USD/CAD Outlook - Support Creaking As US Dollar Weakness Continues

The Canadian dollar’s appreciation against the US dollar has come to a grinding halt just above 1.2000 as higher oil prices and a weaker US dollar continue to keep downward pressure on USD/CAD. The 14-month slide in the pair, boosted by the Bank of Canada’s decision to pare back its bond purchases last month, is now at a critical chart level with little technical support seen below 1.2000. While the chart suggests that the pair’s slide may continue, the central bank may need to stall any move lower to help keep Canadian exports attractive to its neighbor and keep the economic recovery on track. Governor Macklem also reiterated that the central bank will continue to support the economy, and not raise interest rates until the jobs market grows to above pre-pandemic levels, while inflation needs to sustainably meet the central bank’s 2% target.

While the Canadian dollar remains boosted by the country’s ongoing economic recovery, the US dollar continues to slide lower. The US dollar basket (DXY) is also trading just above a critical support level at 89.16 with a break below exposing levels last seen nearly three years ago.

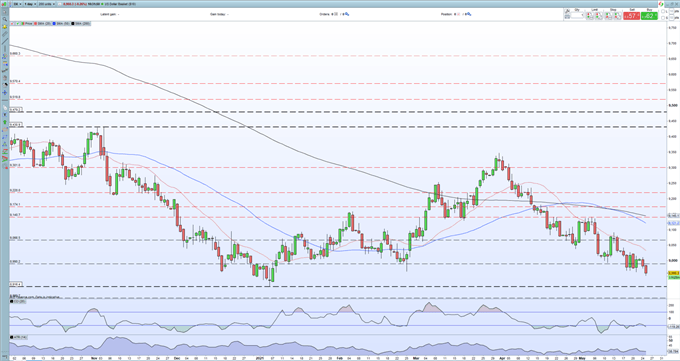

US DOLLAR BASKET (DXY) DAILY PRICE CHART

While the chart set-up remains bearish, it may well be that this move lower is coming to an end. The fundamentals we have already talked about will give the pair some support, and further weakness may be tempered from here, especially if the Canadian export sector starts to suffer. This week sees some high importance US data releases and these should be watched closely for any clues into the strength of the US economy and the US dollar.

USD/CAD DAILY PRICE CHART

IG Retail trader data show 80.16% of traders are net-long with the ratio of traders long to short at 4.04 to 1. We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USD/CAD trading bias.

Disclosure: See the full disclosure for DailyFX here.