EUR/USD: Goldilocks For Bulls? America’s Supply Chain Issues Leave Room For More Gains

Short memory – markets seem to have forgotten Treasury Secretary Janet Yellen’s comments on potentially higher interest rates and are rising again. For the safe-haven dollar, it implies a downfall. Investors have refocused on messages from Federal Reserve officials, who stick to the dovish message that inflation is transitory and that the economy has a long way to go.

Eric Rosengren of the Boston Fed and Lauretta Mester of Cleveland – the latter a known hawk – retreated that message. The data suggests that a shortage in skilled workers and bottlenecks in supply chains could cause prices to rise. However, these are supply issues, not demand ones – therefore “good problems” to have.

The imbalance between supply and demand may result in another outcome – less production rather than higher prices. If the economy adjusts by slowing down, that implies the Fed can continue buying bonds at $120 billion/month for longer. The dollar has more room to fall.

The latest evidence of such a cooldown came from the ISM Services Purchasing Managers’ Index, which dropped to 60.7 in April, below expectations. The figure for America’s largest sector implies a robust expansion, but not overheating. ADP’s private-sector labor market figures also fell short of estimates with under 800,000 new positions. Both publications lower expectations for Friday’s Nonfarm Payrolls report.

The vaccination picture is also shifting in favor of the euro. The old continent is ramping up its immunization effort, with around 30% of Europeans already having received their first shot. The US is still ahead with 45%, but the gap is narrowing.

All in all, fundamentals allow for further gains.

EUR/USD Technical Analysis

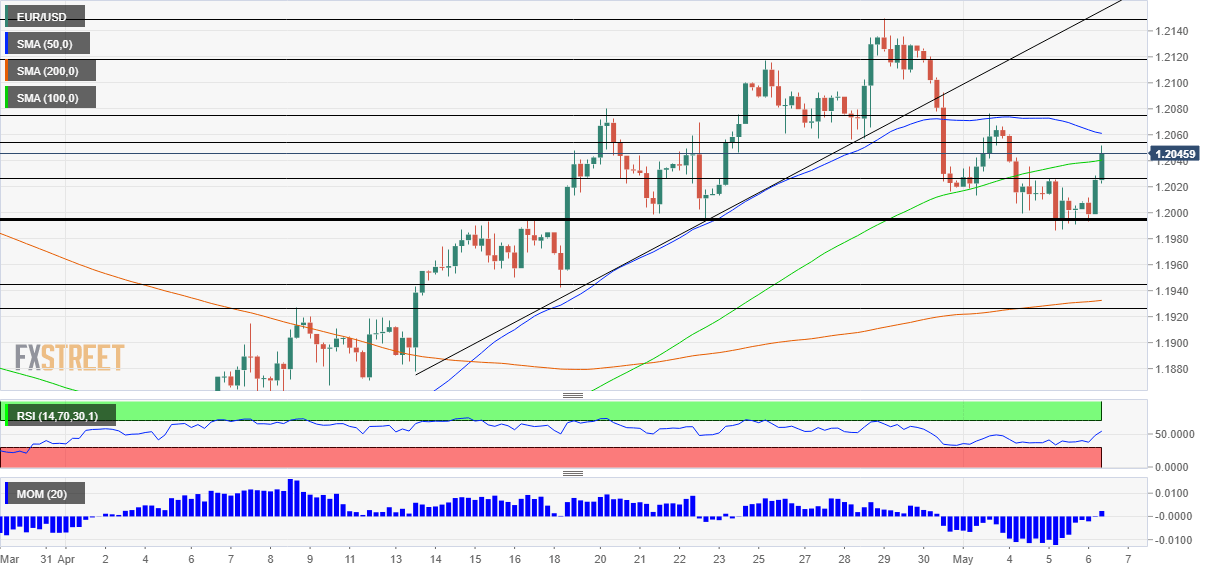

Euro/dollar has topped the 100 Simple Moving Average on the four-hour chart and momentum has flipped to the upside – both bullish developments. It is still below the 50 SMA , which is the first resistance line, at 1.2060.

Further above, 1.2080, 1.2120, and 1.2150 await the currency pair.

Support is at 1.2025, a swing low from last week, followed by 1.1990 and 1.1945.