USD/JPY Eyes Monthly High Ahead Of FOMC Meeting Amid Rise In US Yields

JAPANESE YEN TALKING POINTS

USD/JPY extends the rebound from the weekly low (109.11) as the stronger-than-expected US Retail Sales report fuels speculation for an imminent shift in monetary policy, and the exchange rate may continue to carve a series of higher highs and lows ahead of the Federal Reserve interest rate decision on September 22 as longer-dated US Treasury yields remain afloat.

USD/JPY EYES MONTHLY HIGH AHEAD OF FOMC MEETING AMID RISE IN US YIELDS

USD/JPY appears to be on track the test the monthly high (110.45) as the 10-Year Treasury Yield climbs to a fresh weekly high (1.37%), and the exchange rate may stage a larger advance over the coming days if the Federal Open Market Committee (FOMC) alters the course for monetary policy.

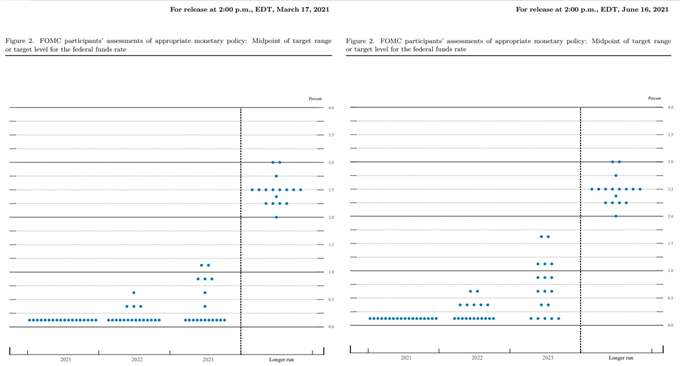

A detailed timetable for tapering the quantitative easing (QE) program should prop up USD/JPY as Chairman Jerome Powell and Co. forecast two rate hikes for 2023, but a more bullish scenario may arise for the US Dollar if Fed officials show a greater willingness to normalize monetary policy sooner rather than later.

Source: FOMC

In turn, another upward revision in the Fed’s Summary of Economic Projections (SEP) may lead USD/JPY to further retrace the decline from the yearly high (111.66), but more of the same from Chairman Powell and Co. may drag on the Greenback as market participants push out bets for higher interest rates.

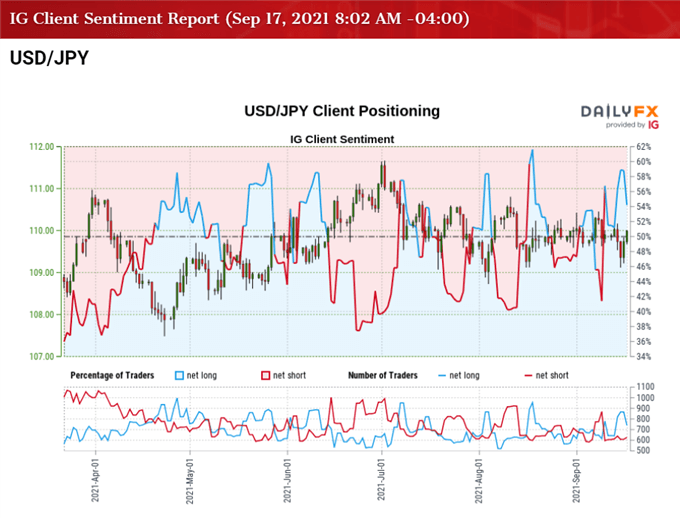

Until then, USD/JPY may continue to carve a series of higher highs and lows as it reveres well ahead of the August low (108.72), but a larger advance in the exchange rate may generate a flip in retail sentiment like the behavior seen earlier this year.

The IG Client Sentiment report shows 51.43% of traders are currently net-long USD/JPY, with the ratio of traders long to short standing at 1.06 to 1.

The number of traders net-long is 26.52% lower than yesterday and 0.57% lower from last week, while the number of traders net-short is 13.16% higher than yesterday and 7.29% higher from last week. The marginal decline in net-long position comes as USD/JPY extends the rebound from the weekly low (109.11), while the rise in net-short interest has done little to alleviate the recent flip in retail sentiment as 49.85% of traders were net-long the pair earlier this week.

With that said, USD/JPY may stage a larger advance ahead of the FOMC rate decision as longer-dated US Treasury yields remain afloat, and the fresh updates coming out of the central bank may instill a bullish outlook for the Dollar if Fed officials show a greater willingness to normalize monetary policy sooner rather than later.

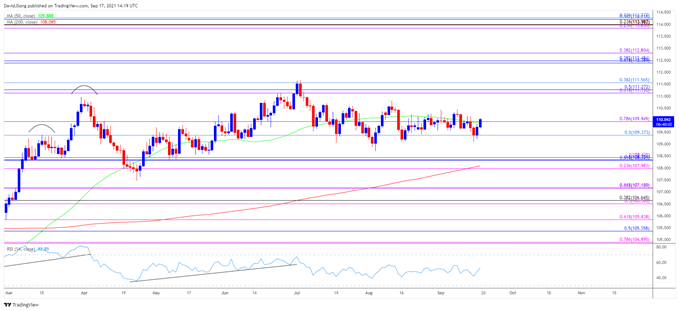

USD/JPY RATE DAILY CHART

Source: Trading View

- Keep in mind, USD/JPY negated the threat of a head-and-shoulders formation as it pushed to a fresh yearly high (111.66) in July, with the Relative Strength Index (RSI) offering a similar development as it established an upward trend during the same period.

- However, the RSI has snapped the bullish formation as USD/JPY struggled to hold above the 50-Day SMA (109.89), with the exchange rate trading within a defined range as the moving average struggles to retain a positive slope.

- Nevertheless, the positive slope in the 200-Day SMA (108.08) indicates that the broader outlook for USD/JPY remains constructive, and the recent series of higher highs and lows may push the exchange rate towards the top of its near-term range as it reverses well ahead August low (108.72).

- A close above the Fibonacci overlap around 109.40 (50% retracement) to 110.00 (78.6% expansion) may push USD/JPY towards the monthly high (110.45), with a break above the August high (110.80) bringing the 111.10 (61.8% expansion) to 111.60 (38.2% retracement) region on the radar, which largely lines up with the July high (111.66).

Disclosure: See the full disclosure for DailyFX here.