Top 5 Events: Q1’19 US GDP & EURUSD Price Forecast

04/26 FRIDAY | 12:30 GMT | USD GROSS DOMESTIC PRODUCT (1Q A)

For much of the first quarter, there was great concern that the US government shutdown between December 23 and January 25 would have a significant negative impact on Q1’19 US GDP. And while the Congressional Budget Office estimated that a net $3 billion in wages would be lost, ultimately, it appears that the underlying strength of the US economy will have prevailed past the government’s self-inflicted wounds.

The Bloomberg News survey is calling for US GDP to come in at 2.2% annualized. Depending upon where you look, estimates vary. The New York Nowcast estimate for Q1’19 US GDP is only at 1.4%, while the Atlanta Fed GDPNow model is pointing at 2.8% growth. Regardless, it does appear that any near-term concerns about the US economy dipping into a recession were overblown.

(Click on image to enlarge)

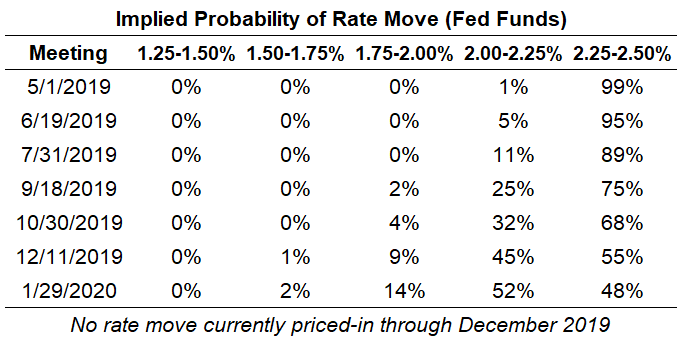

As such, rate expectations have evolved in a manner to suggest that market participants no longer feel the Federal Reserve will embark on a dovish policy course in the imminent future. In fact, at the end of March, Fed funds futures were pricing in greater than a 50% chance of a 25-bps rate cut by July 2019; now, markets are favoring the Federal Reserve to stay on hold for the rest of 2019.

Such a dramatic shift in expectations in just the span of a few weeks has proven helpful to the US Dollar as it tries to work off a six-month-long consolidation (via the DXY Index), mirroring the multi-month consolidation seen in EURUSD.

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

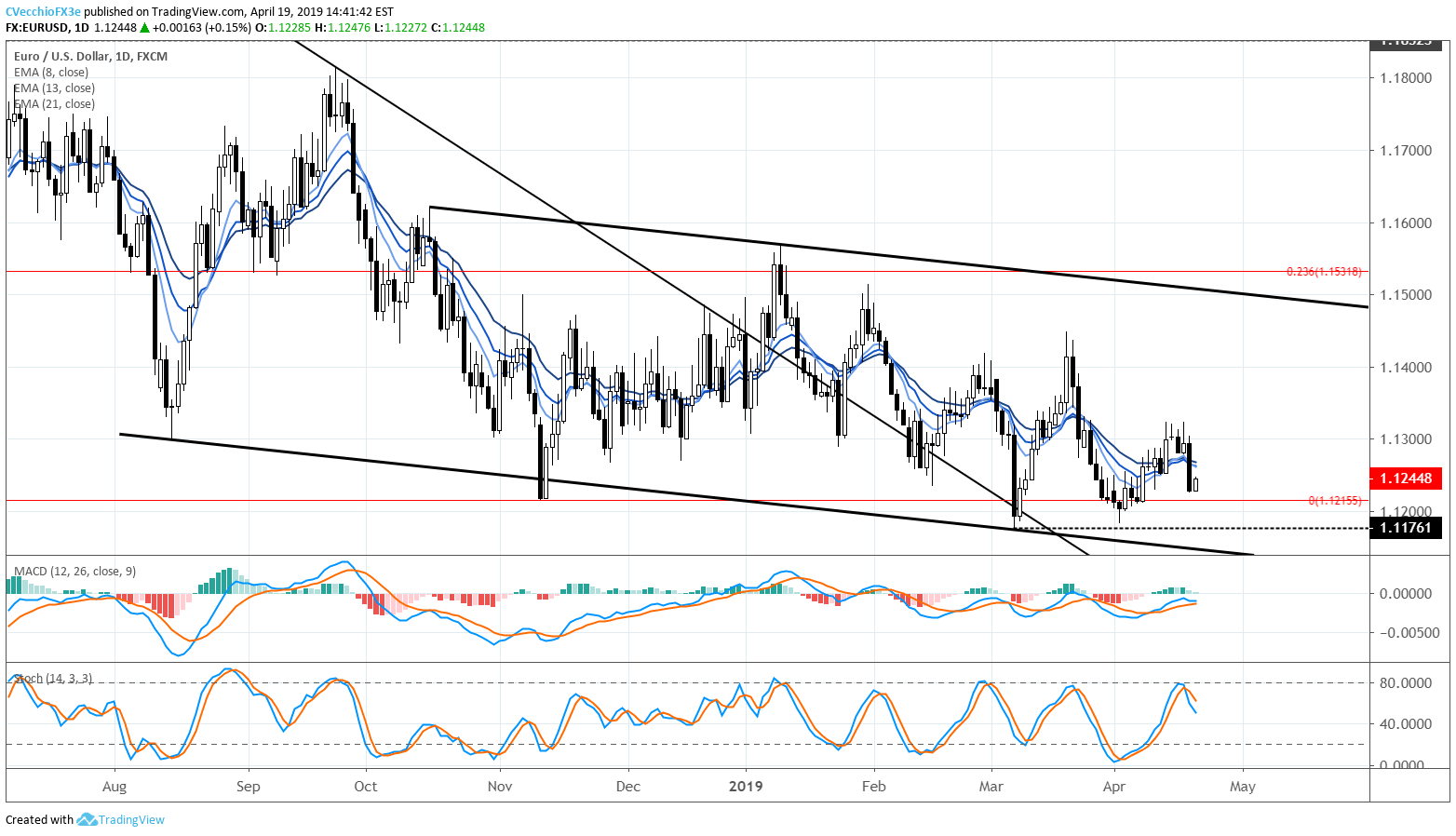

EURUSD TECHNICAL FORECAST: DAILY PRICE CHART (JANUARY 2018 TO APRIL 2019) (CHART 1)

EURUSD rates weakened meaningfully by the end of the week, with the uptrend from the April 2 low busted by the breakdown on April 18. Momentum has started to shift more to the downside, now that EURUSD price is below the daily 8-, 13-, and 21-EMA envelope. Similarly, daily Slow Stochastics have started to swing lower, while daily MACD has narrowed and nearly flipped to the downside.

Given rising European growth concerns, a strong Q1’19 US GDP report could reinvigorate US Dollar bulls and help break out of the multi-month ranges trapping price action. After all, the last six months of trading in EURUSD has been the tightest six-month range seen since the inception of the Euro on January 1, 1999.

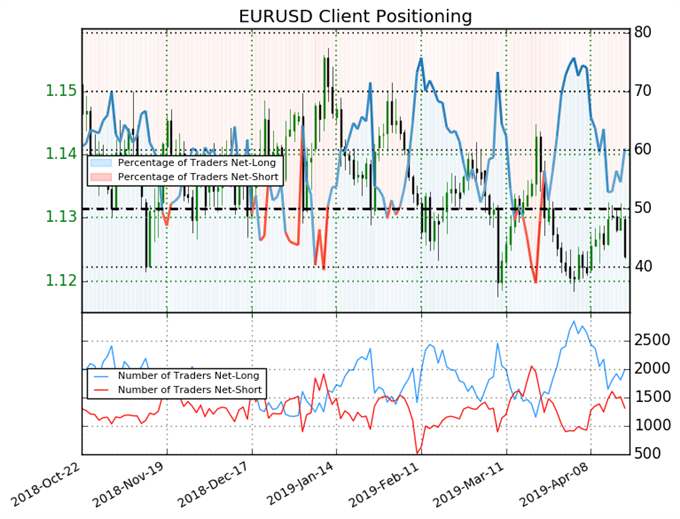

IG CLIENT SENTIMENT INDEX: EURUSD (APRIL 19, 2019) (CHART 2)

EURUSD: Retail trader data shows 60.2% of traders are net-long with the ratio of traders long to short at 1.52 to 1. The number of traders net-long is 10.8% higher than yesterday and 6.2% lower from last week, while the number of traders net-short is 22.7% lower than yesterday and 14.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bearish contrarian trading bias.