Forex Analysis Of USD/JPY For Tuesday, July 10

First, we look into the yesterday trade and what happened on July 9, 2018, and it opened at 110.429 and went high at 110.893 and gone low 110.341 and finally closed at 110.836. The calculated pivot point for the day is 110.690.

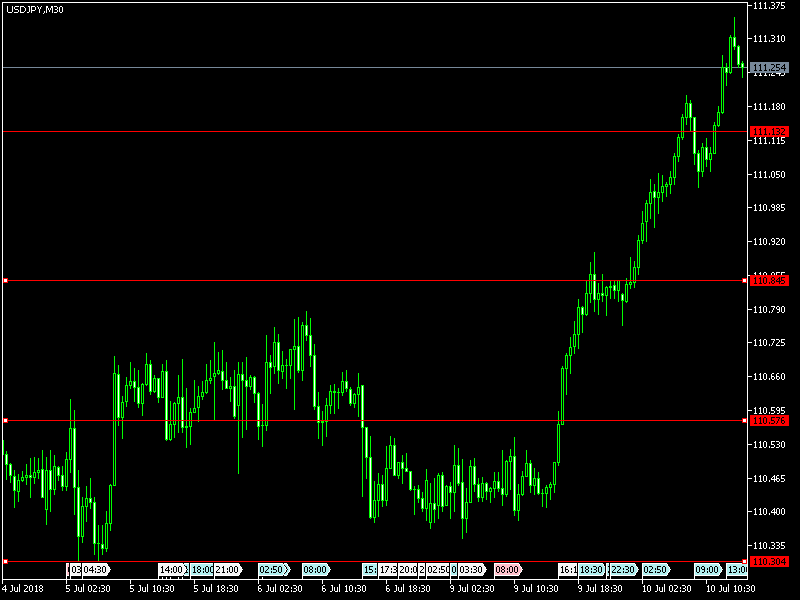

The difference between high and low was nearly 0.552 points and there was a good chance for trader to take the opportunity between low to high levels and finally benefit. Now the opportunity is, from consolidation and sideways trade to higher levels for few days due to the trade war with China. If EURUSD goes high USDJPY goes down and vice versa and watch two pairs for trading before entering into trade. For many days the range for this pair was between 109.360 to 111.300. Hourly traders are waiting for an opportunity to buy at 111.50 level or sell at 110.80 to get maximum profit.

LEVELS TO BE WATCHED FOR TRADERS FOR THEIR TRADING

|

Level |

First Level |

Second Level |

Third Level |

|

Selling Level |

110.30 |

110.02 |

109.74 |

|

Buying Level |

111.47 |

111.75 |

111.98 |

EVENTS TO BE OBSERVED AT THESE TIMES TO TAKE MORE ADVANTAGE

|

GMT |

Event |

Actual |

Previous |

|---|---|---|---|

|

06:00 |

JPY Machine Tool Orders (YoY) |

11.4% |

14.9% |

|

10:00 |

USD NFIB Business Optimism Index |

107.2 |

107.8 |

|

12:55 |

USD Redbook index (MoM) |

-0.4% |

|

|

12:55 |

USD Redbook index (YoY) |

4.4% |

|

|

14:00 |

USD JOLTS Job Openings |

6.698M |

|

|

15:30 |

USD 4-Week Bill Auction |

1.86% |

|

|

17:00 |

USD 3-Year Note Auction |

2.664% |

|

|

20:30 |

USD API Weekly Crude Oil Stock |

-4.5M |

SEE THE LEVELS IN THE CHART AND TRADE ACCORDINGLY