How Do Forex Big Hitters Do It?

Forex trading accounts for more than $5 trillion worth of transactions every day. And while huge chunks of these transactions are done by institutional investors (banks, hedge funds, brokers, and dealers), most of the accounts are held by individual investors. This is a simple way of describing the forex market (there are several traders but only a few players call the shots).

Nonetheless, this does not mean that only institutional investors can profit from forex trading. In fact, there is a good number of notable big hitters who made money in forex trading as individuals. You can read about some of them on the forex millionaire success stories article published on Global Currenciez. It shows clearly that making money in forex is not a myth as some critics of the industry tend to point out. It is just as real as other trusted forms of investments. The only difference is that the risks are higher, and this is clearly stated on every forex broker’s disclaimer statement.

There are some theories which suggest that 95% of those who invest in forex lose money. Based on the unpredictability of the forex market and the clear lack of knowledge amongst most wannabe forex millionaires, it’s easy to see why only a mere 5% end up being profitable in the lucrative day trading market.

So how do the big hitters in forex do it? Let’s examine.

Trade smart not often

According to several reports linked to those who have made money in the forex trading market, trading smart trumps frequency. Novice traders think that by trading several times a day will help them make more profits than those who trade less often. A more detailed report on this subject was published by India’s Economic Times and contrary to the opinion of the many, trading less often has several benefits.

Research has shown that those who trade less often are likely to have a sounder trading plan than those who engage in scalping. Trading more often also leaves traders open to more losses related to a premature closure of positions. On the other hand, when you have a trading plan in place the short-term market fluctuations are likely to have less impact on your trades.

So, does that mean that the longer the trading timeframe the better? Probably not. But the big hitters in forex trading tend to find the right balance between the two extremes.

Choose the right currency pairs

Just like in stocks, some assets are riskier than others. This is primarily due to the issues with liquidity. On the bright side, knowing exactly the right time to take a position is high-risk currencies could result in massive returns. In fact, some forex millionaires have attested to having taken a risky position that paid off in the end.

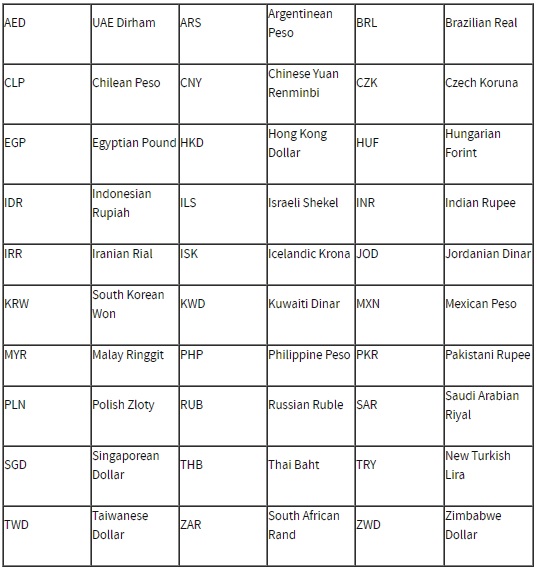

Exotic currencies fall in this category of high-risk forex trading. The screenshot image below provided courtesy of this Investopedia article lists the most popular exotic currencies from all over the world. As you may have noticed, some of them are pretty popular to the point that you could think that they are among the minor currency pairs. Take for instance the Russian Rubble (RUB), the Brazilian Real (BRL), the Mexican Peso (MXN), and the Singaporean Dollar (SGD). These currencies are very popular in today’s forex markets especially when tied to the US Dollar (USD).

As such, it is quite easy to find a novice trader treating them otherwise thereby foregoing the risks attached to exotic currencies.

Forex liquidity is in plenty amongst the major currency pairs, which include the Euro against the US Dollar (EUR/USD), the US Dollar against the Japanese Yen (USD/JPY), the USD against the Swiss Franc (USD/CHF), and the British Pound against the USD (GBP/USD).

With liquidity comes efficiency, which means that the movement in the exchange rates amongst these pairs is likely to be purely determined by the forces of demand and supply, among other common economic factors that affect forex markets. This makes them easier to trade because once a trader notices that a particular position is falling deep into losses, it is easy to close that position and cut the losses.

Finally, don’t go in green

If the two points discussed above sound too complicated for an aspiring forex trader, then it means they are pretty green when it comes to currency trading. As such, the best thing would be to learn more about forex trading before jumping in with the dream of becoming the next forex millionaire.

The right forex trading education should cover lessons in technical analysis, fundamental analysis, risk-weighted trading strategies and some guides on trading psychology. Of course, emotion can play a big part when it comes to forex trading, which is why many educational platforms are now incorporating guides on how to deal with it in their classes and workshops.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor ...

more