Dow Jones, Nasdaq 100, S&P 500 Forecasts After The Fed And Into 2021

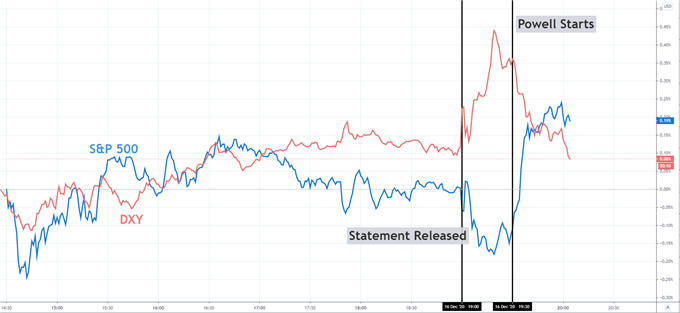

US equities ticked modestly lower in the immediate aftermath of the Fed’s monetary policy statement and updated economic projections while the US Dollar surged higher. Given the reaction in both markets and the Fed’s optimism on the economy headed into the months ahead, it can be argued the statement itself had a slightly hawkish lean – at least relative to the current framework and market expectations. It was Fed Chairman Jerome Powell who then proceeded to talk down some of the perceived “hawkishness” and reiterate the Fed’s willingness to accommodate.

S&P 500 & US DOLLAR REACTION AFTER FOMC MEETING

(Click on image to enlarge)

Still, however, economic projections are the bread and butter of the Fed’s policy given the central bank’s data-driven approach. While Chairman Powell’s commentary may have worked to dissuade any hawkish notions, further Fed meetings may continue to reveal an improvement in the economy and therefore grow increasingly “hawkish” in future meetings - in my opinion. Once again, it is crucial to consider this hawkishness within the context of the current monetary policy framework, which means a “hawkish” statement might equate to slightly reduced bond purchases with rates held at 0 into 2023.

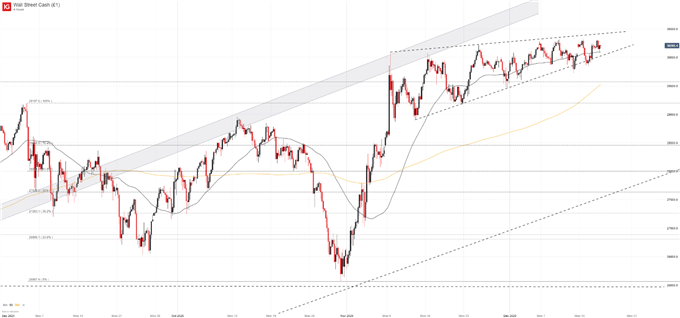

DOW JONES PRICE CHART: 4 – HOUR TIME FRAME (SEPTEMBER 2020 – DECEMBER 2020)

(Click on image to enlarge)

With the Fed revealing a steadily improving economy, a coronavirus vaccination reaching the public, and a potential stimulus bill from Congress, the market is left with few themes to derive catalysts from in the final few weeks of the year. Since stocks remain near their all-time highs and sentiment is at bullish extremes, the lack of catalysts might leave equities vulnerable to a shorter-term pullback. Further still, the promise of stimulus has been cited as a key driver of recent gains, so now that it may materialize, will the market undergo a “buy the rumor, sell the news” sort of reaction?

Simply put, it is difficult to say with certainty, but the fundamental and technical outlooks into the end of the year and early 2021 might hint at shorter-term weakness. Still, the longer-term outlook remains encouraging – a view bolstered by Chairman Powell’s remarks and the Fed’s economic projections.

Disclosure: See the full disclosure for DailyFX here.