Not Even A Global Pandemic Can Shift Preferences For Cash As An Option

As technology evolves, we are moving away from cash. For some, this move has been accelerated by Covid-19. But for others, change is slow: those with an affinity to cash have been less affected by recent events. Not even a global pandemic can shift some preferences for the stability and tangibility of hard-earned cash, even if they use it less than before.

Cash slowly dethroned

Once -- and not so very long ago -- cash was king. Notes and coins travelled constantly from wallet and purse to pay for just about everything. It was, literally, the law of the land.

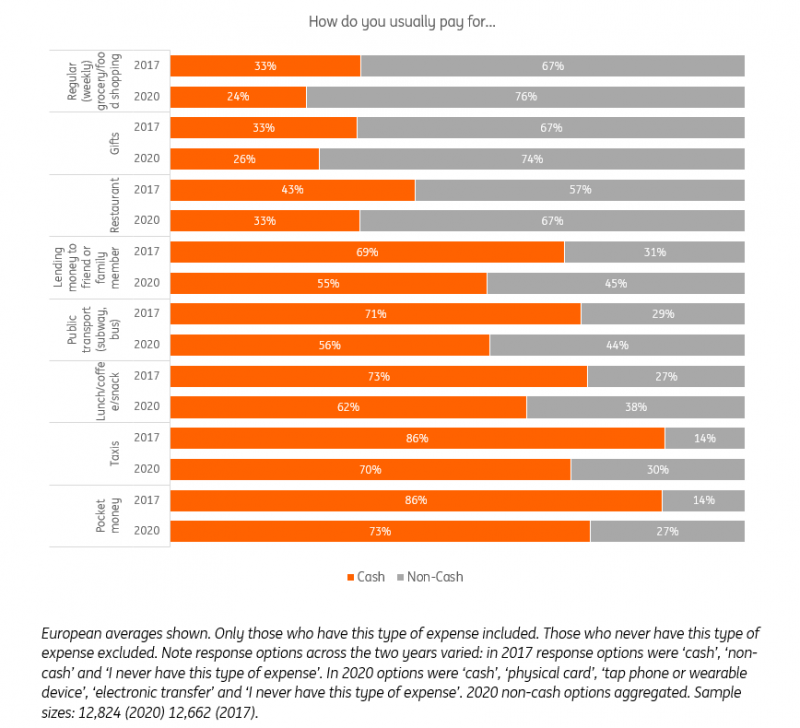

It is still with us, of course, but cash use has been declining. ING International Surveys on financial behaviour since 2017 have noted a steady decrease in people paying for cash across many day-to-day spending categories. The latest was no exception: all eight spending options given to almost 13,000 people across 13 countries showed a reported decline in the use of cash. This was despite the European Central Bank reporting the value of banknotes and coins in circulation continually increasing in Europe between 2008 and 2017.

Consider, for example, something as basic as giving pocket money to kids. Nearly three-quarters (73%) of those who do this still give cash. But this has reduced from 86% in 2017. The rest may transfer pocket money to app-based systems or allow children to use card payments.

Public transport costs are another example of the decline of cash, with pre-paid travel cards or card- and/or app-swiping now ubiquitous. Shifts will have been driven by both choice and necessity. In the UK, Transport for London stopped accepting cash payments on busses as far back as 2014 leaving passengers with no option but to adopt a cashless approach to getting around. Travelers in Amsterdam experienced a similar shift in March 2018.

Cash remains a common way to pay for smaller amounts in person, but rapidly declines in popularity for medium and large expenses. The preference for cash when paying for smaller amounts is driven by convenience, 40% of Europeans say they choose cash because it is ‘quick to pay’. There are benefits of using cash that mean it remains a popular option for many people.

But cash continually has to compete with ever-expanding alternative ways to pay. The advent of multiple methods -- credit cards, mobile phones, online purchasing etc. -- has pushed people's use of cash down their preference list for many expense types.

Four in five (83%) Europeans say to varying degrees that they use cash less since starting to use contactless payments, underlining how technology is changing behavior.

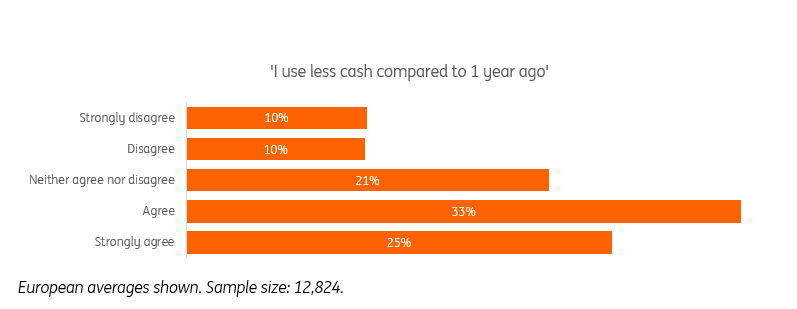

Overall, more than half (58%) say they use cash less in 2020 than they did a year ago, versus 21 percent who disagree with this statement (the rest are non-committal).

The COVID cash push

But as with just about everything else in 2020, there is a large caveat to drawing conclusions: the COVID-19 pandemic has been one of the largest behavioural disruptors in world history. Cash is no exception.

With many shops shut, people have been forced to buy online; similarly, those who have gone out have been put off by health-risk worries about passing cash back and forth. Financial service providers in many countries including the UK, Netherlands, Belgium, France, Germany and Luxembourg have also raised the amount customers can spend by tapping a credit or debit card to encourage movement away from handling physical money.

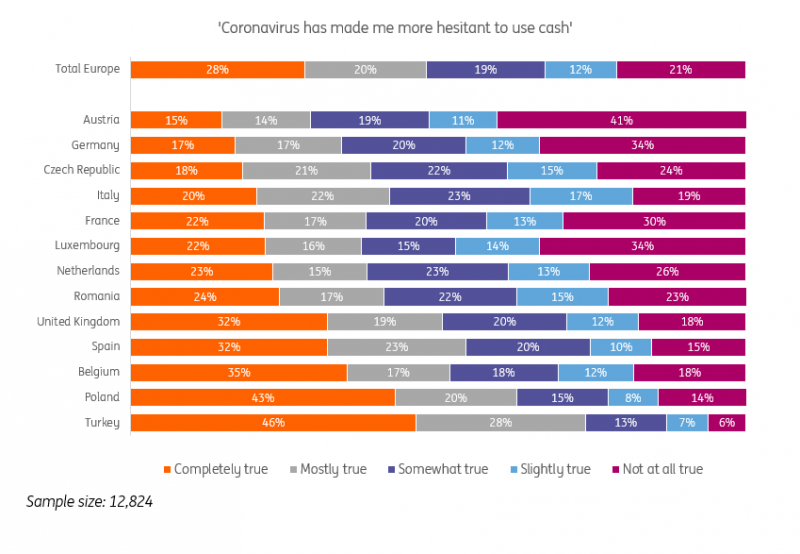

All of this will have influenced cash use -- and to an extent, people in the survey reported it has. Half (48%) say that the statement ‘coronavirus has made me more hesitant to use cash’ is either completely true or mostly true. Only a fifth (21%) said it wasn't true at all.

In the early days of COVID-19 people started taking out more cash, possibly because it was seen as more reliable during uncertain times. After this peak however, cash withdrawals have declined and people are now likely to take out larger amounts, less often (5). It will be interesting to see if this lasts, and for how long.

Sara Hlobil, Payments Analyst, ING Payments Centre

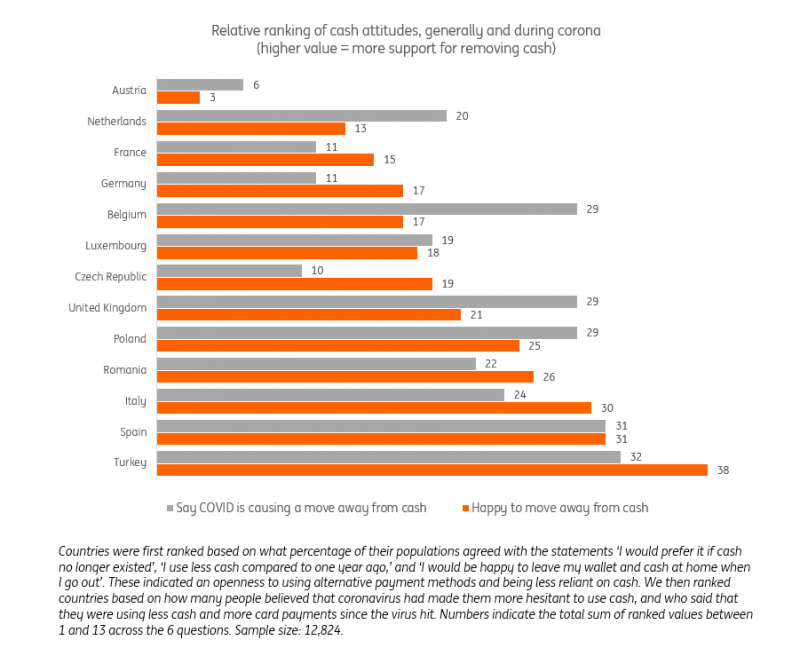

But the global pandemic is influencing cash use differently in different countries. In those countries where a preference for cash is strongest compared to other countries, we saw fewer people reporting that coronavirus had reduced their cash use. It was in those countries where people are already more open to using payment methods other than cash, that a bigger shift due to coronavirus is being reported.

Local conditions and the availability of alternative payment methods influence payment choices. For instance, in Poland, where people tend to use less cash, EMV cards and contactless payments were made available relatively early and BLIK, a local cashless payment option, is quite popular. On the other hand, in Germany, many people continue using cash.

Jaroslaw Bobulski, ATM Community, ING

Change can be slow

Back in 2016, Erkki Liikanen, then-governor of the Bank of Finland, said at the Bank of Finland Conference on going cashless, that it was time to reappraise the future of cash. Its main benefit as a way to store and convey information about a bearer's purchasing power was no longer unique given new payment systems, he said.

Behavioural scientists, meanwhile, have long noted that people, once immediate hesitancy is out of the way, tend to adopt quick and efficient methods of achieving something. It is what market research firm Nielsen has dubbed the "Quest for Convenience". Buying things online (with credit cards and/or payment apps such as PayPal), or in-store by swiping cards, mobile phones and smart watches meets the convenience test. It also avoids the carrying of bulky cash that can be lost or stolen without a recourse such as stopping payment.

This has all led to predictions that cash will not survive, that it will not only be dethroned, but will end up being abolished altogether.

The First Cashless Country?

It is something of an irony that the first country to issue permanent banknotes (in 1661) is the same that is now touted as the first likely to become cashless -- Sweden. Even a date has been set: March 24, 2023.

This calculation comes from research presented in 2017 by Jonas Hedman of Copenhagen Business School, Niklas Arvidsson of Stockholm's KTH Royal Institute of Technology, and Bjorn Segendorf at Sweden's central Riksbank. Among their findings:

- In the 10 years following 2007, the amount of cash circulating in Sweden fell by around half, far more than the single-digit declines seen in other countries; • Only 18% of Swedish consumers want to pay with cash;

- When cash transactions fall below 7% of total payment transactions, it becomes too unprofitable for retailers to accept cash.

Despite this, it may not be all over for Sweden: in 2018, the number of banknotes and coins circulating in the country rose 7 percent -- the first increase since 2007.

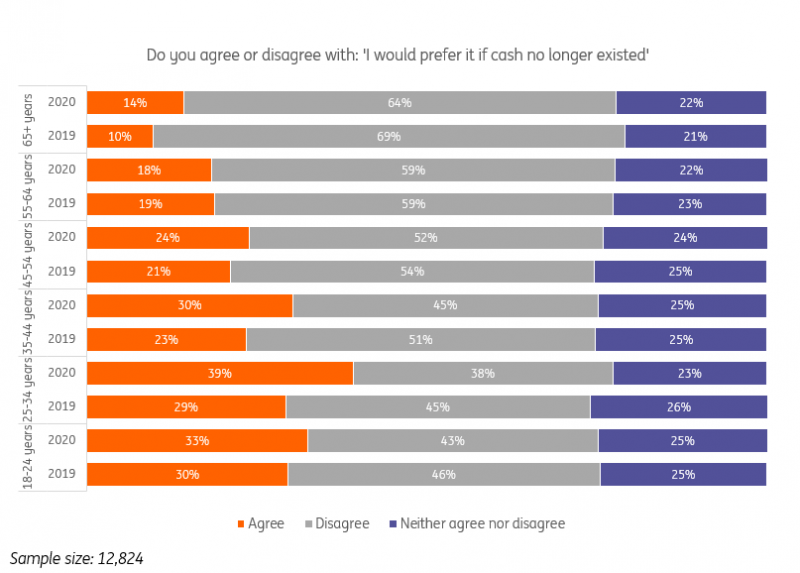

But cash is still very much with us. And while on average, one in 10 (11%) strongly agreed with the statement "I would prefer it if cash no longer existed", three in 10 (29%) strongly disagreed. The remainder were somewhere in the middle. This has shifted a little, mainly within younger to middle-age groups, since one year ago.

Attitudes stable

The attitudinal change -- as opposed to the change in usage -- has not been dramatic. Many people indicate that they are happy for cash to stick around.

This fits with our previous findings that increasingly show people want more ways to pay for things -- even if they don't use them. Cash is clearly one of those ways: when asked what type of payments they expect to use in the next six months, more people picked cash than any other method.

It is still early days to see just how radical an impact the pandemic will have on economies and ways of life. But for now, it has not been big enough to shift attitudes completely away from cash: those who liked it before are less likely to report shifts now.

While day-to-day cash use is undoubtedly decreasing, it is happening slowly. But the option to choose cash -- or at least to retain it as an option -- remains desirable. Cash may no longer be king, but it is still royalty.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more