How To Trade Forex In A Slow Market (Low Volatility)

Most forex traders would have come across this phrase somewhere along their trading journey: “The trend is your friend until it ends.” Many make the mistake of trading in all market conditions or they feel lost when their strategy doesn’t work during certain periods. This is especially so when the market is erratic or too choppy, which results in your trading accuracy and effectiveness to fall.

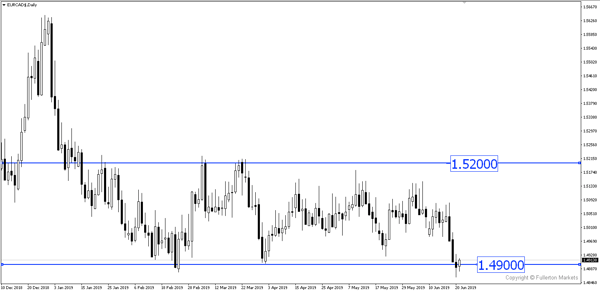

Below is an example of a ranging market (EUR/CAD) which has been ranging in the 300-pips band.

As a trader, you should learn to determine market conditions so that you can tweak your strategies accordingly. There are a few things you can do if you encounter a market period of low volatility:

1. Take a Break

The fastest way to make money is, in fact, through capital preservation. Most traders do not preserve their capital long enough to make substantial profits. If the erratic market conditions do not suit you, don’t trade it. You don’t need to trade every day or even week.

2. Use a Range-Bound Strategy

This could be the most straightforward answer ever. As a trader, we should be able to adapt to all market conditions. We can utilize a range-bound strategy in a ranging market but do note that low volatility in a ranging market produces the most erratic false breakouts and stop hunts. One must then adjust their stop loss and lot size accordingly.

One may ask, how do we then determine whether the market is ranging? A powerful tool that some traders use is the Exponential Moving Averages (EMAs) when support and resistance are not as obvious and when you realize that the candles are not moving in a very clear direction.

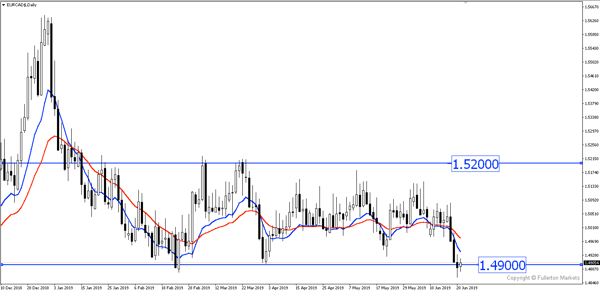

Below is an example with the blue line as the 8-day EMA and redline as the 21-day EMA. You can see that the EMAs have no clear direction and are cutting into each other frequently.

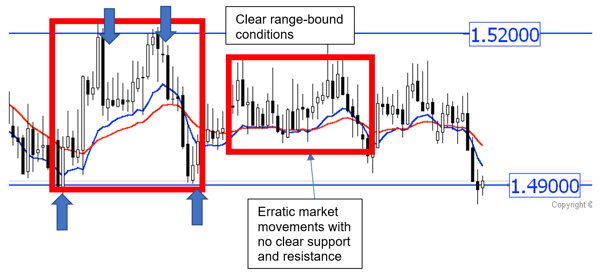

And if we zoom in, we can find a good ranging period and a choppy period from the charts below.

In conclusion, a low volatility market may not be the most ideal market to trade in as the market is not certain as to which direction to move off in. The best thing you can do is to not trade at all until a clear direction is seen or when you can determine clear range-bound conditions to utilise your range-bound strategy.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more