Euro Forecast: ECB Does Little, Euro Facing Turning Risk Trends - Setups In EUR/GBP, EUR/JPY, EUR/USD

EURO’S STRONG APRIL PETERING

It’s been well-documented that April has been the best month of the year for the Euro, and 2021 thus far has fit historically tendencies neatly. But the gains seen in EUR/USD this year have outpaced both the 5- and 10-year seasonal averages, which is a simple heuristic to suggest that markets may have run ‘too far too fast.’ Price action around key events this week suggests that the Euro’s bull run may be indeed facing some short-term obstacles.

The April European Central Bank rate decision yielded little by any commentary that would suggest the central bank supports a strengthening currency, nor were there significant efforts to verbally jawbone the currency lower. This leaves the currency at the whims of broader risk trends, which are eroding as evidenced by declines in global equity markets and global bond yields.

Now, EUR/JPY rates are pulling back from range resistance while EUR/USD rates are dropping from a zone that has proved itself as both support and resistance since last summer. EUR/GBP rates may offer the best choice for Euro bulls in the near term.

ECB RATE DECISION RECAP

While ECB President Christine Lagarde offered little commentary that proved either market-moving or intellectually stimulating – no offense, it was a dull meeting! – it does appear that the market feels that there were enough efforts made to signal, at the margins, that the ECB remains open to more easing. In a world where the conversation around central banks is defined by stimulus reduction (e.g. tapering QE, rate hike timing), rates markets pricing in higher odds for a rate cut by year-end is noteworthy.

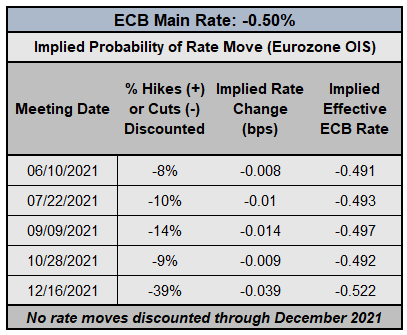

EUROPEAN CENTRAL BANK INTEREST RATE EXPECTATIONS (APRIL 22, 2021) (TABLE 1)

According to Eurozone overnight index swaps, the reaction to the April ECB meeting has been to boost year-end rate cut expectations materially. Earlier this week, there was a meager 15% chance of a 10-bps rate cut by December 2021. After today’s rate decision, markets are now pricing in a 39% chance. This is a new divergence relative to other central banks that could ultimately prove to be an albatross around the Euro’s proverbial neck heading into May.

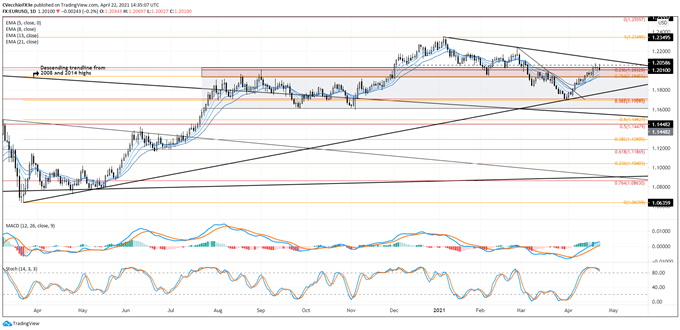

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (MARCH 2020 TO APRIL 2021) (CHART 1)

In the prior update, it was noted that “we can’t dismiss the fact that recent tailwinds may lead to a test of the 1.1945/1.2033 area. Unless the pair climbs through this zone, it remains doubtful that EUR/USD has significant gains ahead of it.” EUR/USD rates have rallied throughout April but have stalled in the past few days near the aforementioned confluence of technical levels that have been established as both support and resistance going back to last July: the 76.4% Fibonacci retracement of the 2019 low/2020 high range at 1.1945; the August and September 2020 highs at 1.1967 and 1.2011, respectively; and the 23.6% Fibonacci retracement of the 2017 low/2018 high range at 1.2033. Traders should see if the daily bearish shooting star candle forming morphs into a daily bearish key reversal, an additional sign that this zone will prove as a cap to price action.

IG CLIENT SENTIMENT INDEX: EUR/USD RATE FORECAST (APRIL 22, 2021) (CHART 2)

EUR/USD: Retail trader data shows 38.04% of traders are net-long with the ratio of traders short to long at 1.63 to 1. The number of traders net-long is 12.69% higher than yesterday and 5.90% higher from last week, while the number of traders net-short is 3.61% lower than yesterday and 8.19% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

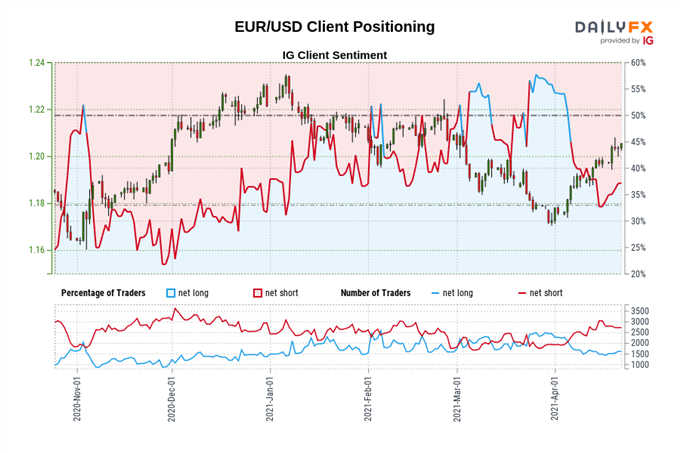

EUR/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (MARCH 2020 TO APRIL 2021) (CHART 3)

In the prior EUR/JPY rate forecast it was noted that “a bull flag has formed between 128.19 and 130.66. More gains may be ahead yet.” The bull flag has been maintained, and gains have not yet materialized; the recent pullback in price action is thus far consistent with the bull flag still being the predominant pattern. Furthermore, EUR/JPY rates are still contending with a break of the downtrend from 2008 (all-time high) and 2014 highs. A dip may be ahead before another crack at fresh yearly highs.

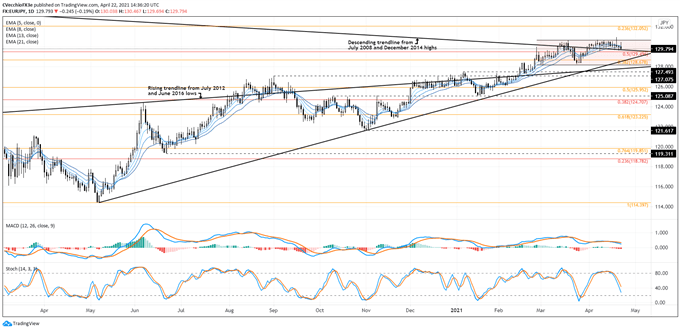

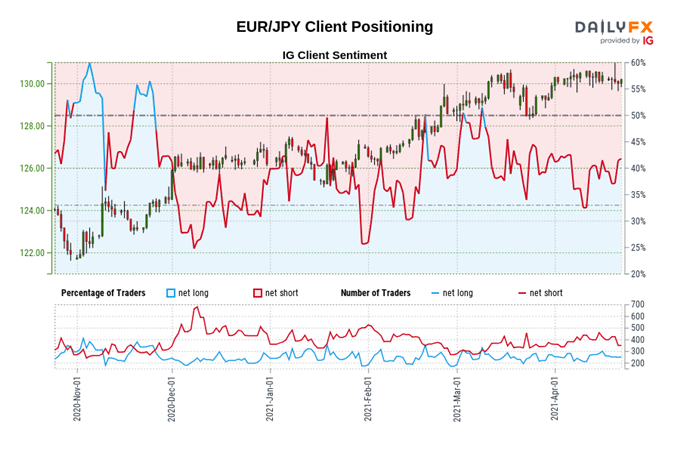

IG CLIENT SENTIMENT INDEX: EUR/JPY RATE FORECAST (APRIL 22, 2021) (CHART 4)

EUR/JPY: Retail trader data shows 40.42% of traders are net-long with the ratio of traders short to long at 1.47 to 1. The number of traders net-long is 2.03% higher than yesterday and 13.45% lower from last week, while the number of traders net-short is 5.37% lower than yesterday and 22.59% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/JPY price trend may soon reverse lower despite the fact traders remain net-short.

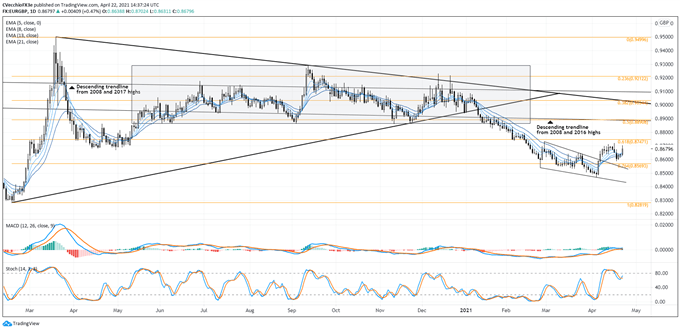

EUR/GBP RATE TECHNICAL ANALYSIS: DAILY CHART (FEBRUARY 2020 TO APRIL 2021) (CHART 5)

In a prior review of EUR/GBP rates, it was noted that “the breakout has failed and reversed course; EUR/GBP is back above descending trendline resistance, suggesting that a return back to consolidation resistance is possible at 0.8731. It may be the case that the pair continues to rise in the near-term before traders take another stab at a shorts.” EUR/GBP rates have not yet realized 0.8731, suggesting more upside may be ahead. Momentum indicators have turned to become more supportive, with EUR/GBP rates above their daily EMA envelope, daily MACD rising through its signal line and daily Slow Stochastics on approach to overbought territory.

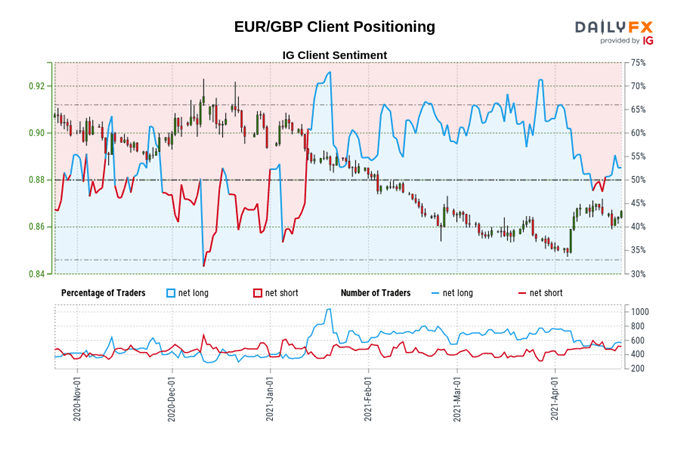

IG CLIENT SENTIMENT INDEX: EUR/GBP RATE FORECAST (APRIL 22, 2021) (CHART 6)

EUR/GBP: Retail trader data shows 53.45% of traders are net-long with the ratio of traders long to short at 1.15 to 1. The number of traders net-long is 2.61% higher than yesterday and 12.19% higher from last week, while the number of traders net-short is 20.22% lower than yesterday and 9.20% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bearish contrarian trading bias.