US Dollar Price Action Setups: EUR/USD, GBP/USD And USD/CAD

The US Dollar is putting in a bounce from yesterday’s lows, following a week-long pullback as the FOMC gears up for their July rate decision.

With this being a non-quarterly meeting, there’s scant expectation for anything new. As outlined by our own Rich Dvorak, given the rise in covid variant numbers and the risk of continued expansion there, this seems like a meeting where Chair Powell may continue to bias towards caution when discussing policy parameters.

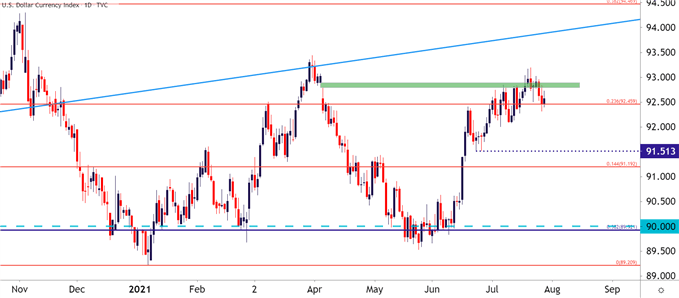

Perhaps with that expectation being priced in, the US Dollar has spent much of the past week pulling back from fresh three-month-highs. Those highs printed just above a zone of previously unfilled gap from early-Q2, with the 93.00 psychological level also coming into play on DXY.

The pullback thus far has found support around the 23.6% Fibonacci retracement of the 2020 sell-off, plotted at around 92.46. A hold of higher-low support through this afternoon’s FOMC rate decision keeps the door open for bullish strategies in the USD.

US DOLLAR DAILY PRICE CHART

Chart prepared by James Stanley; USD, DXY on Tradingview

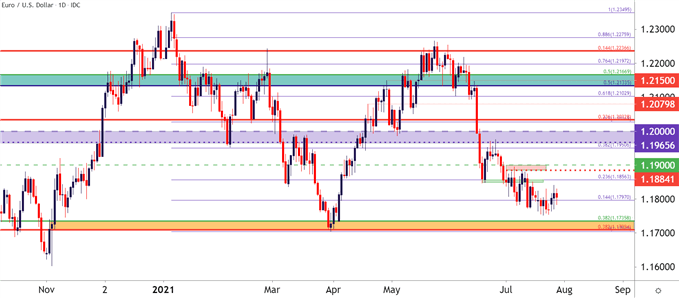

EUR/USD

On the long side of the US Dollar, EUR/USD remains compelling. The pair came very close to testing a big spot of support last week, harbored around three-month-lows. After a minor pullback, sellers appear to be showing resistance inside of the 1.1856 Fibonacci level, and this can keep the door open for a re-test of the big spot of support, running from Fibonacci levels around 1.1709-1.1736.

EUR/USD DAILY PRICE CHART

Chart prepared by James Stanley; EURUSD on Tradingview

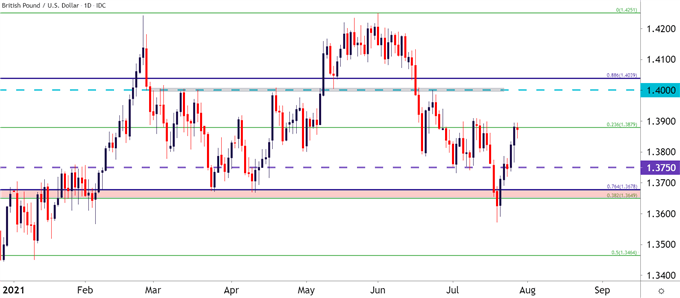

GBP/USD AT A BIG SPOT

There’s a case on both sides of the USD if looking at GBP/USD. The past week of USD-weakness has reflected very well on the long side of GBP/USD, in stark contrast to the EUR/USD scenario looked at above. This highlights how GBP/USD may be a more amenable venue should USD-weakness result from this afternoon’s FOMC rate decision.

The pair is currently testing a Fibonacci level at 1.3879, similar to what I had looked at earlier in the month. And while that resistance test failed, prices have hurried back with renewed vigor, and this keeps the door open for breakout scenarios.

On the long side of the USD, the look would basically be for a resistance hold with respect to the lower-highs set earlier in the month.

GBP/USD DAILY PRICE CHART

Chart prepared by James Stanley; GBPUSD on Tradingview

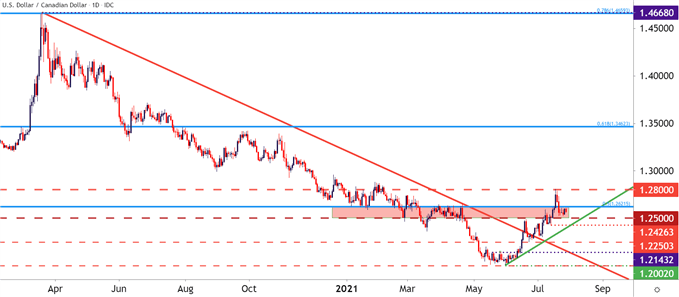

USD/CAD STILL IN THE ZONE

USD/CAD appears to be lining up attractively for the scenario of USD strength. Last week saw the pair set a fresh five-month-high while breaking out from a big zone of resistance.

That zone has been in play for much of 2021 trade and runs between a Fibonacci level at 1.2622 and the psychological 1.2500 level. Higher-low support has, thus far, held above that 1.2500 spot, and as long as that remains, the door can stay open for longer-term bullish continuation strategies in the pair.

USD/CAD DAILY PRICE CHART

Chart prepared by James Stanley; USDCAD on Tradingview

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more