Market Briefing For Thursday, July 30

Recognizing the severe economic downturns - was and is essential coming from the Fed. Their comprehensive approach to assisting both monetary and fiscal policy moves (and supporting efforts that Congress may determine) is absolutely essential.

The statements relating to 'retaining the policies through year-end' also is expected, by us to ensure we set-up or robust recovery in time. It also negates the prevalent concern that the Fed, not today, but at the next meeting, might start revising them.

The Chairman spoke to the circulation of 'coins' being anemic. Normal (what is that?) circulation has been requested and so on. But that's mechanical. More notable may be the persisting Dollar weakness (UDN), which is at a 'trend-line' now, and if it bounces a different aspect should be contemplated, which would be a pullback by Gold (GLD).

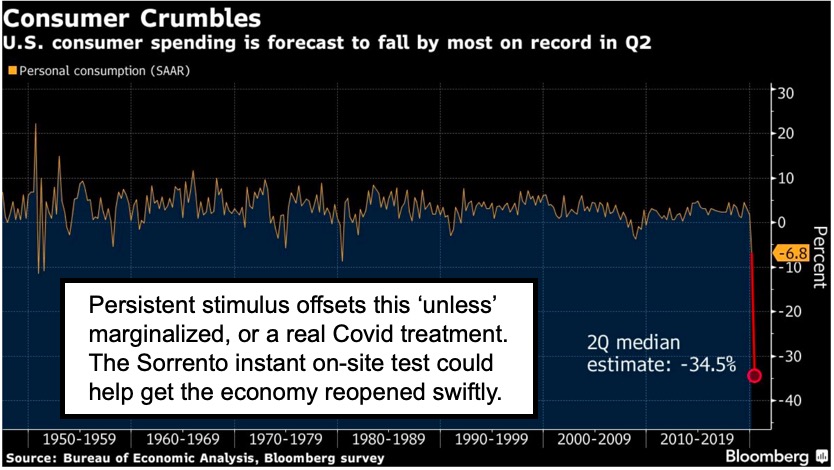

Risks related to a 'double-dip' recession are speculative for sure. However consumer spending increases -along with virus level increases- occurred faster than they were prepared for. So that brought the monitoring of 'high-frequency data', which shows a slowing of the pace of recovery, since the recent spiking in COVID-19 cases. Sure, lots of folks are restricting their 'external' mingling or dining activity versus the first attempts at 'reopening'. Chairman Powell says it's too soon to conclude slower spending, but I will say it's pretty evident (my own personal experiences venturing-out) concur that it is not a safe environment, but could be if we had on-site near-instant testing.

Executive summary (includes Fed highlights):

- Preserving flow of credit essential to mitigate damage to the economy.

- Continued fiscal and monetary (expansive) policy required.

- Direct fiscal support needed for small business.

- Lending (demand) levels were lower than they anticipated.

- Given biggest shock in history, lending facilities must be sustained.

- Results of early fiscal action are shown by 'some' revival.

- I suspect that action is the only reason we're not in 'formal' Depression.

- Consumer spending measures this month have taken a dive.

- This tough situation persists, and the wage-composition is an aspect, there will not be aggregate upward pressure on wages or the foreseeable future.

- Path forward remains difficult to predict, but we see prospects beyond near-term concerns that are patently obvious.

- Workers in hard-hit sectors will need help (airlines, but years before they come back to anything remotely like what they all would like to see).

- Banks may be allowed to grow their balance sheets by leverage-ratio relief.

- Fed not even thinking about raising rates in the foreseeable future (of course).

- Fed support needed until 'shown otherwise', that simplifies and puts to rest the chatter that wants to find an excuse to still 'fight the Fed'.

- Changes in policy will just acknowledge or codify what the Fed's already doing.

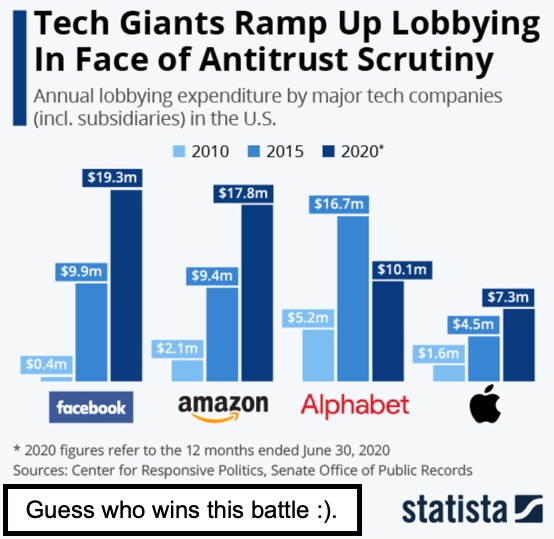

- On stocks: I loved the question to Jeff Bezos, as to whether it's OK for Amazon (AMZN) to extract leverage to gain contract from AT&T's (T) HBO Max for Amazon Fire.

- Structural conflicts of interest are used for gaining content leverage and Bezos clearly doesn't want to touch that area of concessions for access (dealing).

- And they weighed-on Amazon's 'below-cost' pricing of devices at times, so as to lock-in customers and whether that's an anti-competitive situation.

- What he confirmed was this isn't about 'price or sales', but market position.

- Too bad nobody mentioned spinning-off AWS (web services), not retail units of Amazon (Congressmen's good questions avoided the 'real' spin-off issue).

- Google (GOOGL) got pounded a bit for taking Chinese military money for 'AI research'.

- Tax-hike from a Biden administration would likely be a greater market worry;

- Testimony suggested Google search 'does' have a 'deceptive news' blacklist, so yet-another ranking that decides what is fringe, what constitutes free expression, and what constitutes review and approval manually (inconsistencies).

- Qualcomm (QCOM) announced settlement with Huawei over licensing, shares jumped, that's even as they project higher targets for the (eventual) SOC 5G modem.

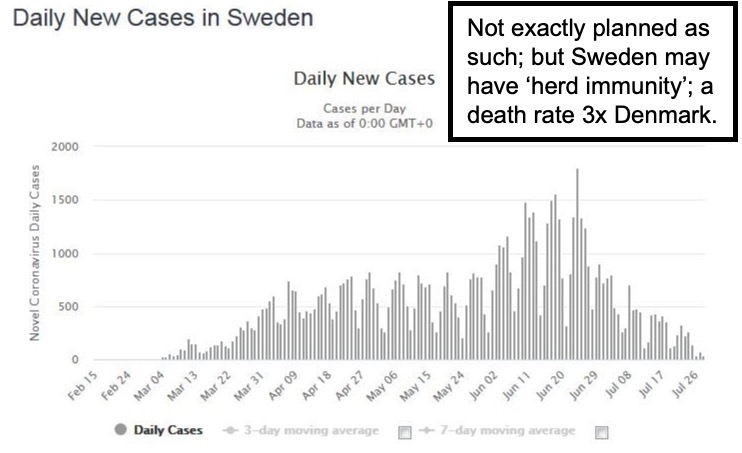

- Important (and under-appreciated) Columbia University 'COVID-19 test' is a likely game changer, although limited people tested, the approach now licensed to Sorrento Therapeutics (SRNE), would probably widely-make-it the 'go-to' test and even help open-up the U.S. economy.

- Many analysts continue to 'pan' Sorrento, well, we're sitting at just about double, so have a nice cushion to work with while they sort out details and the FDA, at the same time there are analysts with price targets in the 20's, but COVID-19 winners defines near-term prospects, goal could be lower or higher ... depending if they get multiple successes.. probably not all but even one would zoom it higher.

- Market continues with the Fed Put, and upside next year will come from actual earnings, given profitability as the economy recovers 'with' a COVID-19 resolution.

In-sum: The pace of recovery has been stymied by the 2nd wave COVID-19 surge, and I emphasize that because the Fed is 'in the game' and will keep programs in-place. It is stating this will take a really long time, and lending facilities will stay in-place.

To be sure, the Fed can shift anytime if they want, but it relates to the pace of COVID-19, as the virus is in-charge until medical science (not politicians) reverses this fiasco for the majority of people, irrespective of some terrific stock market results for many.

Bottom-line: The Fed says the 'upside economic case' is not the problem, they got that covered. It's the broad support for the economy that's been communicated, as it is a situation that's dire, but the Fed has to man the weapons and stay the course.