Powell Gives Risk Sentiment A Boost

Some much-needed calm as the new trading week gets underway along with a degree of optimism as reflected in a lower VIX and Yen pairs recovering from last week’s ‘flash crash’. All helped along by Powell’s emollient words on Friday when at an event with Former Chairs Bernanke and Yellen he confirmed the Fed was ‘listening’ to the markets and ‘always prepared to shift the stance of policy and to shift it significantly’. Moreover, it appears this flexibility also extends to the Fed’s monthly reduction of its balance sheet and it seems the Trump tweet triumphs again. We are certainly moving in interesting times.

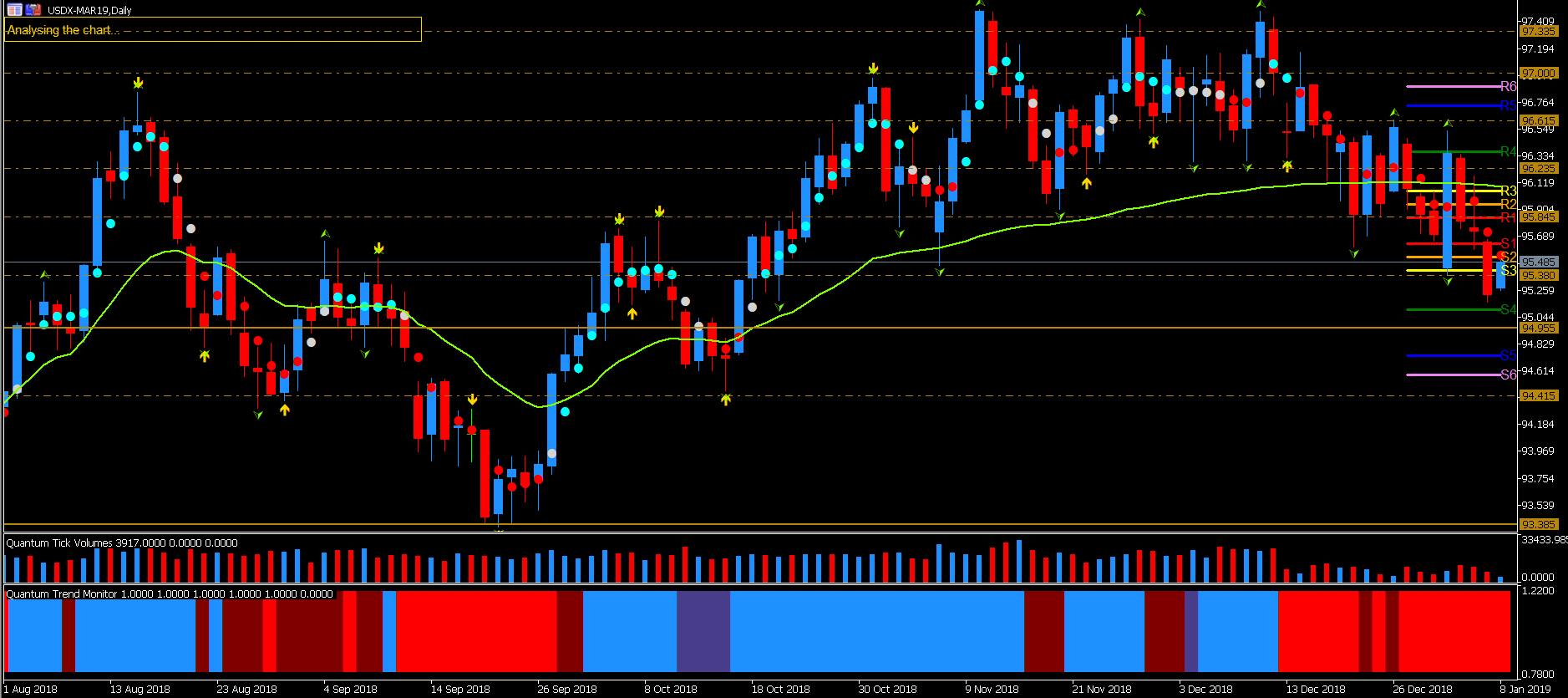

Powell’s words had an immediate effect on the USD which rose sharply on the back of strong NFP data before falling back to the 95.50 region on the DXY. USD continued lower yesterday taking out our S3 95.40 level, but falling short of the significant S4 level at 95.14. In the overnight session, USD found some bullish momentum with a move to retest 95.50 but has since moved back to 95.40 as we wait for the US markets to get underway. To the downside 95 and 94.50 is the key region where a strong level of support now awaits.

But as I’ve been mentioning in my various Facebook posts technical sets on the charts can very easily and quickly change making it imperative we keep abreast of the news and our stops tight.

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more