USD/CHF Is Looking Higher

Today we will talk about the USD/CHF currency pair, which is in a massive rally, because of the US dollar recovery and very weak Swiss franc. Let's talk about price action from a technical point of view and wave structure from the Elliott Wave perspective.

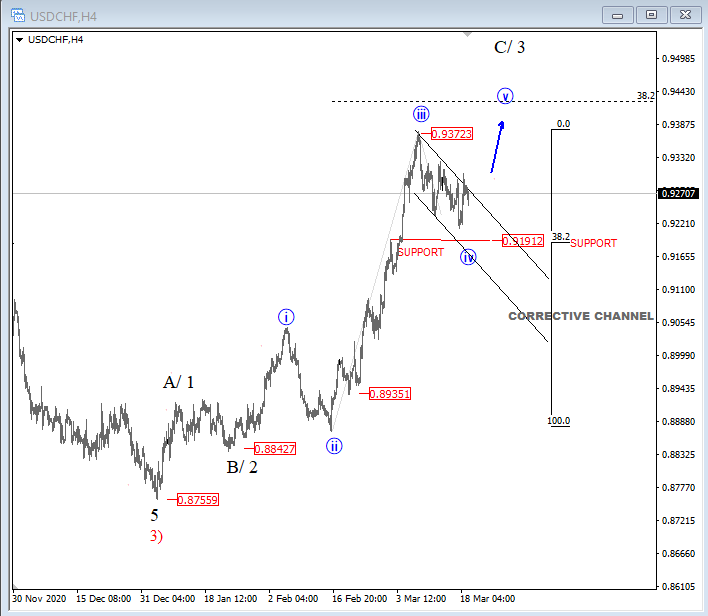

Well, in Elliott Wave theory, impulses should be labeled as a five-wave structure, however, we are currently observing wave C or 3, but it has an incomplete five-wave bullish cycle of a lower degree that can send the price even higher, at least towards 0.94 - 0.95 area.

As you can see, we are tracking a correction in subwave "iv", mainly because of slow price action and corrective wave structure, which can easily send the price back to highs for wave "v", just be aware of a retest of 0.9190 support level before a continuation higher.

We should also mention that the Swiss national bank vice-chairman said this month that he welcomes the recent weakening of the Swiss franc and that it would be too early to speak of long-term change in interest rates.

So, for now, the interest rate remains negative,- 0.75% and that is the lowest in the world. As such, CHF may continue to weakening.

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.