EUR/USD Eyes Higher

- Slow forex market may change after US CPI figures & ECB decision

- Sooner or later euro will be higher

- A daily close above 1.2220 signals a bullish continuation

The forex market is slow but this may change today because of US CPI figures and ECB decisions. US CPI figures will be tracked very closely because of the potential one step closer to tapering if inflation numbers will pick up.

Technically speaking, the EURUSD has a very tricky structure but can be bullish if 1.2140 support will hold, but we need a rise and daily close above 1.2220 to confirm bullish continuation.

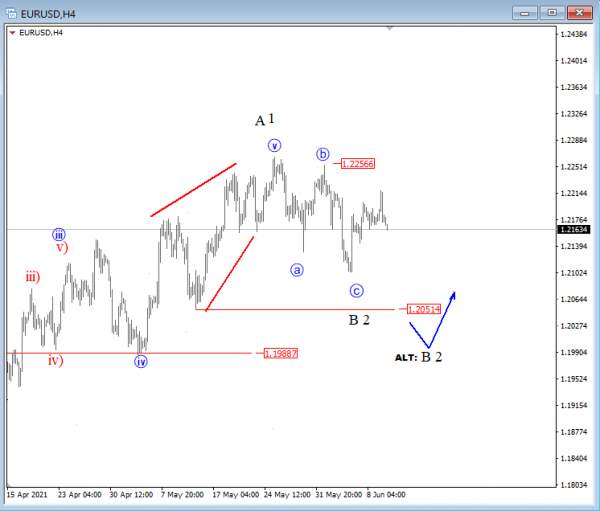

On the 4h Chart, EURUSD came down from resistance in the last two weeks as expected, but not for long. In fact, the drop was made by three waves so we have to consider a potential resumption higher again, especially as FED may not be thinking about tapering after another US NFP miss. From an Elliott Wave perspective, we think that sooner or later euro will be higher either from here or after a drop to 1.2-1.2050 area.

EUR/USD 4h Elliott Wave Analysis Chart

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.