth, may signal inflation - if velocity of money follows an uptrend.

However, just like the last bout of inflation in the 1970's, an unexpected surge in inflation might come about as supply chains fray. The supply chains are concentrated and more fragile than ever before. For example, consider how the shutting down of one Tyson Foods (TSN) plant had affected 4 to 5% of pork supply in the US.

The probability of highly fragile structures failing and leading to inflation cannot be downplayed, and deserves a much important role in portfolios. As a trader remarked on CNBC, the bond market almost universally expects deflation - which means there will be inflation.

The problem lies in the possibility of the worst outcome: stagflation. The supply chains are going to be reshored, inventory buildup is no longer going to be "just in time," but more long term, and this will increase the use of working capital. I agree that demand will take time to recover, but for stagflation, you don’t require high demand - but, instead, a reduction in supply.

I believe the outcome of COVID-19 will be a stagflation, and don’t count on bond markets to tell you that, as any signs of inflation or stagflation will lead to capping of yield by central bankers.

In the chart above depicting US ten-year treasuries, you can see that yields are now confined to a range. The future performance will be determined; whether by design, or by market forces.