Fed To Cut Rates Despite Better US Retail Sales

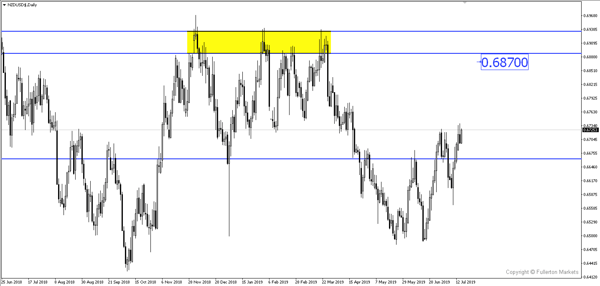

Fed is still expected to cut rates even though retail sales surpassed market expectations. Long NZD/USD?

US retail sales increased by 0.4% in June as purchases of motor vehicles, furniture and building were ramped up. This surpassed the forecast of 0.1% that the market was expecting. Core retail sales which include automobiles, gasoline, building materials and food services increased by 0.4% as well.

The strong gains in retail sales this time round suggest that consumer spending accelerated in Q2 after rising at its slowest pace in a year in the January-March period.

Dollar strengthened across the board as US treasury prices yield lower. Stocks on Wall Street were trading lower mostly due to quarterly earnings from the banks which drew mixed reactions from investors.

The market is already pricing in a cut this month with some expecting 50 basis points cut which most feel is necessary to “un-invert” the yield curve – making long-term rates higher than short-term rates.

Powell’s commitment to cut rates seemed certain during his testimony last week and the question most investors will ask is whether it will be a 25bps or 50bps cut. With retail sales soaring, possibility of a 50bps cut could be reduced.

All in all, the Fed cutting rates is still seen as dovish regardless of it being 25bps or 50bps.

NZD/USD could rise further as the monetary divergence between the Reserve Bank of New Zealand (RBNZ) and Federal Reserve could continue to diverge as RBNZ could keep rates unchanged until the end of 2019. Fed, on the other hand, could be looking to cut twice this year.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more