SPX, Gold, Oil And G6 Targets For The Week Of March 11th

The 43rd president said it best:” Fool me once, shame on...shame on you. Fool me — you can't get fooled again”. That’s exactly how the market reacted to the latest upbeat comments about the US/China trade negotiations in the wake of the failed US/North Korea negotiations. After briefly making a new swing high at the beginning of the week, the major indices got sold off and broke through several technical support levels, confirming 2763 as the key bull/bear pivot for the upcoming week.

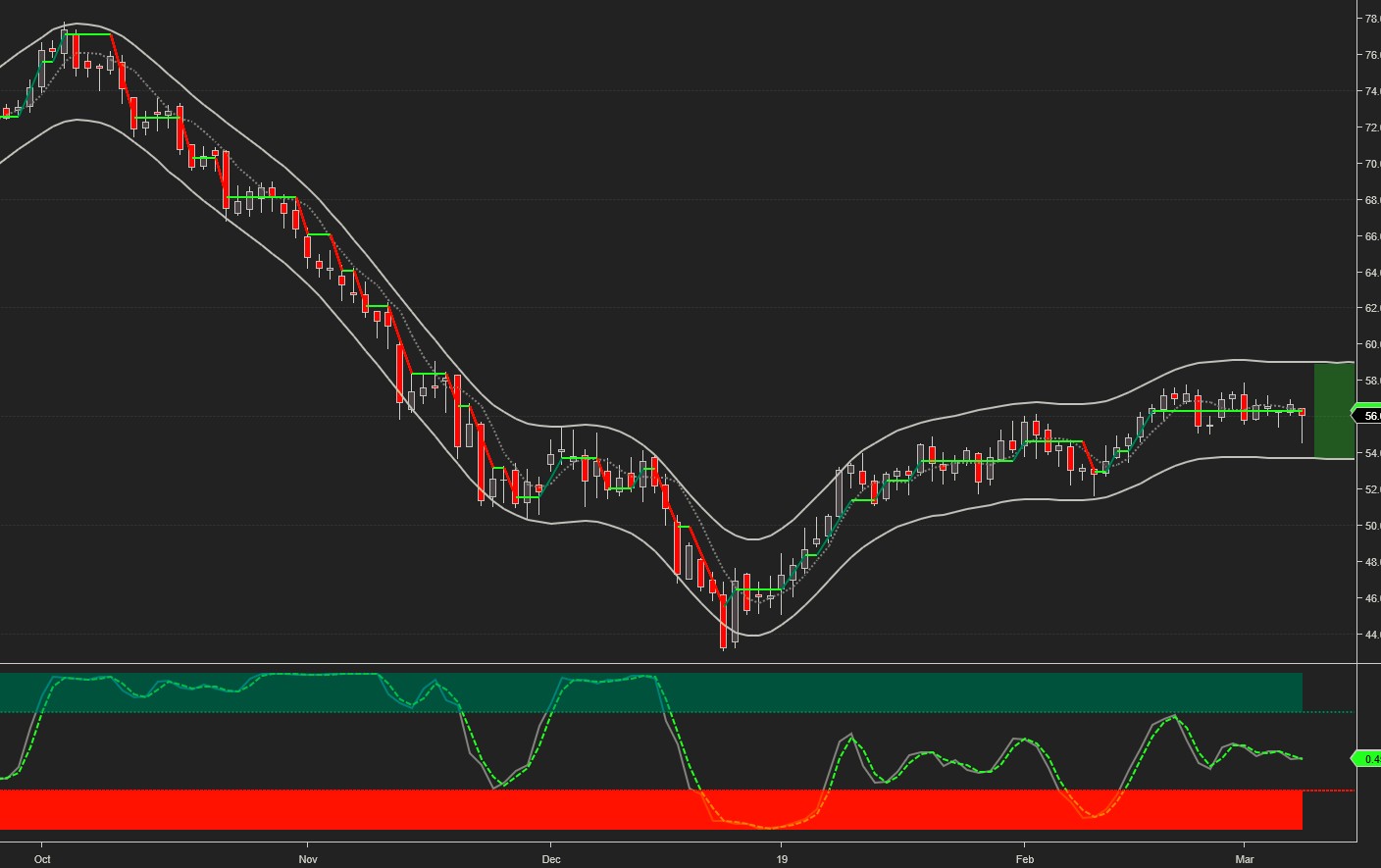

The daily SPY chart shows in greater detail the level of market breadth deterioration during the last five trading days, which is consistent with previous retracements. A break below Friday’s low should lead to a retest of February’s lows. However, after five days of declines, the market breadth oscillator has reached oversold levels, suggesting that a bounce could be imminent.

Current signals*: Daily Short, Weekly Short

For Weekly Buy/Sell pivots check the TV page which gets updated on Monday.

The projected trading range for next week for SPX remains unchanged at 2690-2825.

Oil continues trading flat, unable to break above $58.

Current signals: Daily Flat, Weekly Long.

The projected trading range for Oil for next week remains 54 – 59:

GOLD confirmed our expectation that last week’s downswing was getting overextended. It dropped to the lower weekly target on Monday, and traded there until Thursday, when it finally staged a rebound.

Current signals: Daily Flat, Weekly flat.

The projected trading range for Gold for next week is: 1275 – 1310:

USDCHF broke above $1.00 and reached the upper weekly target. Parity remains the bullish/bearish pivot going forward.

The projected trading range for USDCHF for next week is 1.000– 1.015:

USDJPY showed signs of trend exhaustion early in the week and stalled at last week’s upper target. It remains in an uptrend, however, and keeps the same weekly targets.

Current signals: Daily Long, Weekly Long.

The projected trading range for USDJPY for next week is 110.25 – 112.55:

EURUSD sold off following Draghi’s comments, and dropped below the lower weekly target. The stakes are high for the Euro, since a break below 1.12 could lead to an 8% drop.

The projected trading range for EURUSD for next week is 1.115 – 1.132:

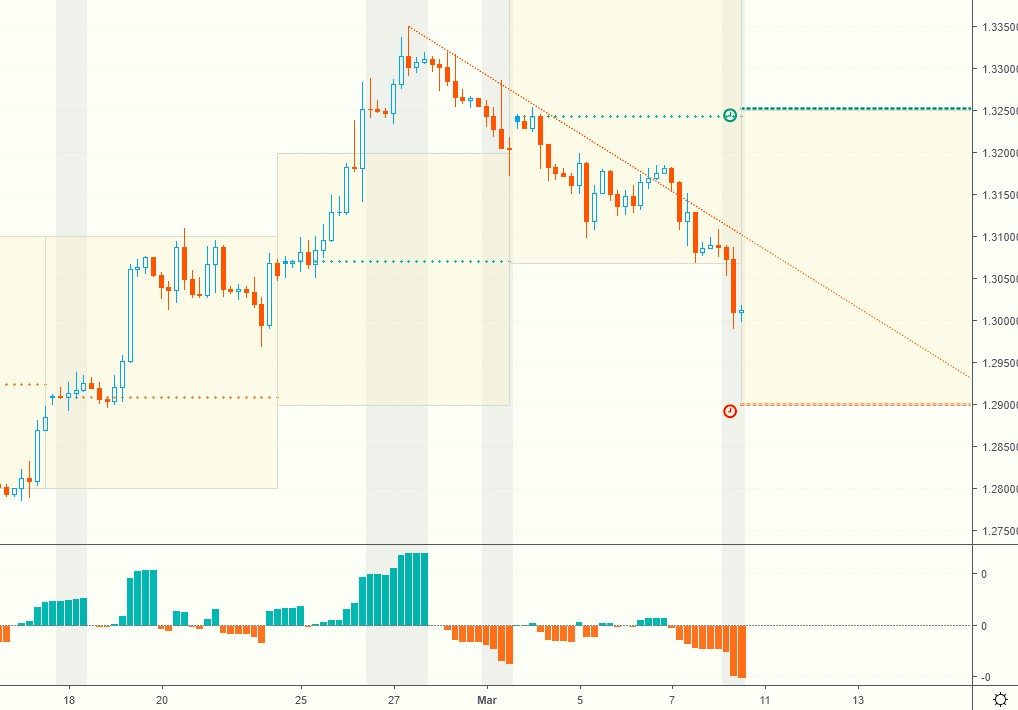

GBPUSD dropped to the lower weekly target and is showing signs that the current down-swing may be getting over-extended.

The projected trading range for GBPUSD for next week is 1.29 – 1.325:

USDCAD finally broke above the January highs, and the breakout was successfully retested on Friday.

Current signals: Daily Flat, Weekly Long.

The projected trading range for USDCAD for next week is 1.33 – 1.355:

AUDUSD dropped to the lower weekly target mid-week, before staging a modest rebound on Friday. A break below current support at 0.7 could lead to a retest of the January flash crash lows.

Current signals: Daily Short, Weekly Short.

The projected trading range for AUDUSD for next week is 0.695 – 0.7115:

*Please note that the signals are provided for informational purposes only. They are in effect as of the close on Friday and may change as soon as the markets re-open.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

For intraday charts and update follow us on TradingView

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more