US Dollar Price Forecast: Unfazed Fed, Real Yields To Undermine EUR/USD

US DOLLAR, FEDERAL RESERVE, US REAL YIELDS, EUR/USD, EUROPEAN CENTRAL BANK – TALKING POINTS:

- Equity markets stabilized during the APAC session as the recent selling in the bond market subsided.

- Climbing real yields, and a relatively unfazed Federal Reserve may open the door for USD to gain ground against its major counterparts.

- EUR/USD is at risk of extended losses after collapsing back below the 100-MA.

ASIA-PACIFIC RECAP

Equity markets dipped marginally lower during Asia-Pacific trade as the relentless selling in global bond markets subsided. Australia’s ASX 200 slid 0.74%, Japan’s Nikkei 225 dropped 0.23%, Hong Kong’s Hang Seng Index fell 0.06%, and China’s CSI 300 slipped 0.11% lower.

In FX markets, the cyclically-sensitive CAD outperformed as crude oil prices surged above $64 a barrel, alongside the haven-associated USD and CHF. Gold and silver prices drifted lower despite yields on US 10-year Treasuries holding relatively steady.

Looking ahead, the US non-farm payrolls report for February headlines the economic docket alongside Canadian trade balance date from the month of January.

UNFAZED POWELL SENDS YIELDS SOARING HIGHER

As mentioned in previous reports, a lack of regard from Federal Reserve Chair Jerome Powell surrounding the relentless sell-off in US Treasury markets would probably send yields higher, and in turn strengthen the US Dollar. That is indeed what happened overnight, with Powell’s comments underwhelming market participants and resulting in yields on US 10-year Treasuries spiking to the highest levels since February 2018.

When asked about the rise in longer-term rates, Powell stated that it “was something that was notable and caught my attention” but failed to hint at any impending action from the central bank. Instead, the Chairman reiterated that the Fed is still a “long way from our goals” and will be patient in assessing when the right time will be to eventually begin tapering monetary policy measures.

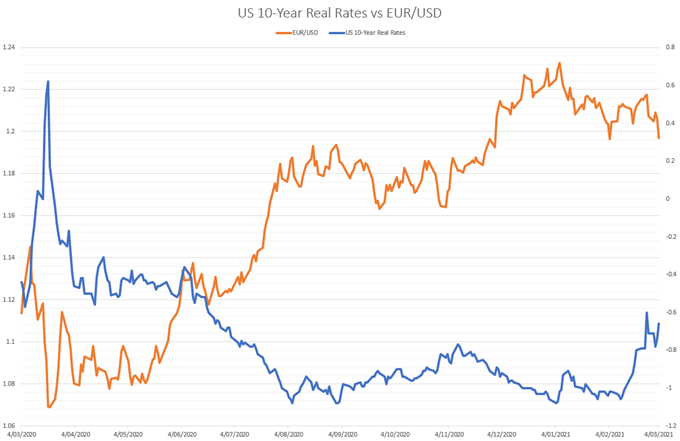

The absence of concern from the Fed Chair has opened the door for real rates to rebound higher, and may ultimately result in the US Dollar continuing to gain ground in the near term. Moreover, the possibility that the European Central bank will increase its weekly bond purchases to cap an unwanted rise in long-term yields, could trigger further losses for the EUR/USD exchange rate.

Data Source – Bloomberg

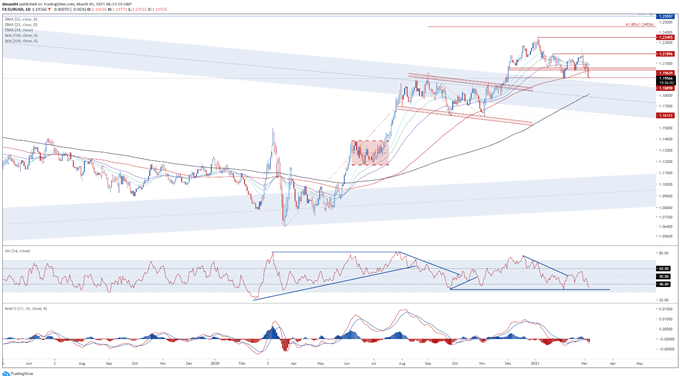

EUR/USD DAILY CHART – 200-MA IN THE CROSSHAIRS

From a technical perspective, EUR/USD rates look set to continue sliding lower in the coming weeks, as price slices through key psychological support at the 1.200 mark and the 100-day moving average.

With the RSI diving below 40, and the MACD slipping into negative territory, the path of least resistance seems lower.

A daily close below 1.1950 would probably intensify selling pressure and carve a path for price to challenge psychological support at 1.1900. Clearing that brings the sentiment-defining 200-MA (1.1810) into the crosshairs.

Alternatively, if 1.1950 holds firm, a relief rally back towards range resistance at 1.2035 – 1.2055 could be in the offing.

EUR/USD daily chart created using Tradingview

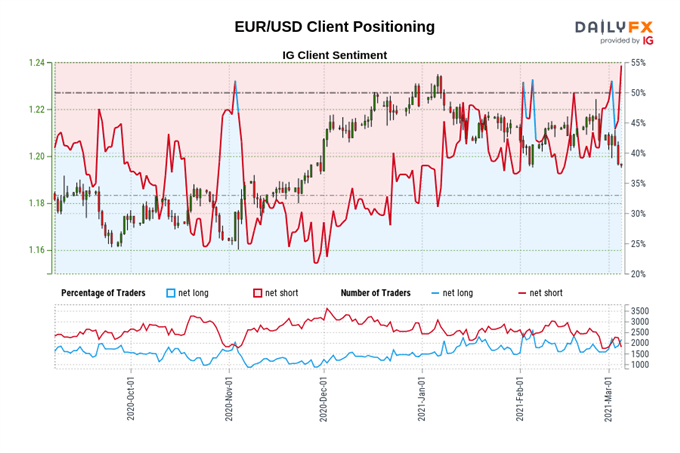

IG CLIENT SENTIMENT REPORT

The IG Client Sentiment Report shows 54.43% of traders are net-long with the ratio of traders long to short at 1.19 to 1. The number of traders net-long is 15.33% higher than yesterday and 44.37% higher from last week, while the number of traders net-short is 20.82% lower than yesterday and 22.01% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Disclosure: See the full disclosure for DailyFX here.