USD/CHF Is Looking For A Recovery

Today we will talk about USDCHF, its price action from a technical point of view, and wave structure from the Elliott Wave perspective.

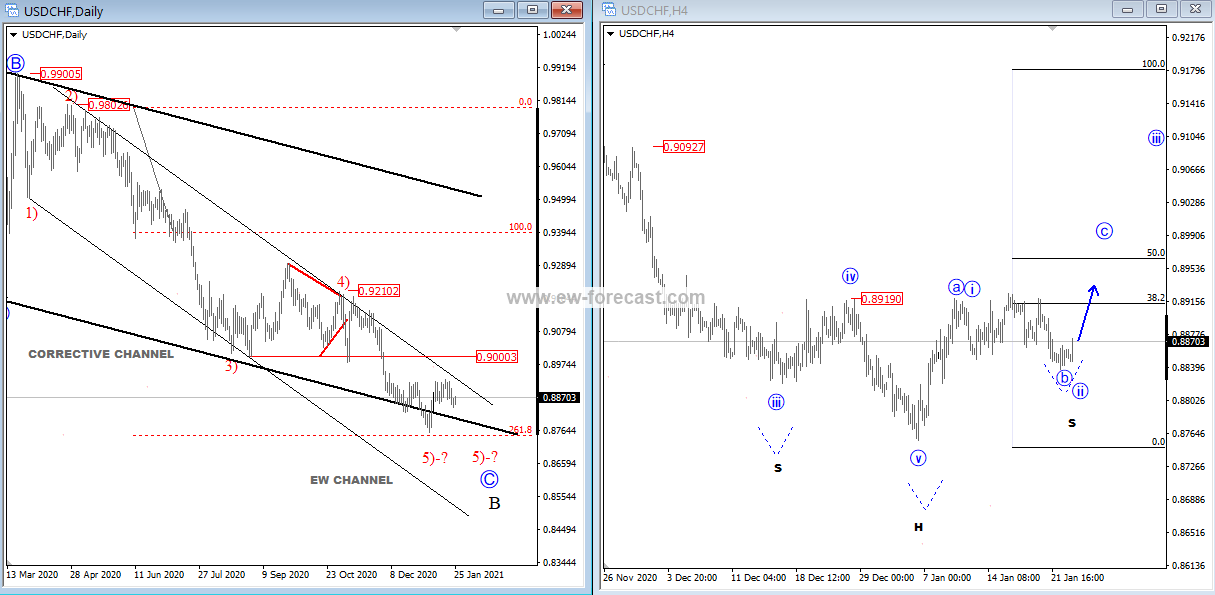

USDCHF is down since March, but looking at the daily chart, we can see it trading in a potential wave C of a higher degree wave B, right at the support line of a corrective channel connected from highs, but we are not sure if subwave 5) is fully completed.

USDCHF, Daily+4h

(Click on image to enlarge)

Anyway, looking at the 4h-chart seems like USD/CHF is trying to face a bigger recovery at least in three waves a/i-b/ii-c/iii that can push the price up to 0.90 area, especially if we consider a potential inverted Head and Shoulders pattern.

What we want to say is, be aware of that intraday recovery at least for wave "c" up to 0.90 area, from where potentially another decline may occur.

However, any bigger and stronger rise up to 0.91 - 0.92 area and EW channel would be signal for the bottom followed by ongoing wave "iii".

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.