Despite Trade Jitters, The US Dollar Has Not Lost Any Of Its Dominant Currency Status

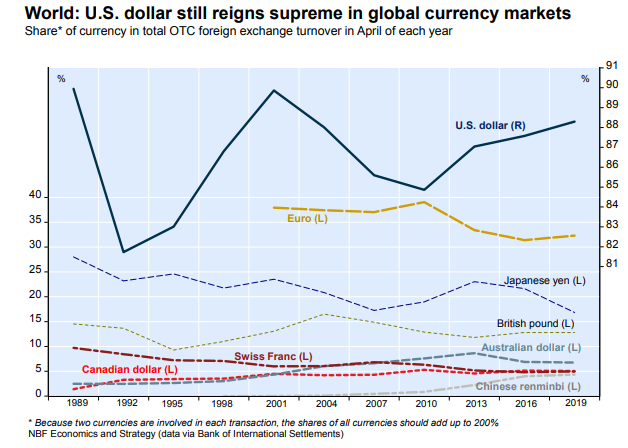

“The US dollar retained its dominant currency status, being on one side of 88% of all trades. The share of trades with the euro on one side expanded somewhat, to 32%. By contrast, the share of trades involving the Japanese yen fell some 5 percentage points, although the yen remained the third most actively traded currency (on one side of 17% of all trades). As in previous surveys, currencies of emerging market economies again gained market share, reaching 25% of overall global turnover. Turnover in the renminbi, however, grew only slightly faster than the aggregate market, and the renminbi did not climb further in the global rankings. It remained the eighth most traded currency, with a share of 4.3%, ranking just after the Swiss franc.” (The Bank of International Settlements, September 2019 Triennial Survey)

The latest BIS foreign exchange survey information was recently published. The report indicated that the trade in the global foreign exchange markets averaged a record $6.6 trillion/day in April 2019. The BIS data also highlighted the massive expansion in the financial derivatives market since the Great Recession ended in 2019.

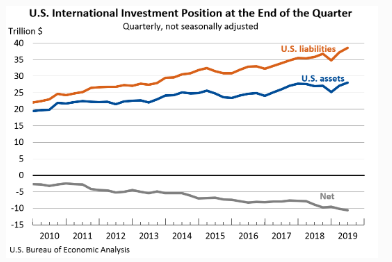

While the US dollar has retained its position as the pre-eminent global currency (see the first chart below), in fact, the country’s net international indebtedness position continued to worsen this year, and in fact, has been worsening for many decades.

The net international investment position (NIIP) is effectively America’s balance sheet with the rest of the world since it measures the gap between the US stock of foreign assets and foreigner's holdings of US assets.

Thus, at the end of the second quarter of this year, the US net international investment position, the difference between U.S. residents’ foreign financial assets and liabilities, was a negative $10.56 trillion. In the second quarter of 2019 US assets totaled $28.01 trillion while US liabilities were $38.56 trillion.

In recent years many of the emerging market currencies, including the Chinese renminbi, have increased their share of global FX turnover, but in general and compared to the US dollar, their percentage shares are still quite small.

The BIS data indicate that the Canadian dollar is the world’s sixth most traded currency with a 5% share of global FX turnover, just behind the Australian dollar (6.8%), British pound (12.8%), Japanese yen (16.8%), Euro (32.3%) and, of course, the U.S. dollar which remained the world’s dominant currency.

As the chart also illustrates, the Japanese yen’s share of the FX market has been declining since 2013.

The BIS report also highlighted that there has been an enormous growth in the global financial derivatives market that some economists, including this one, believe was a key factor behind the Great Recession of 2007-08.

Derivatives as financial instruments have been around for a long time, and their application sharply accelerated after the 1970s. In effect, modern finance today could not function without derivatives.

Derivatives are contracts that derives their value from the performance of an underlying entity. In other words, financial derivatives derive value from some other asset and then transfer the risk from risk adverse investors to risk accepting investors. As well, derivatives are often highly levered.

Some of the more common derivatives include forwards, futures, options, swaps, and variations of these such as synthetic collateralized debt obligations and credit default swaps.

The advantage of derivative instruments that increase the efficiency of financial markets. However, they are also associated with some profound disadvantages, since leveraged derivatives were also at the forefront of the financial crisis of 2007-2008.

Indeed, the rapid meltdown of mortgage-backed securities and credit-default swaps at that time led to the collapse of financial institutions and securities around the world.

As well, even though many derivatives traded on exchanges generally go through a diligence process, some of the contracts traded over the counter do not include sufficient due diligence. Thus, there is a possibility of counter-party default.