NFP Tonight Could Continue To Fuel Dollar

With ADP employment change doubling and jobless claims falling, we could expect a healthy NFP data though the gains should be modest. Short EUR/USD?

Most signs point towards a healthier NFP tonight as ADP employment change doubled while jobless claims continue to fall.

The only concern is that the labor component of Non-Manufacturing ISM fell to a 4-month low in January.

The recent rally in dollar despite the coronavirus outbreak could mean that market sentiment could take precedence instead of data.

We believe that dollar’s rally could continue as long as the US stock market continues to move higher.

Thus, we are bullish on dollar movement and even a slightly weaker NFP could provide a better short entry opportunity for EUR/USD.

However, we do not expect huge movement even if NFP surpasses market expectations by a huge mile.

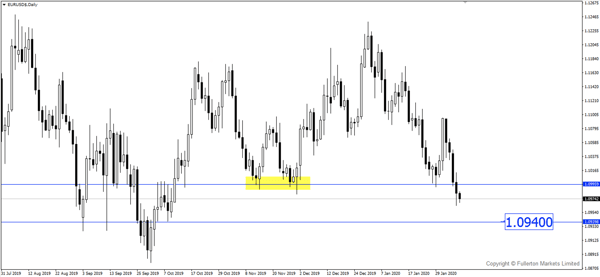

EUR/USD recently broke critical support at the 1.0990 price level and could head lower towards its next support at 1.0940.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more