Why Soft US Jobs Data Is Good For Dollar

A Dovish Fed may offer more room for ECB to revisit its policy; short EUR/USD?

US jobs data is weak? The economy in Eurozone could be much weaker.

US hiring slumped in February, a sign that US growth is cooling, though strong wage growth and earlier robust job gains suggest that the economy’s decade-long expansion will endure. However, soft jobs data leading to a dovish Fed could give ECB more room to tweak its monetary policy.

US nonfarm payrolls rose a seasonally adjusted 20,000 in February, marking the slowest pace for job growth since September 2017. This was when the hurricanes skewed hiring patterns, causing job growth to fall well below economists’ expectations of 180,000 new jobs. Still, we think some of February’s weak job growth might have been a response to strong hiring in previous months. Payrolls grew 311,000 in January and 227,000 in December. The three-month average for job gains clocked in at 186,000, near the average for much of the expansion. From this point of view, US jobs market remains solid.

Last Friday, Powell said Federal Reserve doesn’t need to change its interest rate policy right now against a mixed backdrop of restrained price pressures, a generally strong US labour market and slower global growth. Powell’s remarks followed the ECB’s surprise announcement on Thursday of new plans to stimulate the eurozone economy before a slowdown deepens. Central banks in Canada and Australia also noted rising risks to the outlook.

Powell’s speech also came on the heels of a mixed US employment report that showed hiring that had stalled in February, but the unemployment rate fell, and wages rose at their best annual pace in several years.

Fed officials last year had been raising rates toward a neutral setting designed to neither spur nor slow growth. Powell said the benchmark rate was now within the broad range of estimates of the neutral rate and that his colleagues on the central bank’s rate-setting committee generally agree that this policy stance is appropriate. With the Fed done raising rates for now, officials have focused in recent months on when to stop shrinking the central bank’s $4 trillion asset portfolio.

The ECB cut its forecast last week for this year by the most since the advent of its quantitative-easing program four years ago, predicting economic expansion of 1.1%. While we think ECB policymakers downgrading growth forecast for 2019 is still too optimistic, Draghi himself should have pushed for the enhanced package to support the economy which the Governing Council unanimously approved.

Our Picks

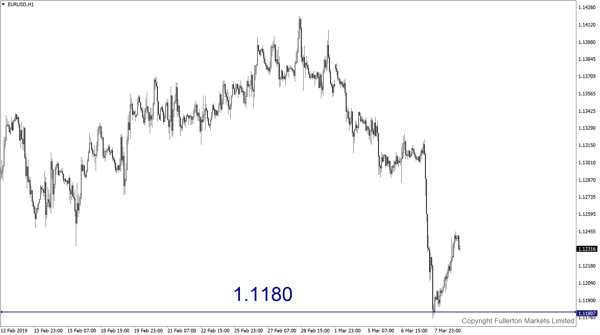

EUR/USD: This pair may drop towards 1.1180 as weaker eurozone outlook weighs on.

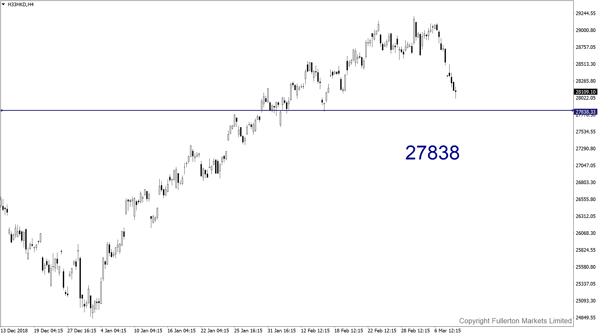

Hang Seng Index:

This index may drop further towards 27838 this week as China had shown that its monetary policy will not be as aggressive as what markets expect, which may dampen sentiment in regional stocks market.

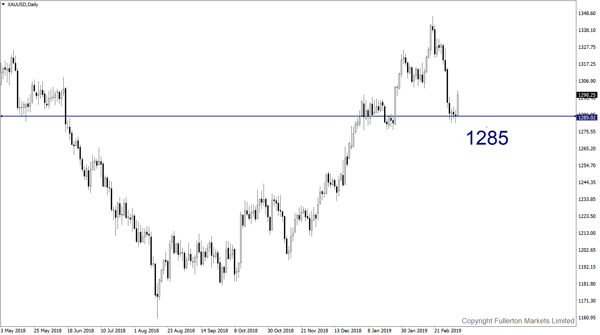

XAU/USD:

This pair may drop towards 1285 this week.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more