Wacky Wednesday Moves

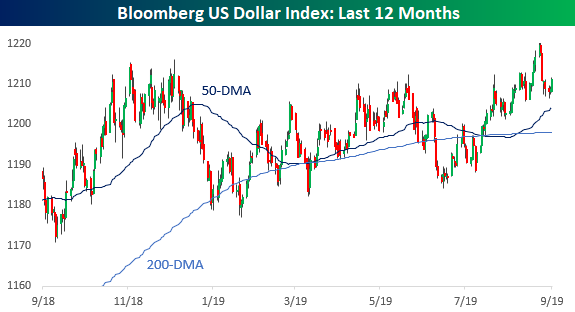

There’s been a number of eyebrow-raising moves in the market this week, and while some of the more extreme moves have subsided today, we’re still seeing some. Take the performance of the dollar and stocks tied to the dollar. From its highs last week through yesterday, the Bloomberg US Dollar Index was down over 1%, but today the greenback is getting a bit of a respite from the selling with a rally of 0.2%.

(Click on image to enlarge)

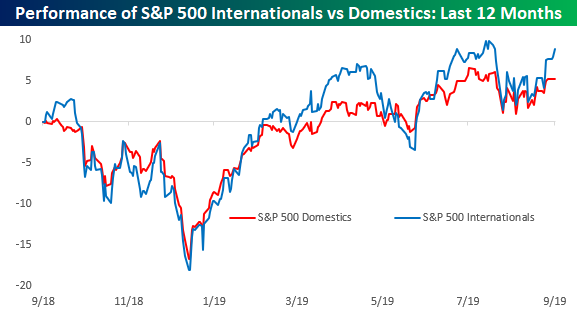

As you would expect, the Dollar Index’s pullback has benefitted companies that derive the bulk of their sales outside of the United States. From last week’s peak through the close yesterday, our index of S&P 500 stocks that generate more than half of their sales outside of the US rallied over 3.6% while S&P 500 companies that generated more than 90% of their sales domestically was up just 1.6%.

With the dollar rallying today, one would expect our index of Internationals to be down or, at the very least, underperforming today. As shown in the chart below, though, the Internationals are both up today and handily outperforming their domestically focused peers. In fact, while the Internationals are up nearly a full percent today, the S&P 500 is up less than half of one percent while the Domestics are actually down fractionally. Not what you would expect on a down day for the dollar.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our International Revenues Database so you can track ...

more