Europe's Alternative To SWIFT: Another Nail In The Dollar's Coffin

The Wall Street Journal reports that Europe has agreed to develop an alternative to the SWIFT payments system to facilitate trade with Iran.

The European Union’s announcement that it would establish a special payments channel to maintain economic ties with Iran sent a clear message to Tehran and Washington: Europe is intent on trying to save the 2015 nuclear deal.

Channel NewsAsia reports that the system is being put into place to protect the freedom of trade.

Iran and the European Union announced their defiance towards US President Donald Trump's administration after high-level talks at the United Nations among the remaining members of the accord.

The countries said in a statement that they were determined "to protect the freedom of their economic operators to pursue legitimate business with Iran".

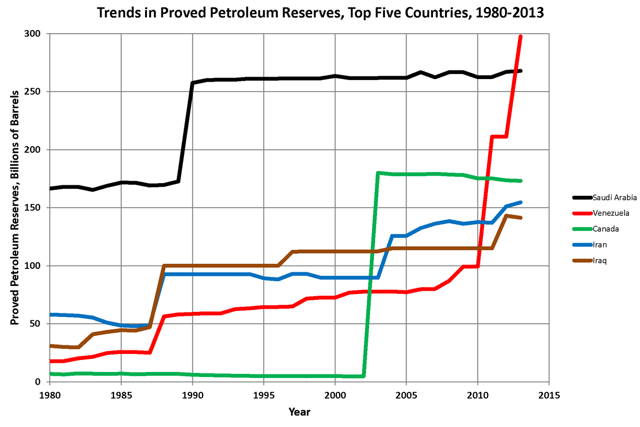

The system would facilitate payments related to Iran's exports, including oil. Iran is in the top 5 globally in proven oil reserves, which means the deal is extremely important to the future US dominance in global oil trade through petrodollar agreements.

Further, NewsAsia reports that Iranian foreign minister Mohammad Javad Zarif intimated that Iran would also be open to using the system to fund deals with other trade partners.

"In practical terms, this will mean that EU member states will set up a legal entity to facilitate legitimate financial transactions with Iran and this will allow European companies to continue to trade with Iran in accordance with European Union law and could be open to other partners in the world," she told reporters.

Will the end of the petrodollar dominance signal the end of the US dollar as the world reserve currency for trade? This is quite possible one of the big nails in the coffin for the Dollar.

Leonid Bershidsky, via Bloomberg, notes that "creating "a defensible banking architecture may well be the end goal for the Europeans, China and Russia, anyway."

European, Chinese, and Russian leaders have been discussing moving away from having a single dominant trade currency, and thus, ending the Dollar's role in facilitating international trade. Bloomberg notes:

In his recent State of the European Union speech, European Commission President Jean-Claude Juncker called for strengthening the euro’s international role and moving away from traditional dollar invoicing in foreign trade. China and Russia have long sought the same thing, but it’s only with Europe, home of the world’s second biggest reserve currency, that they stand a chance of challenging American dominance.

In the following video, I discuss these events' impact on the Dollar in global trade. I relate the significance of these moves with my past discussions on why the US dollar may be near its end.

Video length 00:09:07